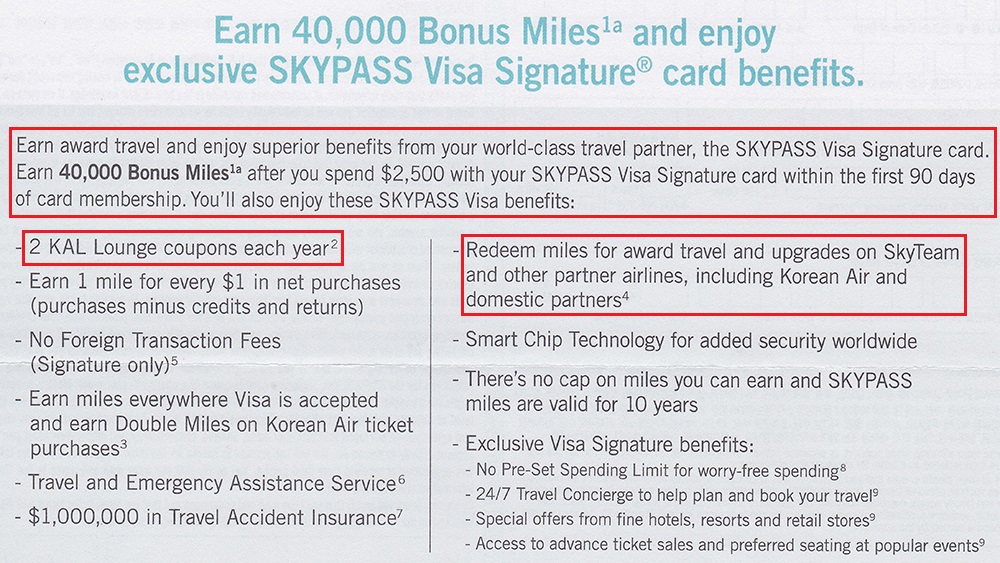

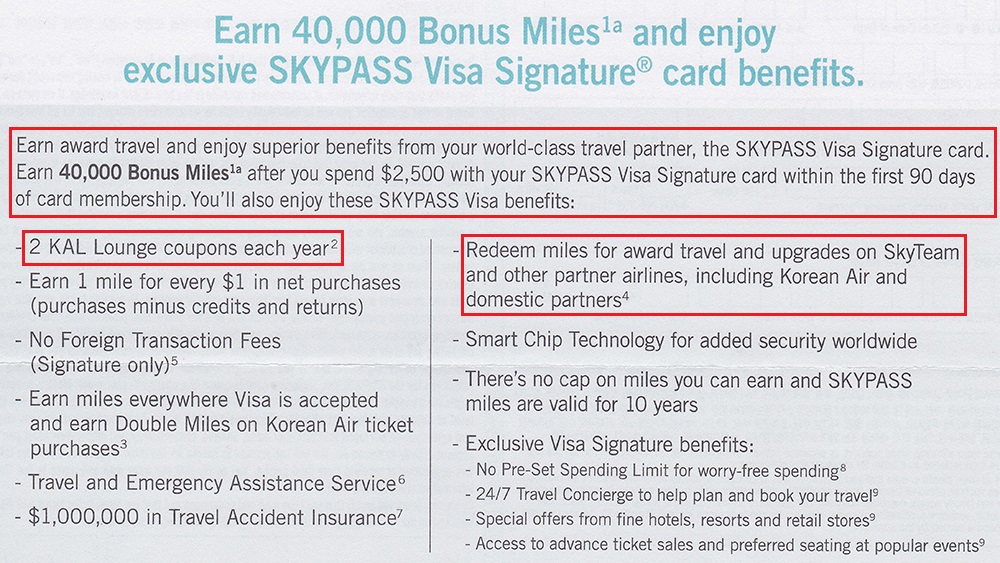

Good morning everyone, I hope you had a great Father’s Day weekend. It’s been about 3 months since my last (mini) App-O-Rama. I successfully got a Chase Ink Plus Business Credit Card and my second Citi Hilton HHonors Reserve Credit Card back in mid March. The sign up bonuses have both posted, so now it’s time to think about my next credit cards. I received the following targeted offer for the US Bank Korean Air Skypass Visa Signature Credit Card that comes with 40,000 Korean Air Miles after spending $2,500 in 3 months ($80 annual fee). What other credit cards am I considering? Scroll down to find out.

I never considered signing up for the US Bank Korean Air Skypass Visa Signature Credit Card before now, but here are the card benefits. I asked on Twitter if this was a newsworthy credit card offer and several people said it was the highest sign up bonus they have seen for this credit card.

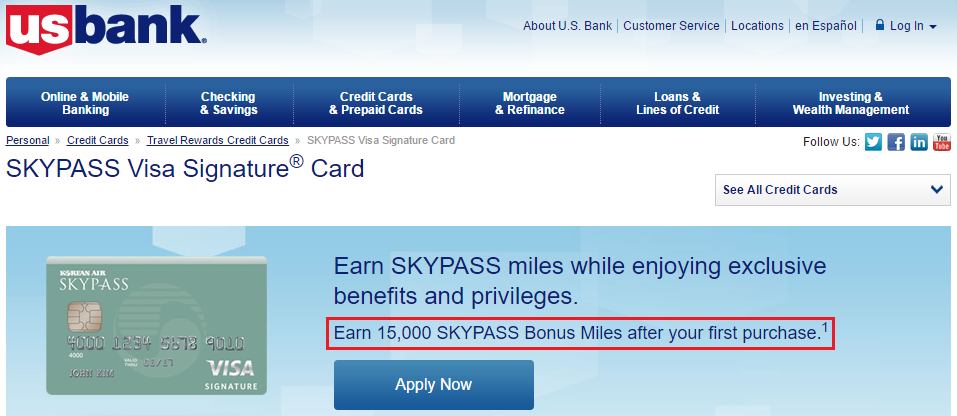

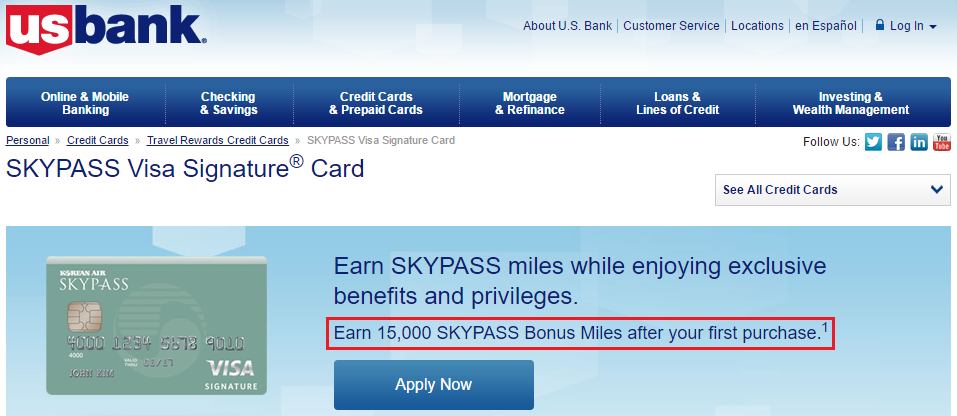

The currently available public offer is 15,000 Korean Air Miles after your first purchase, so 40,000 Korean Air Miles is a much larger sign up bonus. I’m not sure if the Korean Air award chart has had any/many devaluations in the last few years, but this Travel is Free post from 2014 has several great uses for Korean Air Miles.

