Good morning everyone, happy Friday! Earlier this month, Frequent Miler wrote Ritz card: Double Dip Restaurants 10X + $300. In that post, Greg covered 2 overlapping promotions available on the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card:

- Earn 10x Marriott Bonvoy Points at restaurants and gas stations through September 30, 2020

- Use the $300 annual travel credit to reimburse purchases made at grocery stores and restaurants though December 31, 2020

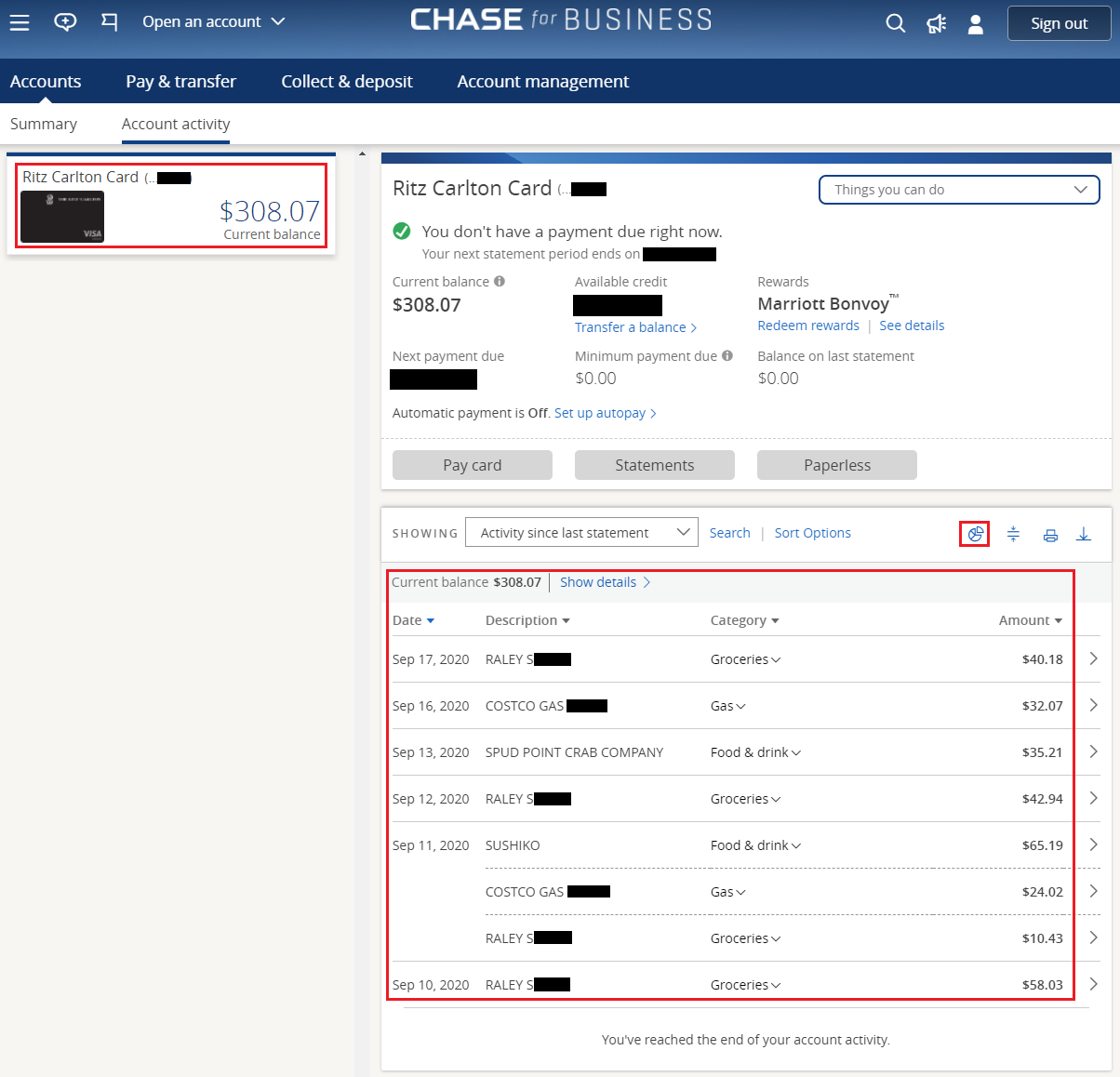

Before the Coronavirus Pandemic, I used $84.67 of my $300 annual travel credit, so I still had $215.33 remaining that I needed to use by December 31, 2020. With the above information in mind, I decided to use my Ritz Carlton Credit Card for purchases at grocery stores and restaurants until I spent at least $215.33. I made the necessary purchases and clicked the pie chart icon to confirm that the purchases fell into the right categories.