Good morning everyone. Last month, my brother and I went to Zion National Park for Labor Day Weekend (September 4-7). The trip was amazing and I definitely recommend everyone go to Zion National Park for a few days if you are ever in Southwest Utah. A few weeks ago, Frequent Miler wrote a post about his recent trip through Zion National Park where he stayed at the Zion Lodge (log cabins) for ~$200/night. I thought it would be a good idea to share my experience at the Holiday Inn Express Springdale / Zion National Park and show what other points hotel options were available at Zion National Park.

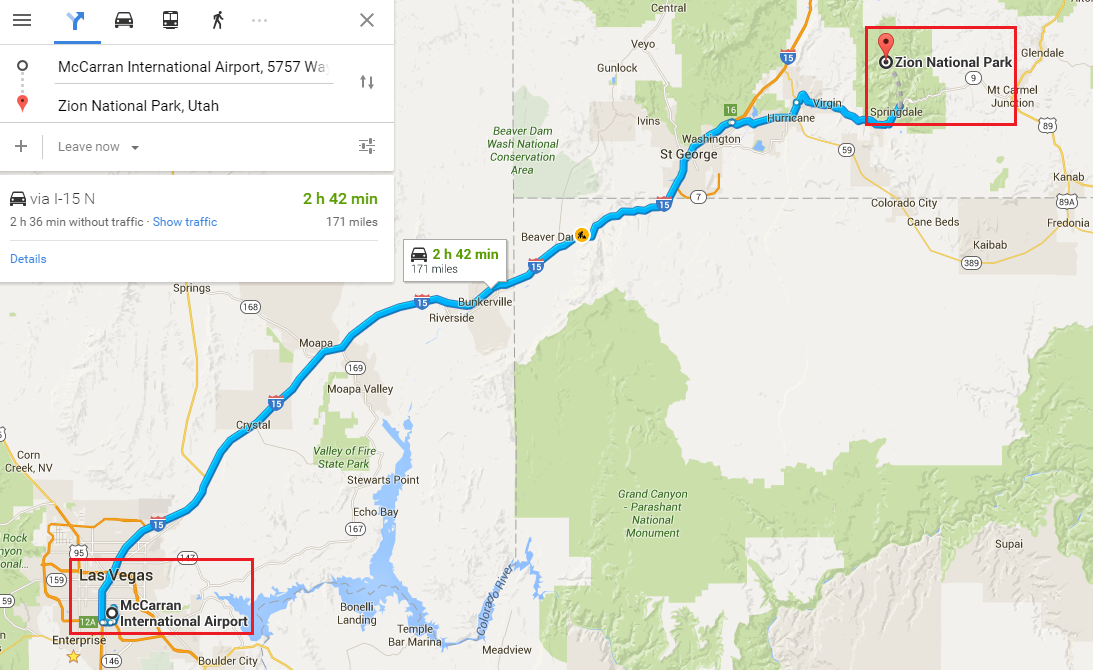

Getting to Zion National Park is tricky. You can fly into St. George, Utah, but that is a very small/expensive airport. I recommend flying into Las Vegas (easily accessible from every airport with many flights from many airlines) and then driving ~3 hours to Zion National Park (Google Map). My brother and I landed in Vegas around 8:30pm and then made our way to the Las Vegas rental car lot and then toward Utah. We arrived at the Holiday Inn Express hotel a little after 1am (1 hour time change from Arizona to Utah).