(Hat Tip to Doctor of Credit’s post: Free $10 Amazon Credit with $20 Amazon Cash Reload)

Good morning everyone! A few days ago, Amazon introduced a new way to reload your Amazon gift card balance, called Amazon Cash. Instead of buying an Amazon gift card in store, scratching off the code, and entering the code into your Amazon account, you can now create a specific barcode that will load money directly to your Amazon account. Just show the barcode at the register of qualifying stores, pay for your purchase, and your gift card balance will be instantly updated.

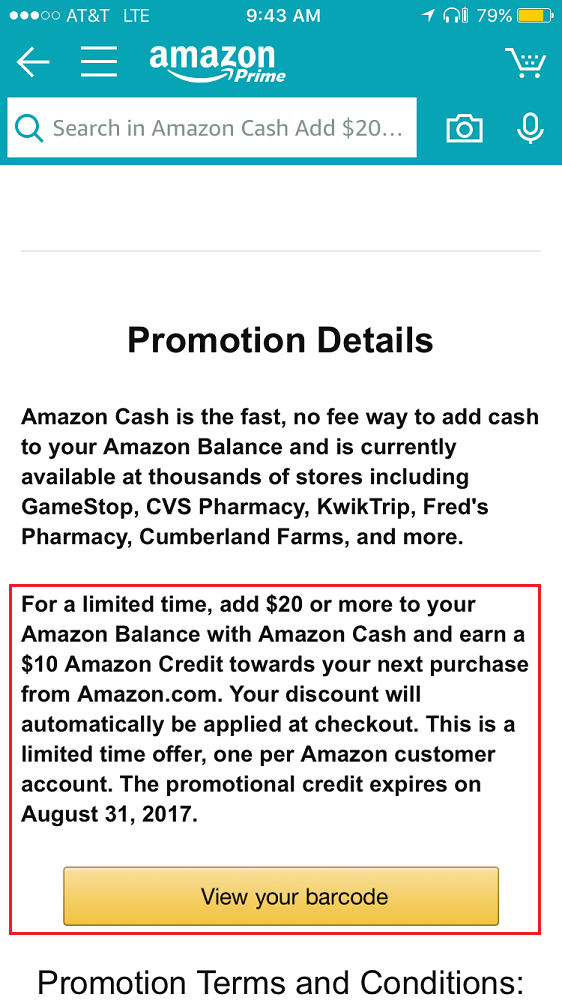

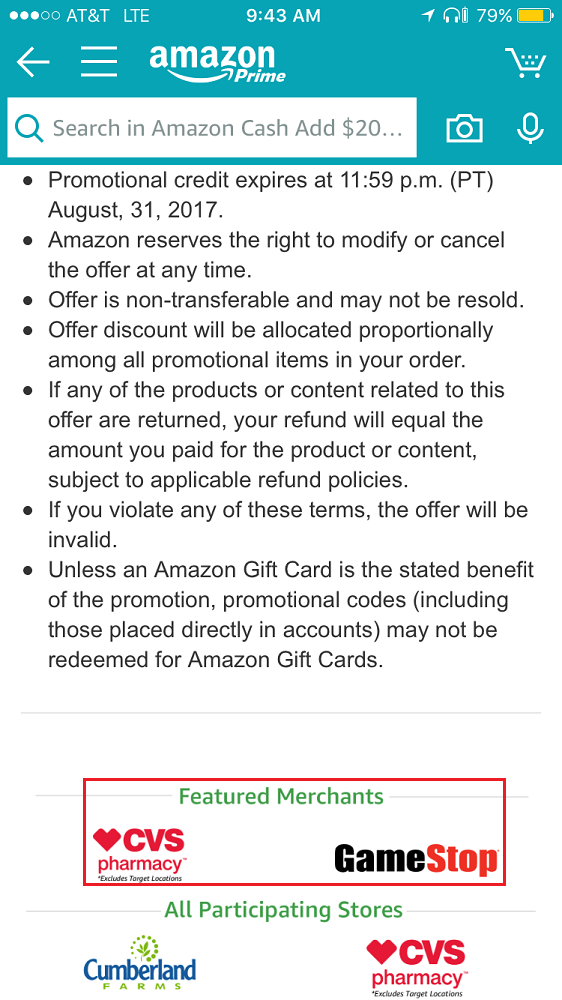

If you act before July 31, 2017, you can get a $10 promo credit (that must be used before August 31, 2017) if you use your Amazon Cash barcode to load $20 or more. One of the qualifying stores that accepts Amazon Cash is CVS, so I went to my local CVS and tried it out. Here are the promo terms: