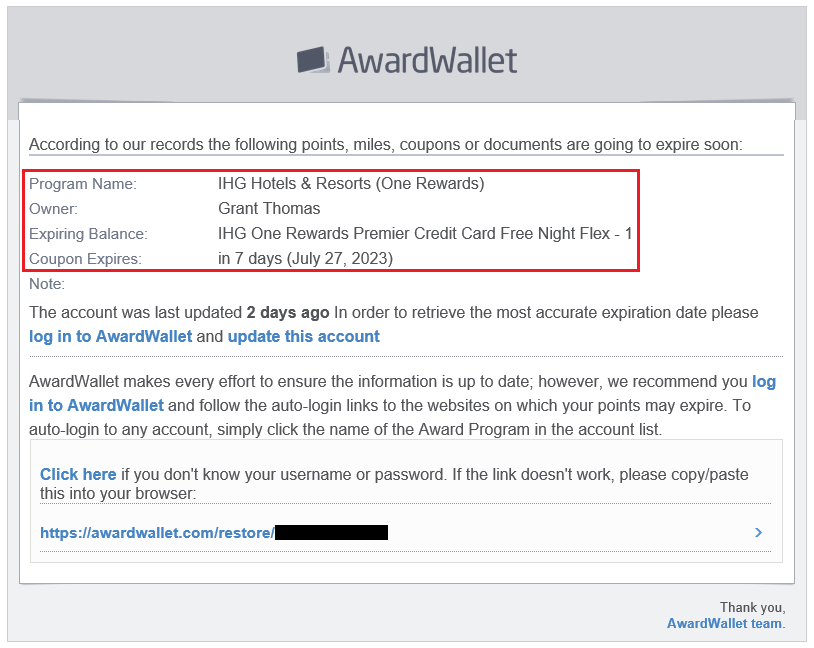

Good afternoon everyone, I hope you had a great weekend. I am not a juggler, but I do a pretty good job juggling free night certificates and not letting them expire… until last week. My first clue that something was wrong was when I received this email from AwardWallet alerting me to the fact that one of my IHG Free Night Certificates was going to expire on July 27. At first, I thought it was a glitch with AwardWallet or IHG since I just booked a stay using my IHG Free Night Certificate back on June 29 for a Crowne Plaza hotel on July 17. After thinking it over, I decided to take a closer to see what was going on…