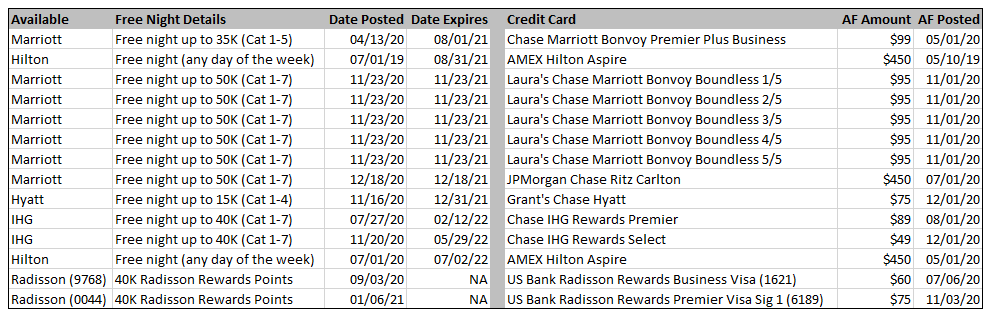

Good evening everyone. 2 years ago, I wrote Track Hotel Free Night Certificates & Credit Card Annual Fees with my Spreadsheet. In that post, I shared my strategy for keeping track of free night certificates. If you have several co-branded hotel credit cards (like the Chase World of Hyatt Credit Card or Chase IHG Rewards Premier Credit Card), you need to keep track of free night certificate expiration dates so you do not forget to use them before they expire or you run out of time to use them at a good property (the hotel is not going to remind you to use your free night certificate – they want you to pay the annual fee and forget to use your free night certificates). Here are the unused free night certificates I have, as of March 2021. I sorted the list by the expiration date of my free night certificates, so I know which free night certificates I need to focus on first.

The inspiration for this post came from a recent Miles to Memories post called Don’t Fall Into The Free Night Certificate Fuzzy Math Trap! In that post, Mark shared all the downsides of free night certificates, like short expiration dates, some certificates only work at certain hotel categories or on certain days, etc. I totally agree with all of those downsides, but I had the pleasure of redeeming 2 free night certificates today and wanted to share an upside I found with free night certificates.

Continue reading →