Good afternoon everyone. I was reviewing my recent American Express credit card statements and spotted a few changes that I wanted you to be aware of. The first 2 changes were shown on my American Express Blue Business Plus Credit Card and the last change was specific to my AMEX Old Blue Cash Credit Card (no longer available). The first 2 changes affect small business credit and charge cards that earn American Express Membership Rewards Points. With that said, let’s go through the first change.

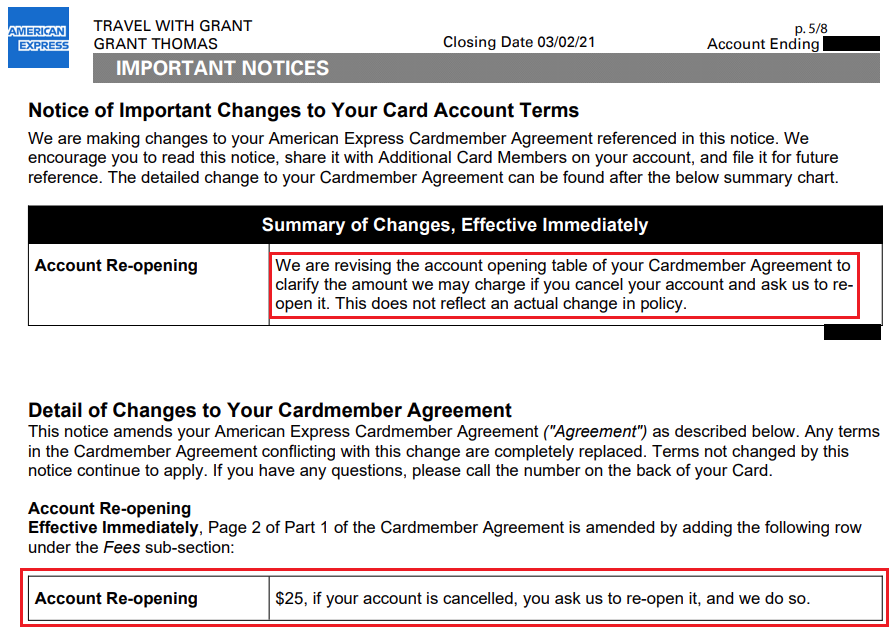

Effectively immediately, if your American Express card is closed (presumably by you), then you change your mind and want to reopen the card, you will now have to pay a $25 reopening fee. Before you close your card, call American Express to see if you can get a retention offer, see if you can convert that card to another card, and redeem any points tied to that card. If you do those steps, you should not need to reopen an account and incur the $25 reopening fee.