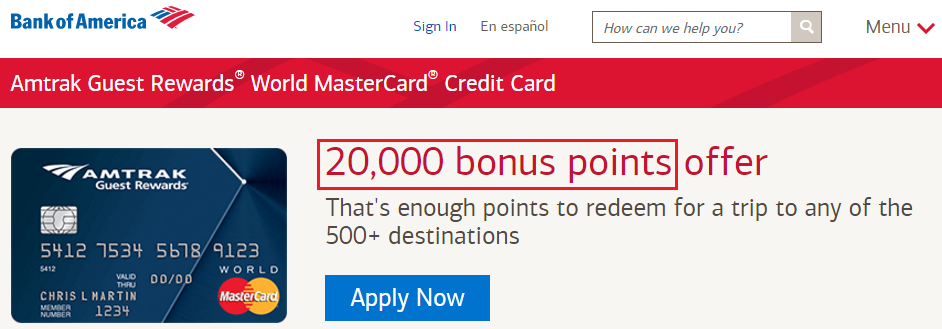

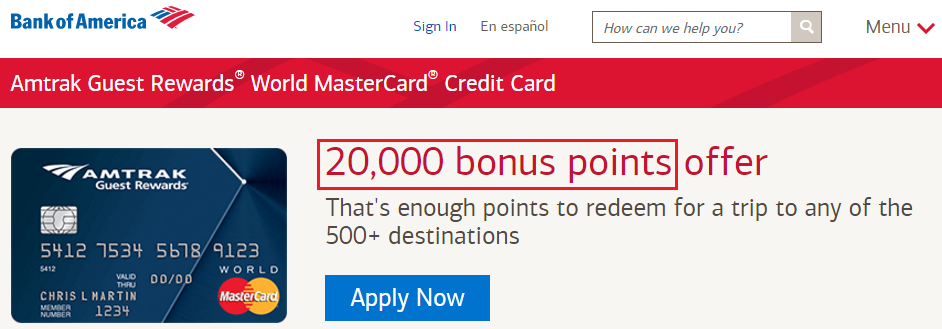

The next credit card I am considering is the Bank of America Amtrak Guest Rewards World MasterCard that comes with 20,000 Amtrak Points after spending $1,000 in 3 months ($79 annual fee). I went on 2 great Amtrak sleeper bedroom trips (Coast Starlight from Seattle to Los Angeles and California Zephyr from Denver to San Francisco) but I haven’t touched the new Amtrak Guest Rewards (AGR) 2.0 program. Since each Amtrak Point is worth 2.9 cents per point (CPP), the sign up bonus is worth $580 in Amtrak travel. I have my eye on the Empire Builder route from Seattle to Chicago (or vice versa).

