Good afternoon everyone, I hope your week is going well. I’m kicking off a new series on the blog called Miles & Points Mantra, where I’ll be sharing the personal “rules” I follow when it comes to using airline miles, hotel points, credit card rewards, and all things travel. I try to follow these rules 100% of the time, but I have been known to break the rules from time to time. Whether you’re brand new to travel hacking or a seasoned pro, I’d love to hear if you agree or disagree with these “rules.” I have a long list of mantras to share, but if you have one you swear by (or want me to cover), please share it in the comments section below. Let’s get started…

Miles & Points Mantra #1: “Use Hotel Free Night Certificates ASAP”

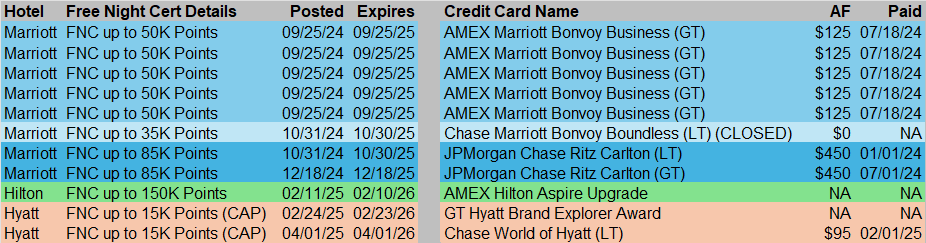

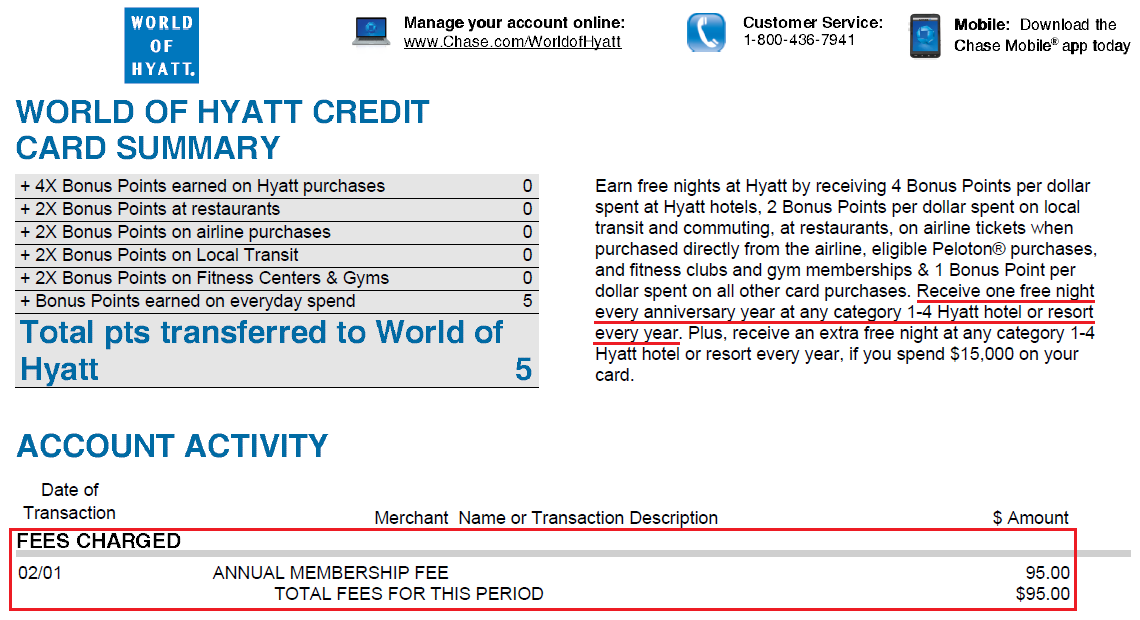

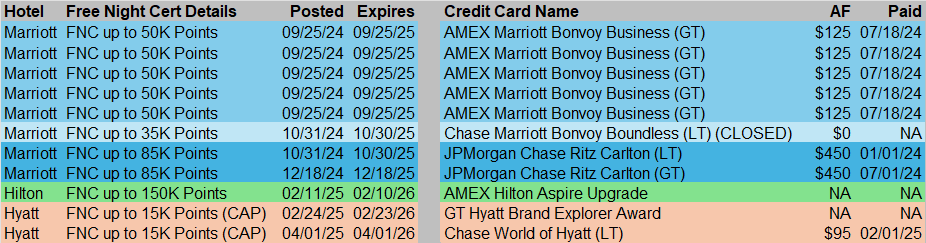

If you are just starting out and only have 1 or 2 hotel Free Night Certificates (FNCs), it might not be too difficult to remember to use them before they expire. Fortunately / unfortunately, between Laura and myself, we have earned / received 15 FNCs in the last 12 months from various credit card sign up bonuses, paying renewal annual fees on our hotel credit cards, and from completing a Hyatt Brand Explorer challenge. 15 FNCs means we have to spend at least 15 nights in hotels throughout the year in 4 different hotel brands (Hilton, Hyatt. IHG, and Marriott) within certain categories and point limitations. The only way I can manage these FNCs is in a spreadsheet.

Continue reading →