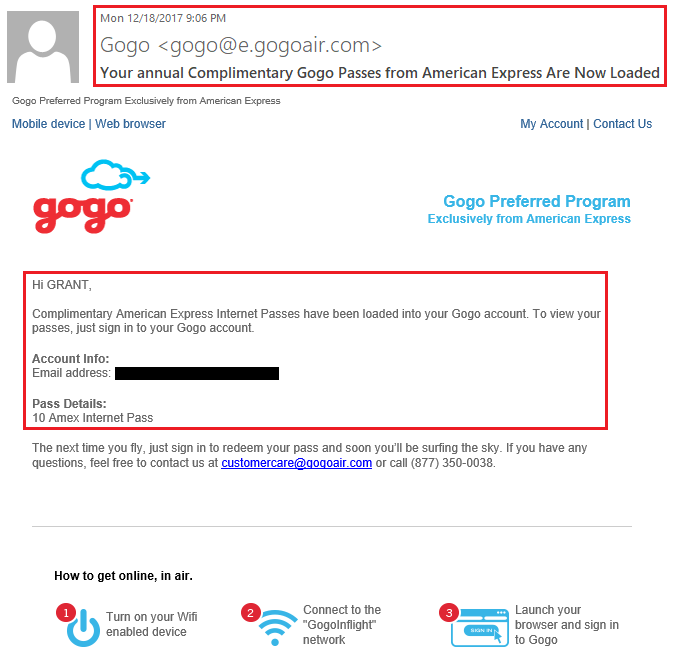

Good morning everyone, happy Friday! According to the news, yesterday and today are 2 of the busiest travel days of the year (roughly 3 million people are projected to travel both days). If you are traveling this holiday season and especially if you are traveling with friends or family members, I highly recommend creating a second Gogo account. Let me explain why. A few days ago, I got the following email from Gogo regarding my 10 free Gogo passes for having an American Express Business Platinum Charge Card (if you have this charge card, I will show you how to get your 10 free Gogo passes below.)

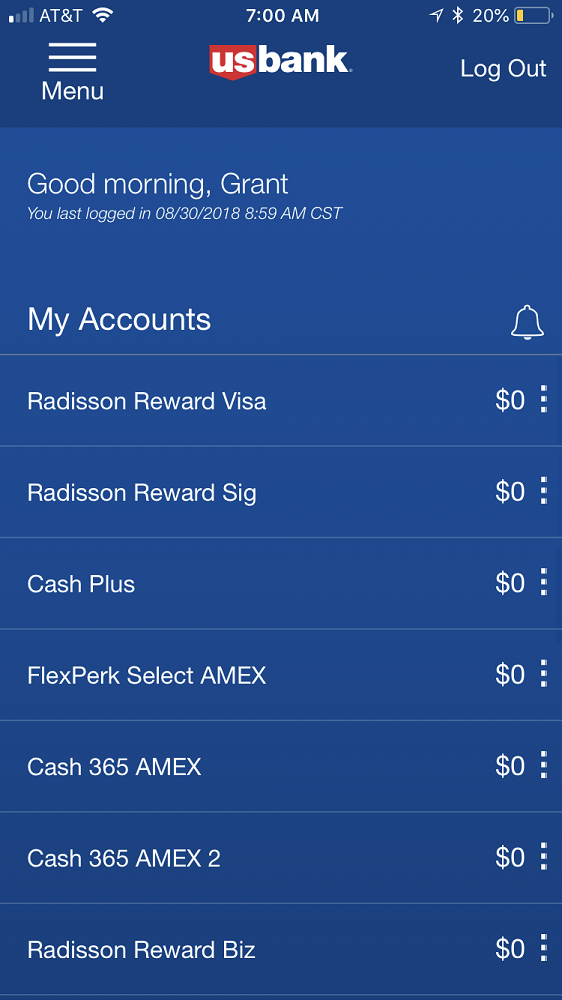

I tend to fly Southwest Airlines often and they do not offer Gogo, so most of my Gogo passes expire at the end of the year. But of the few times when I am travelling on an airplane that offers Gogo, I am usually travelling with my girlfriend and Gogo only allows you to use 1 Gogo pass per flight. If you have more than 1 Gogo account, you can use passes from each Gogo account on the same flight. Pretty novel idea, right?