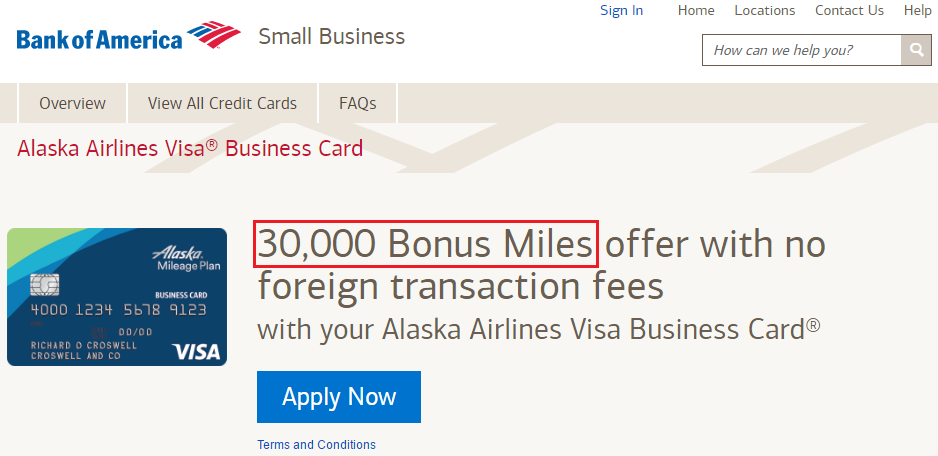

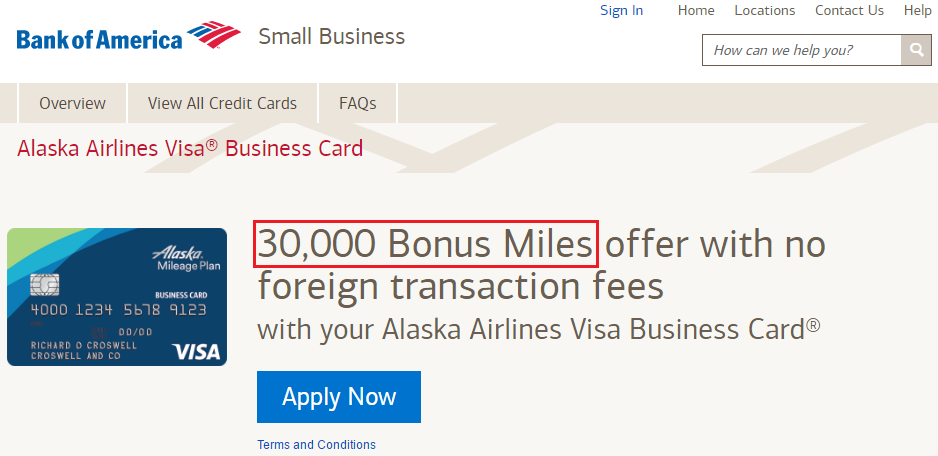

If I get instantly approved for the above credit card, I might go for the Bank of America Alaska Airlines Business Credit Card. I have 150,000+ Alaska Airlines Miles, so I am not in a big hurry to earn more, but if given the chance to earn 30,000 Alaska Airlines Miles, I will not turn down the opportunity.

