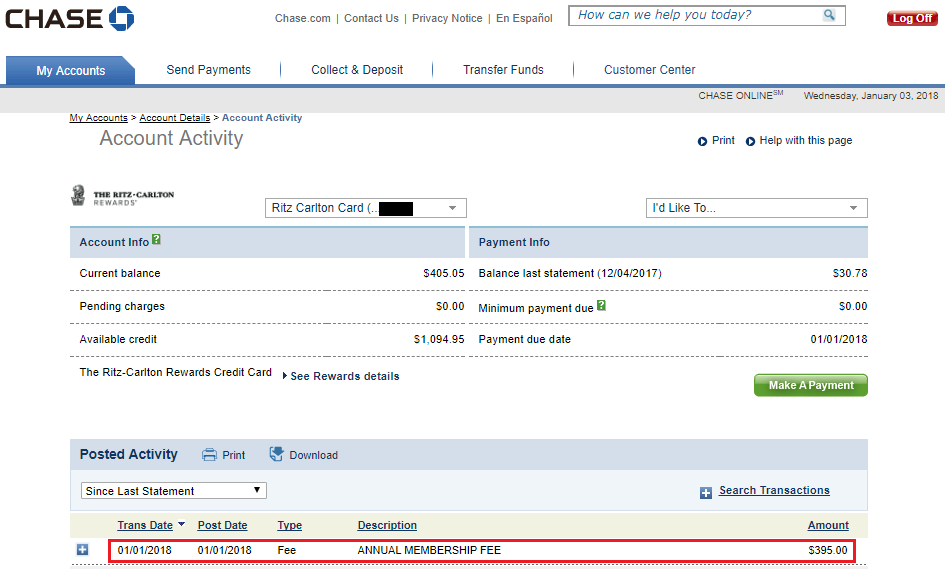

Recently, I had one of those “the devil’s in the details” experiences I want to share with you because as we all know, details are important, especially with credit card benefits! I’ve had the JPMorgan Chase Ritz Carlton Credit Card for quite a few years already, and for the first time this past year, I just couldn’t use the full $300 worth of travel reimbursement credit. The benefits I receive from other credit cards mean I don’t pay for checked bags. I had no flights where I could pay for a seat upgrade, and how many fruit and cheese plates can one eat? So I only spent about $100 of the $300 travel credit. This made me wonder if maybe it was time to let go of this credit card.

Similar to Grant, I inquired and asked Chase which credit cards I could get to replace my JPMorgan Chase Ritz Carlton Credit Card. I was still in decision-making mode when I read a comment on Grant’s post. This reader is a huge fan of the JPMorgan Chase Ritz Carlton Credit Card. He laid out his formula for how he gets so much benefit from the credit card. He feels people are short sighted when it comes to the benefits of the card, and cancel it in haste. Hmm, was I missing something?