What one credit card do you know the LEAST about? If there’s one credit card I don’t know much about, it’s the Discover It Credit Card. And yet, quite often friends and family members ask me about it. Just last week, my cousin received an email with an advertisement encouraging her to apply for a Discover It Credit Card. She’s smart, so she did what smart cousins do… she asked me what I thought :) My cover as a know-it-all regarding credit cards was blown. I told her to stay tuned and I’d check into the Discover It Credit Card and let her know my thoughts.

Then I did what smart bloggers do – and reached out to the source I knew who had written a ton about the Discover It Credit Card. In fact, from way back in 2015, I had it on my to-do list to reach out to him and ask him about the Discover It Credit Card. It was time to bring that to-do item to the top of the list – so I sat down with Harlan at Out and Out and talked all things Discover. And now I can give my cousin, and all of you, the best information and advice possible.

First off, Discover has two cash back credit cards to choose from and most importantly, it’s a lucrative card – especially in the first year.

Discover It Credit Card (Harlan’s referral link)

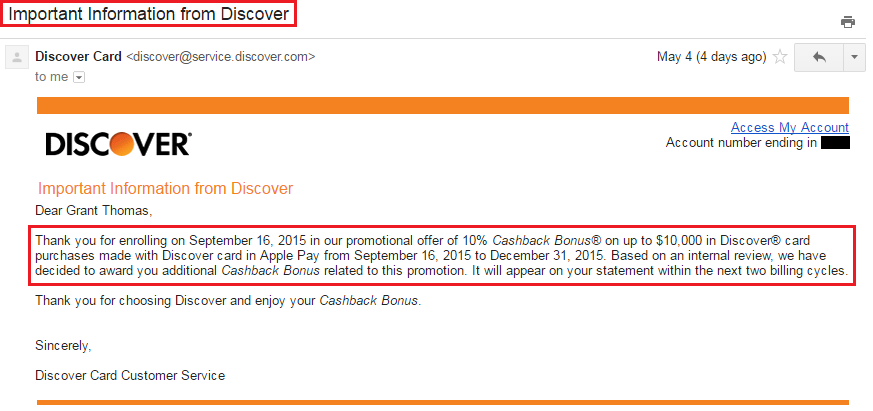

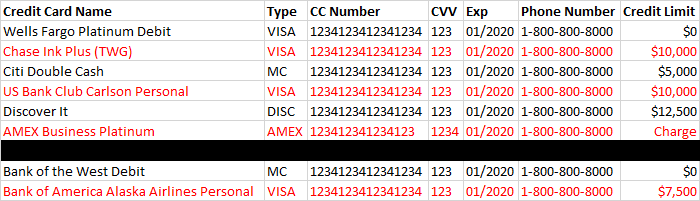

The Discover It Credit Card gives you 1% cash back, no annual fee, and no foreign transaction fees. It also has quarterly bonus rotating categories where you’ll get 5% cash back on up to $1,500 spend in those categories. And because Discover matches what you’ve spent in the first year, it effectively becomes a 2% and 10% cash back credit card for that first year. Harlan said the bonus categories are great and he never has trouble spending $1,500 in the bonus category every quarter. Here’s one important tip on this card. You MUST register your credit card each quarter before you start shopping to earn the 5% bonus. Activation is easy, so do it BEFORE you start your quarterly shopping.