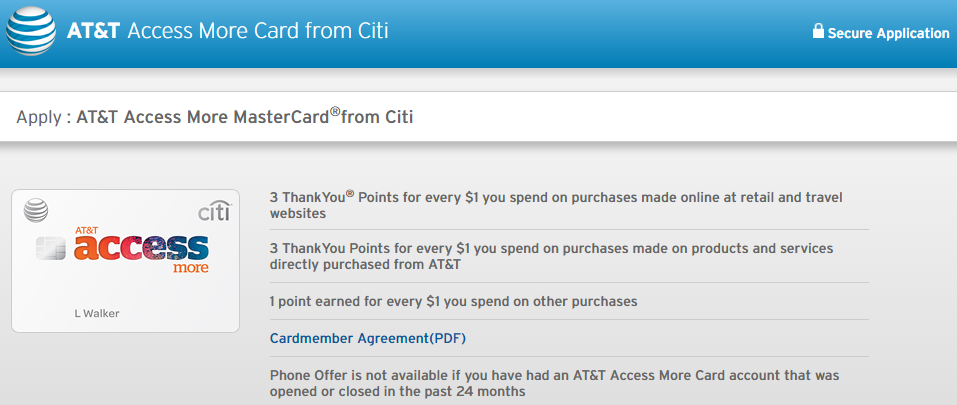

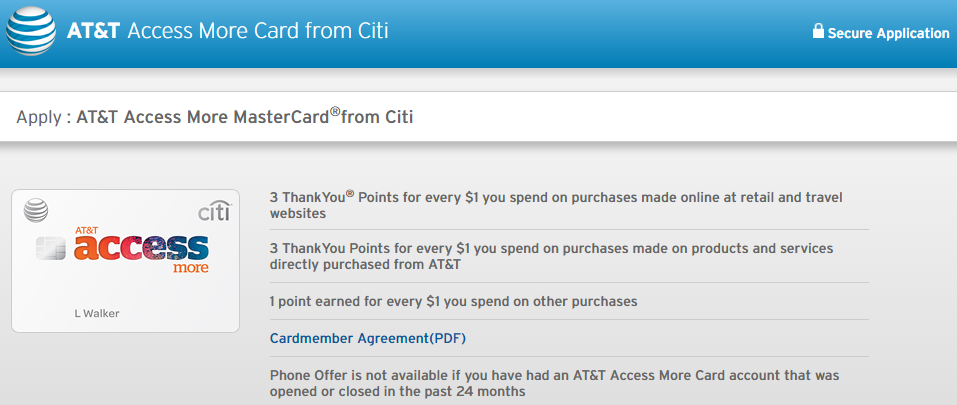

Since I have practically every Citi credit card available, my options are limited. I have had my eye on the Citi AT&T Access More MasterCard that comes with a $650 cell phone credit after spending $2,000 in 3 months ($95 annual fee). I currently have the iPhone 6S, but I know the iPhone 7 is coming out soon. Can I wait a few months to purchase the iPhone 7 after the initial 3 month sign up period ends or do I need to purchase the new phone during the first 3 month period? I don’t do much manufactured spend (MS) anymore, but the 3x online shopping might come in handy from time to time.

Update: thanks to Emery for the Flyertalk link. regarding the Citi AT&T Access More MasterCard. 14. Does the phone purchase offer expire?

The minimum spending requirement expires in 3 months. The phone purchase requirement is indefinite. It says “now or later”.

“You may redeem the Phone Offer using the link at any time after your Card account opening.”

“Offer is valid for a one time statement credit up to $650 for one eligible phone, is not transferrable and so long as your card account is open and current,does not expire.”

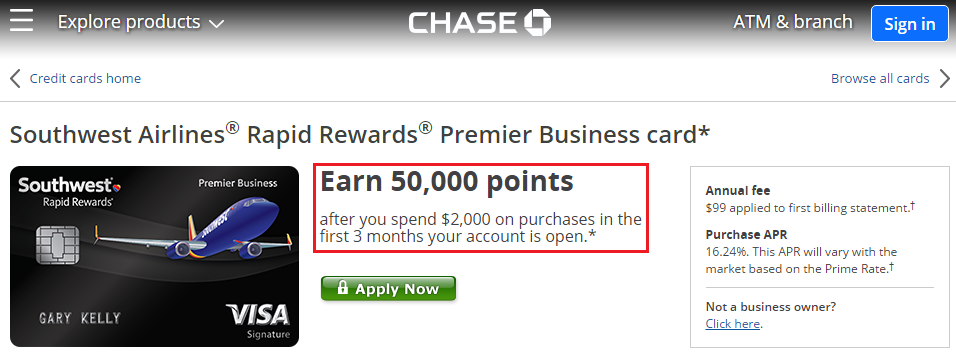

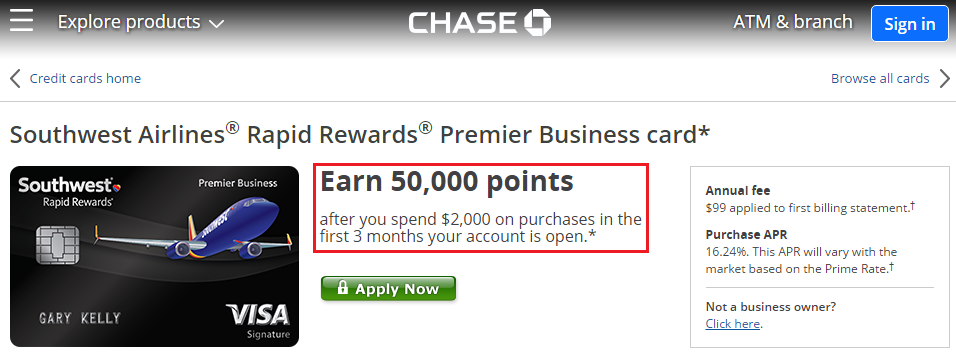

I was recently approved for a Chase Ink Plus Business Credit Card in mid March, but I am eyeing the Chase Southwest Airlines Premier Business Credit Card that comes with 50,000 Southwest Airlines Miles/Points after spending $2,000 in 3 months ($99 annual fee). Since Southwest Airlines Miles/Points are worth roughly 1.4 CPP, this sign up bonus is worth $700 in Southwest Airlines travel. Does anyone know if this Chase business credit card is affected by the Chase 5/24 rule?

