Good afternoon everyone. First off, thank you for all the kind messages and encouragement you shared with me in my previous post about the birth of my daughter: Attention Passengers: Madison has Joined the Travel with Grant Family. I’m glad to share the exciting news with TWG readers and I promised I would have some good blog posts in the works. Here is the first one…

Back in December, I signed up for the waitlist for the new premium Alaska Airlines credit card (now called the Bank of America Atmos Rewards Summit Credit Card). A few weeks ago, I received a targeted email to apply for the credit card and receive 5,000 bonus Atmos Rewards Points, bringing the total sign up bonus to 105,000 points, but I only had 2 weeks to apply for this offer.

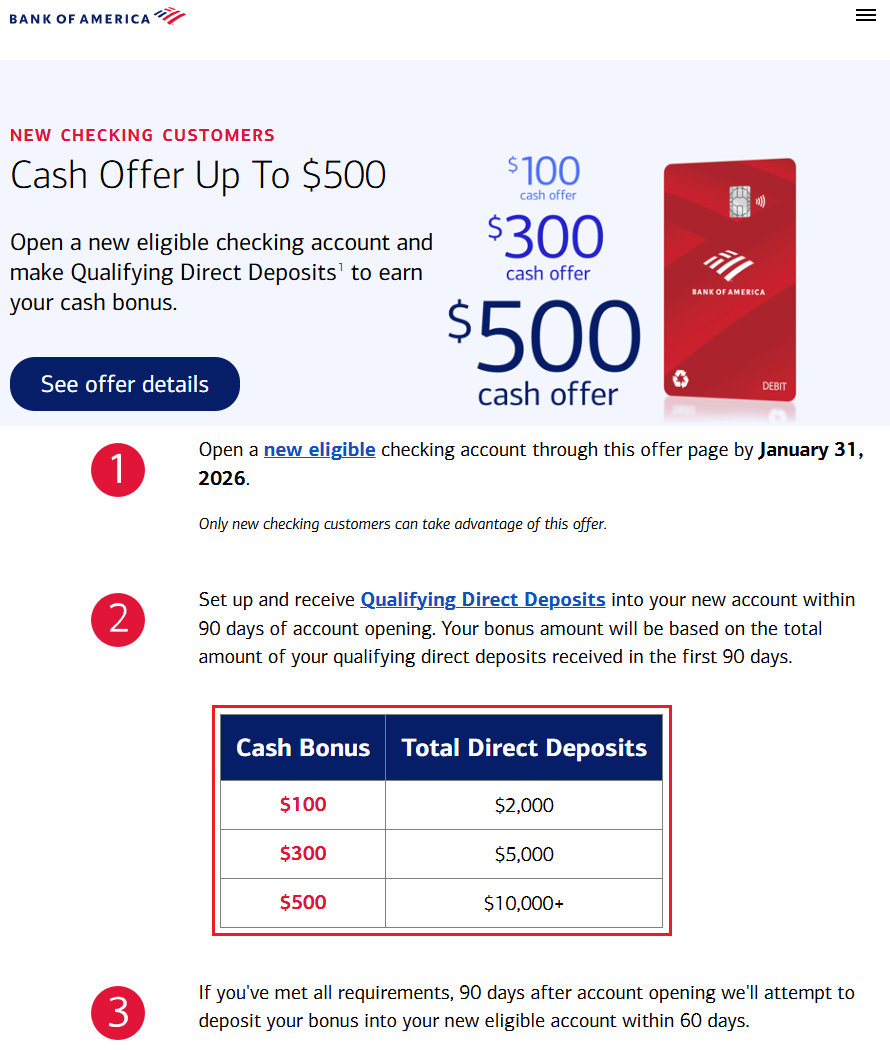

Unfortunately, Bank of America has their “3/12 Rule” (Doctor of Credit post) where BofA will only approve you for a credit card if you have 3 or fewer inquiries from all issuers in the last 12 months. But… if you have a BofA checking or savings account, the rule changes to the “7/12 Rule” where BofA will only approve you for a credit card if you have 7 or fewer inquiries from all issuers in the last 12 months. I was slightly over the 3/12 cutoff, but as luck would have it, BofA is currently offering a new checking account bonus up to $500 (Doctor of Credit post), depending on your total direct deposits within the first 90 days.