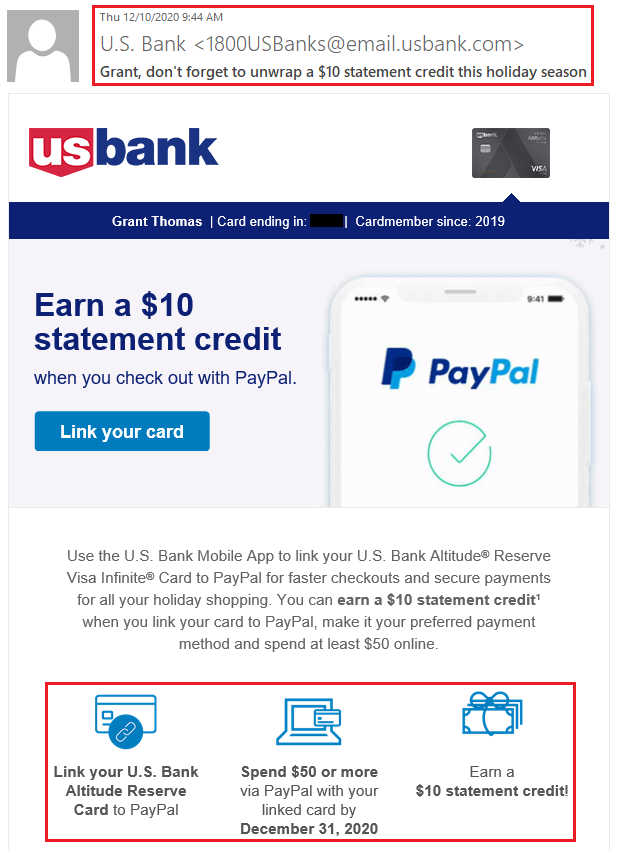

Good morning everyone, happy Super Bowl Sunday! 2 months ago, US Bank sent out a (targeted?) promo to US Bank credit card holders where you could earn a $10 statement credit for adding your credit card to PayPal and making $50 of PayPal purchases by December 31, 2020. This was an easy money maker for me, so I added my US Bank Altitude Reserve Credit Card to my PayPal account and made a $50 purchase. The $10 statement credit took a while to post to my account, but finally posted on February 5, 2021 (a day after my February credit card statement closed). If you participated and completed this promo, you should see the $10 statement credit right after your February 2021 statement closes.