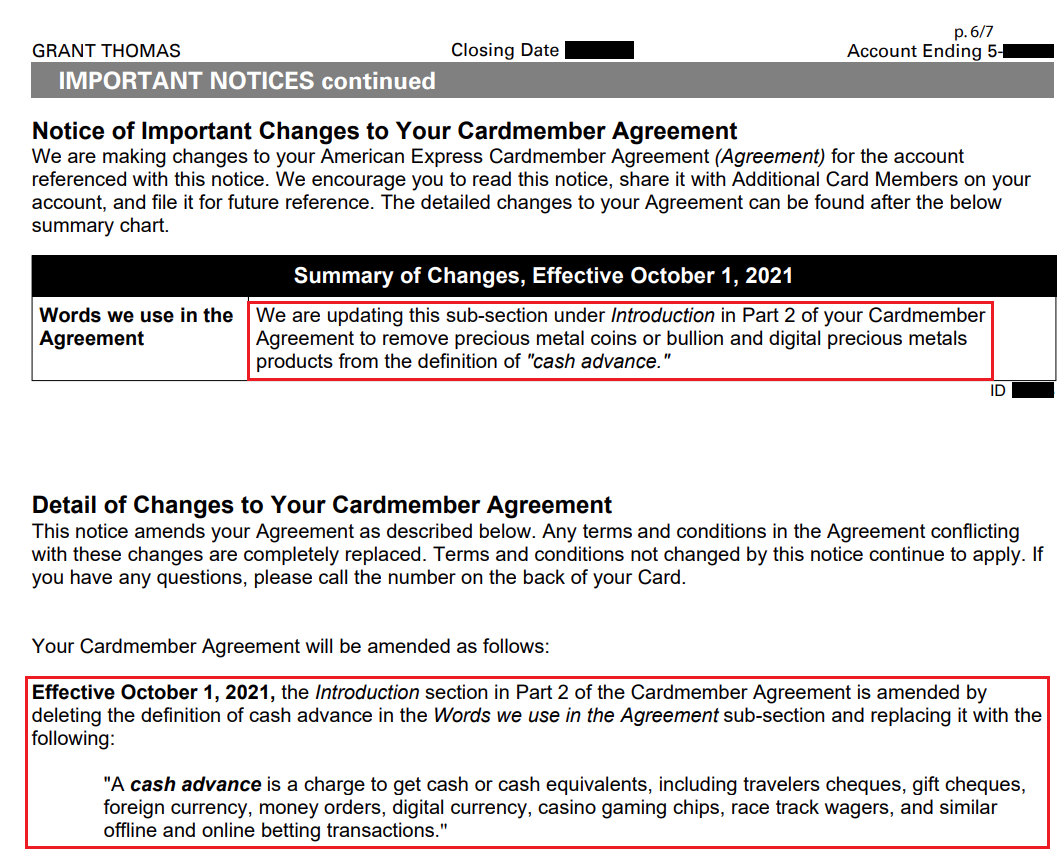

Good evening everyone, I hope your weekend is going well. I was just reviewing my recent American Express statements and saw a few changes regarding cash advance fees, earning bonus points on meal-kit delivery services, losing points when you close an account, late payment fees and the Centurion Lounge Guest Access Policy. The most interesting change is regarding cash advance fees. Effective October 1, 2021 (aka now), “precious metal coins or bullion and digital precious metals products” are no longer considered as a cash advance, so those purchases should earn points, miles, and cash back. This is great news if you buy coins from the US Mint (to keep or resell). As you might remember, American Express added precious metal coins or bullion and digital precious metals products to their definition of cash advance effective January 15, 2021. It is good to see American Express changing their mind regarding precious metal coins and bullion.