Good morning everyone, I hope you are all having a great week. By the time you read this post, I will be ATVing around the island of St. Kitts (I know, tough life). Anyway, I wanted to talk about one of my favorite topics – credit card sign up bonuses. In March, I discussed Which 10 Credit Cards am I Considering for my March App-O-Rama and then in early April, I wrote about my March App-O-Rama Results. In this post, I will share with you my plans (if any) for redeeming my miles and points. If you have any better suggestions than the ones I share in this post, please let me know in the comments. Thank you!

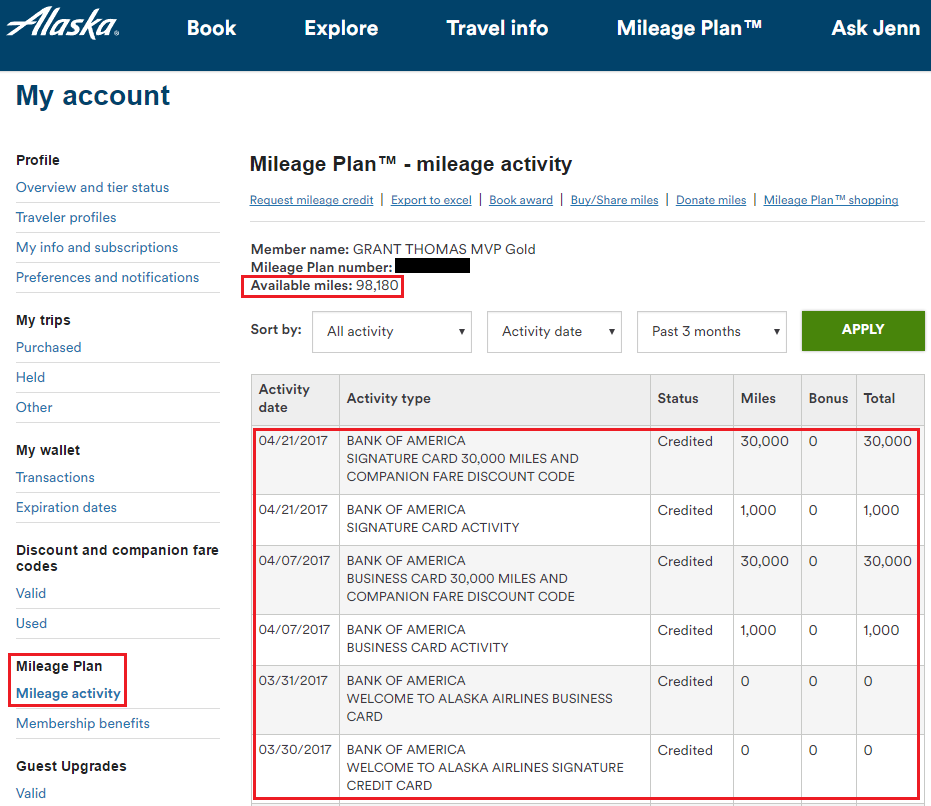

To get started, I was approved for the Bank of America Alaska Airlines Visa Signature Credit Card and the Bank of America Alaska Airlines Business Credit Card. Both credit cards offered 30,000 Alaska Airlines miles after spending $1,000 in 3 months along with an Alaska Airlines Companion Ticket (which can now be used on Virgin America). I have a few other Alaska Airlines Companion Tickets in my Alaska Airlines account, so I will probably not use them all. 60,000 Alaska Airlines miles is worth ~$900 to me (valuing Alaska Airlines miles at 1.5 CPP). I don’t have an exact use in mind, but I like flying on Virgin America first class when I fly from SFO to JFK.