Good morning everyone, I hope you enjoyed reading about my credit card decisions surrounding keeping, closing, or converting my credit cards after the annual fees post. Check out my thoughts on my Chase Sapphire Reserve and Chase Ink Plus Business credit cards; my American Express Hilton Ascend and SPG Business credit cards; my Bank of America Alaska Airlines Business and Citi AT&T Access More credit cards. As a reminder, here are all the credit cards and their annual fees. In today’s post, I am going to cover both the US Bank FlexPerks Gold American Express Credit Card and the Wells Fargo Propel World Elite American Express Credit Card. Are they worth keeping, should I close them, or should I convert them to another credit card?

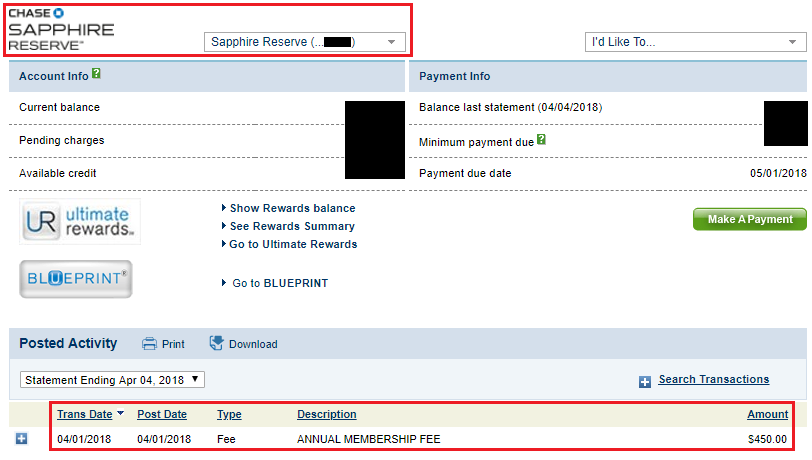

- Chase Sapphire Reserve – $450 (posted 4/1)

- Chase Ink Plus Business – $95 (posted 4/1)

- American Express Hilton Ascend – $95 (posted 4/3)

- American Express SPG Business – $95 (posted 4/6)

- Bank of America Alaska Airlines Business – $75 (posted 4/2)

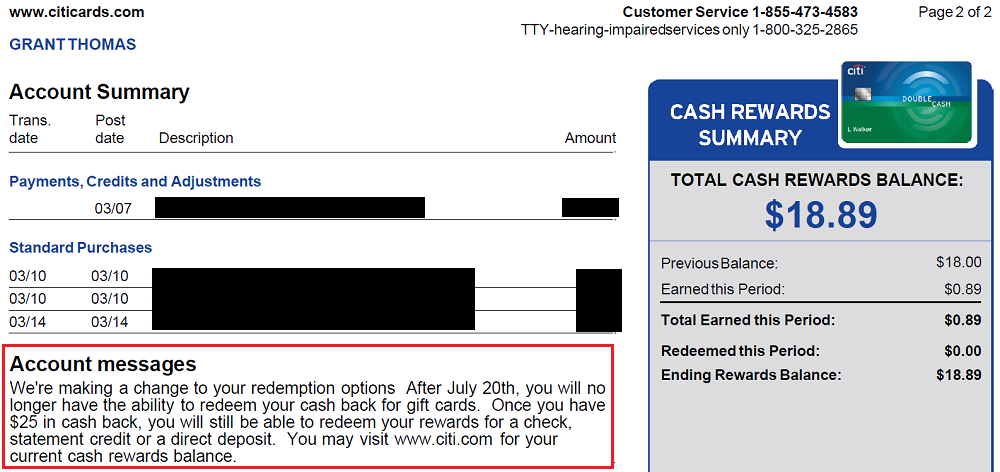

- Citi AT&T Access More – $95 (posted 4/4)

