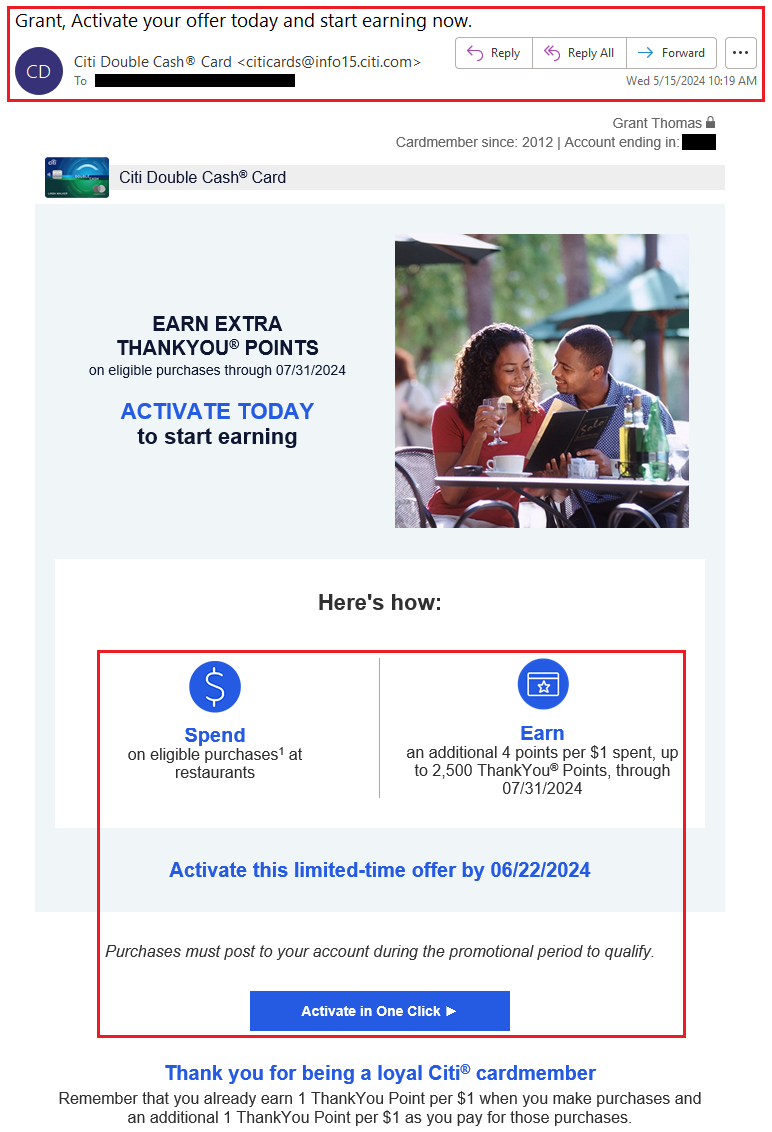

Good afternoon everyone, I hope your week is going well. Earlier today, I received an email from Citi regarding my Citi Double Cash Credit Card. The subject line sounded generic: “Grant, Activate your offer today and start earning now” and didn’t look very enticing until I read further down the email. After activating the offer, I can “Earn an additional 4 points per $1 spent, up to 2,500 ThankYou® Points, through 07/31/2024” when I “Spend on eligible purchases at restaurants.”

4x Bonus Citi ThankYou Points on top of the 2x the Citi Double Cash already earns = 6x at restaurants on the first $625 spent. That is better than the 4x on the American Express Gold Card, and a little better than 5x on the Citi Custom Cash Credit Card and the old Citi Prestige Credit Card, but not as great as the 7x on the Chase Freedom Flex Credit Card. If you have a Citi Double Cash, check you email for this targeted email offer from Citi.