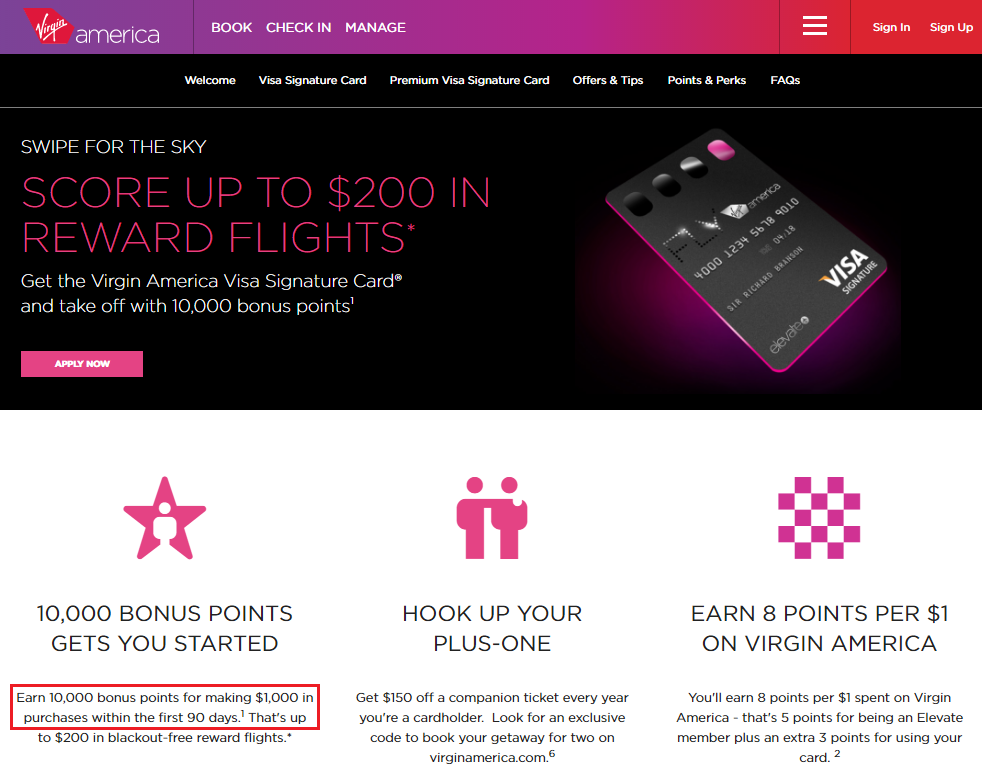

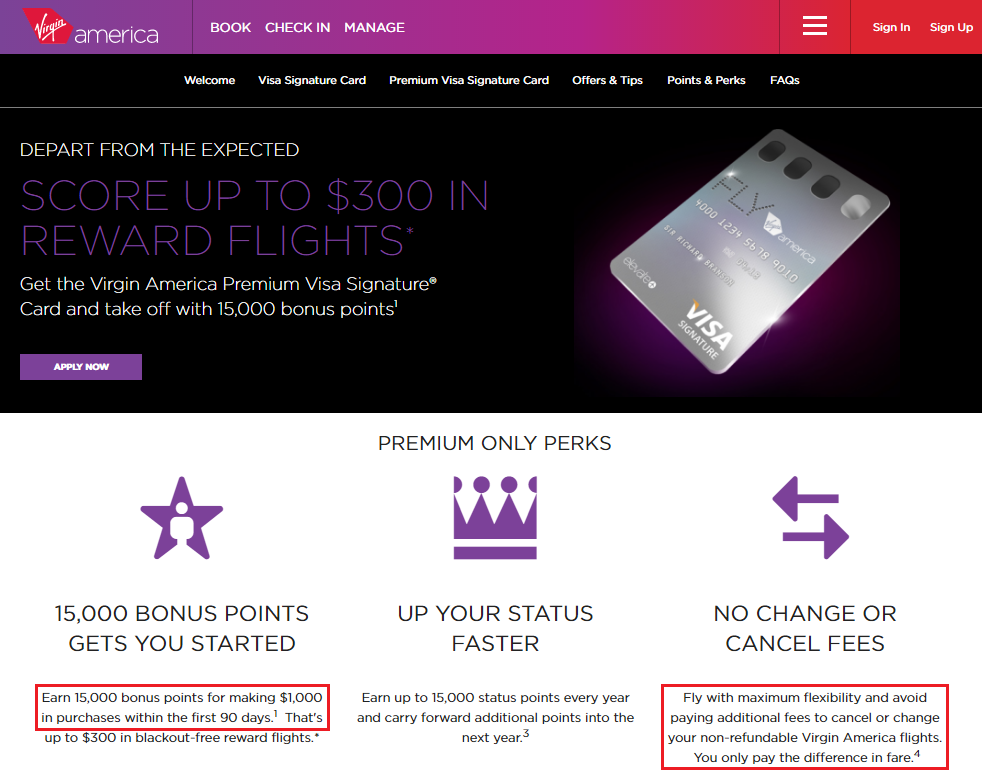

