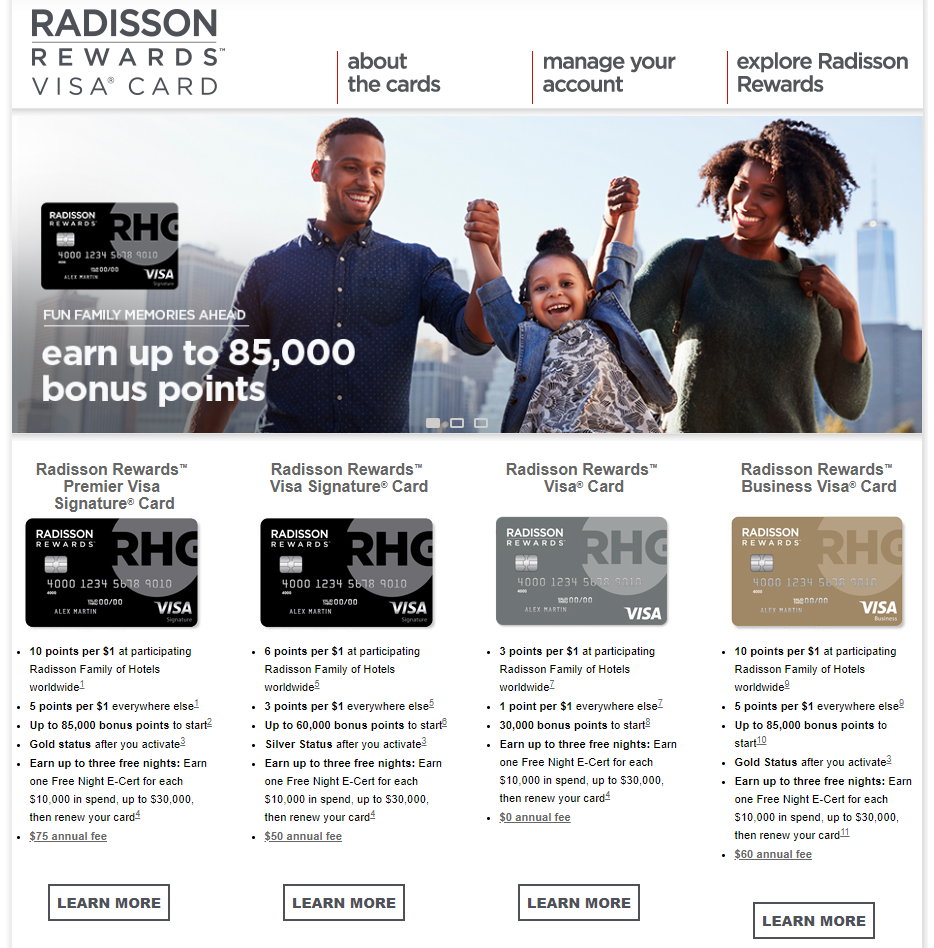

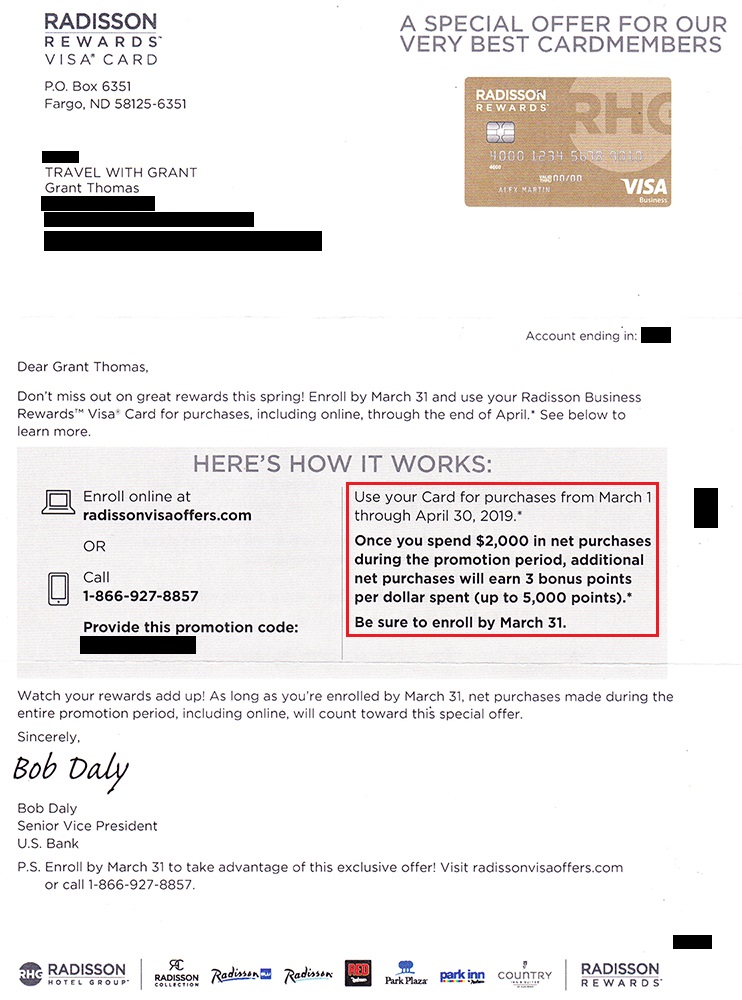

Good morning everyone. A few years ago, Club Carlson / Radisson Rewards credit cards were awesome because you could redeem points and get your last night free. If you booked a 2 night stay, you got 50% off the total price. Well, it was too good to last, so Club Carlson / Radisson Rewards got rid of that benefit. A lot of people burned all their points and closed their credit cards, but I decided to keep my Club Carlson / Radisson Rewards credit cards. To make thing confusing, there are 4 US Bank issued Radisson Rewards credit cards (3 personal and 1 business).

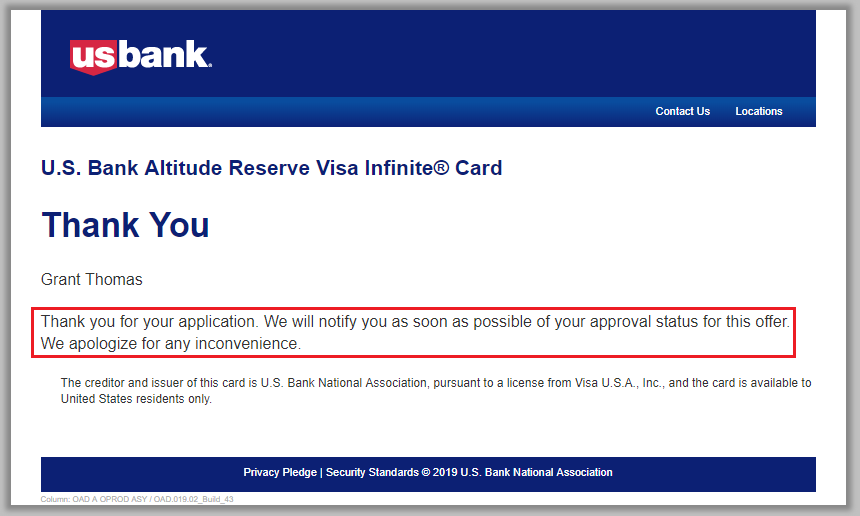

For the longest time, I had the US Bank Radisson Rewards Premier Visa Signature Credit Card ($75 annual fee) and the US Bank Radisson Rewards Business Visa Credit Card ($60 annual fee). Both of these credit cards offer 40,000 anniversary bonus points every year, just for paying the annual fees. For $135 in annual fees, I could get 80,000 Radisson Rewards points every year. Since I wanted more cheap Radisson Rewards points, I decided to apply for the US Bank Radisson Rewards Visa Signature Credit Card ($50 annual fee) and then upgrade to the US Bank Radisson Rewards Premier Visa Signature Credit Card ($75 annual fee) in the future. As luck would have it, I wasn’t approved for the US Bank Radisson Rewards Visa Signature Credit Card ($50 annual fee), but instead, I was approved for the US Bank Radisson Rewards Visa Credit Card (no annual fee).