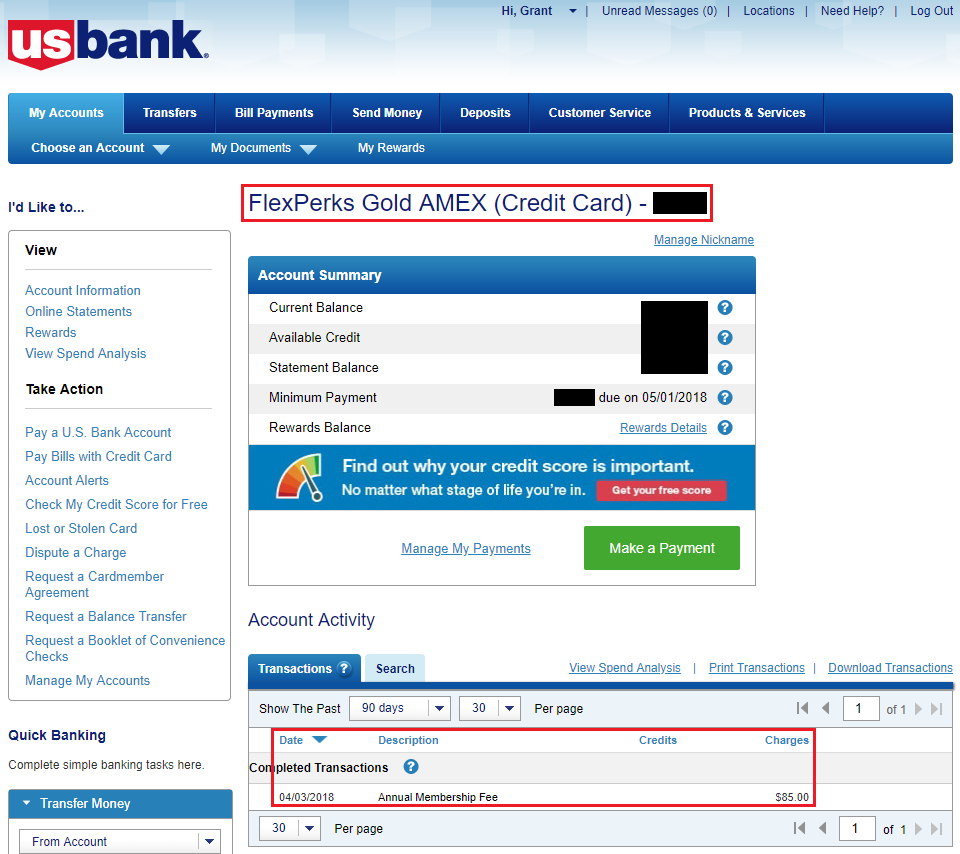

- US Bank FlexPerks Gold – $85 (posted 4/3)

- Wells Fargo Propel World – $175 (posted 3/31)

US Bank FlexPerks Gold American Express Credit Card

The $85 annual fee just posted and I have seriously lost interest in FlexPoints over the years. The death nail came on December 31, 2017, when FlexPoints changed to a fixed 1.5 cents per point (CPP) value for all travel redemptions. This credit card earns 3x on airfare, 2x on gas, and 2x on restaurants. I currently use my Chase Sapphire Reserve Credit Card for travel, restaurants, and gas since I get 3x Chase Ultimate Reward Points on those purchases. I can also redeem Chase Ultimate Reward Points for travel at 1.5 CPP, so the Chase Sapphire Reserve Credit Card is as good or better in every way compared to the US Bank FlexPerks Gold American Express Credit Card. I redeemed almost all of my FlexPoints before December 31, 2017, and have a few hundred FlexPoints leftover in my account. Not to worry, I have a no annual fee US Bank FlexPerks Select+ American Express Credit Card that will keep my few hundred FlexPoints alive.

Decision: US Bank FlexPerks Gold American Express Credit Card will be converted to a no annual fee US Bank Cash 365 American Express Credit Card. That card earns 1.5% cash back on all purchases, so it will never be used.