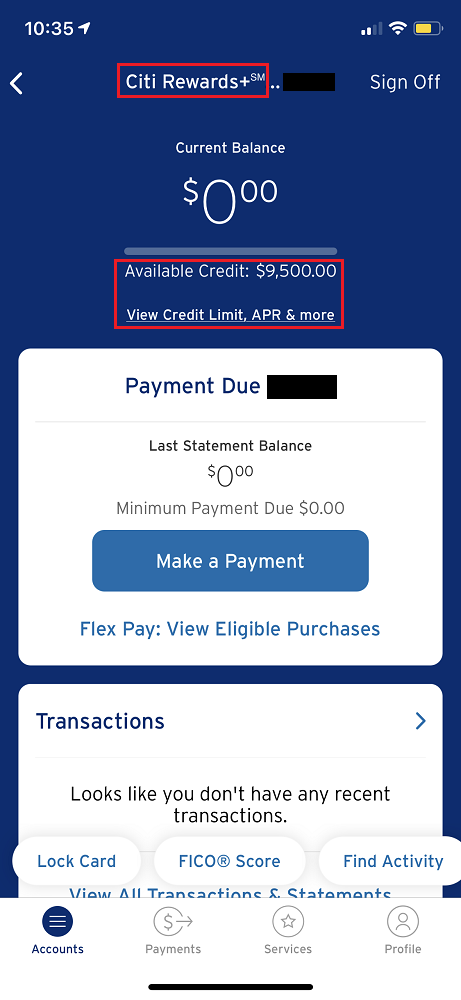

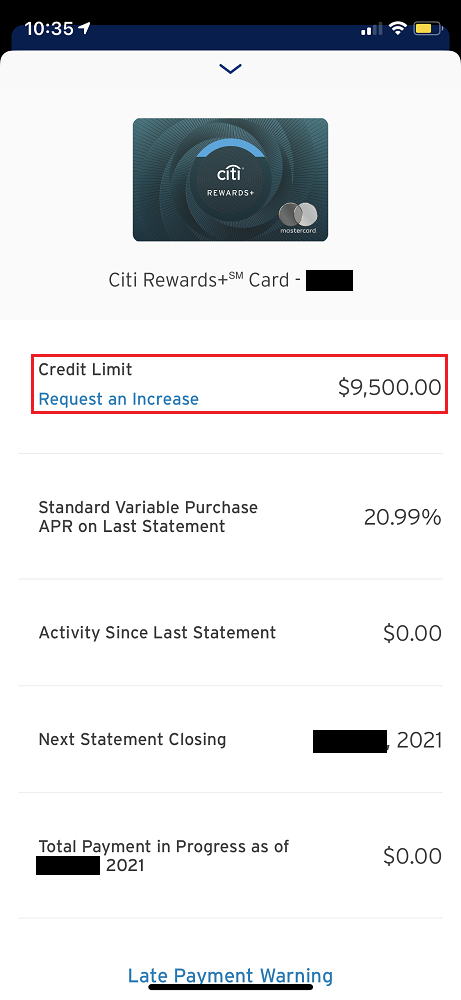

Good morning everyone, happy Friday. I was reviewing my recent Citi credit card statements and noticed a bug on the Citi website and on the Citi App. For some of my credit card accounts, it is not showing the payments in the Transactions section. I needed to navigate to the Payment Activity page to confirm that the payment actually posted to my account. I will show you what is happening and how to verify that the payment posted to your account successfully. If your current balance is $0.00, that most likely means that the payment posted successfully.

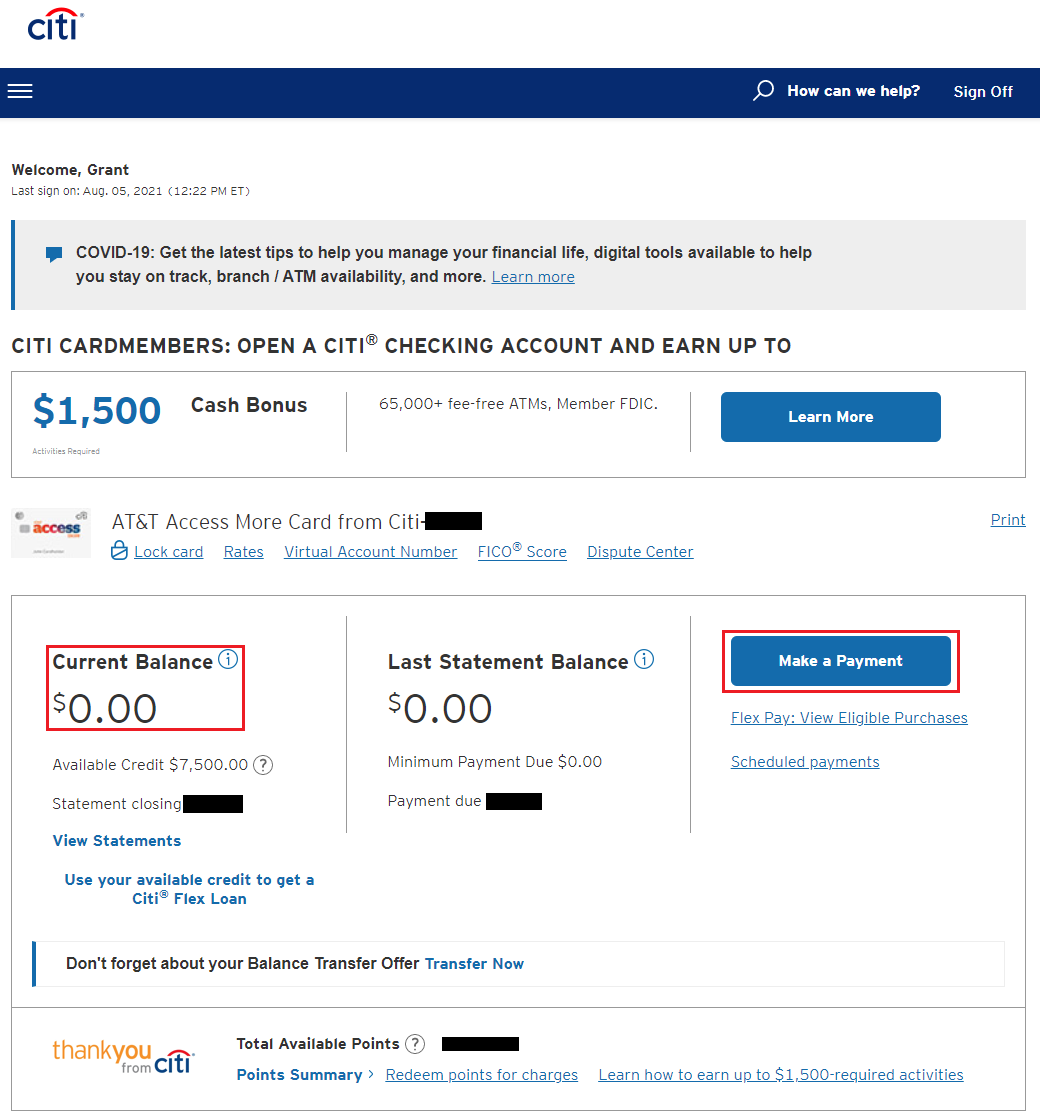

Here is what one of my Citi AT&T Access More Credit Card accounts looks like online.