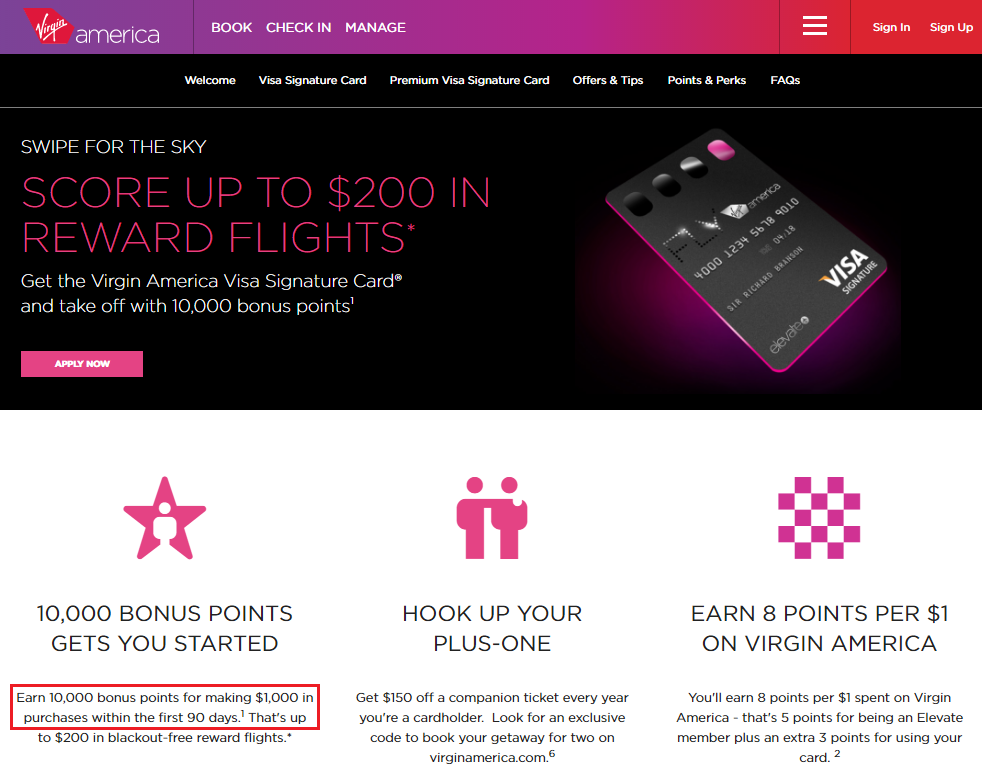

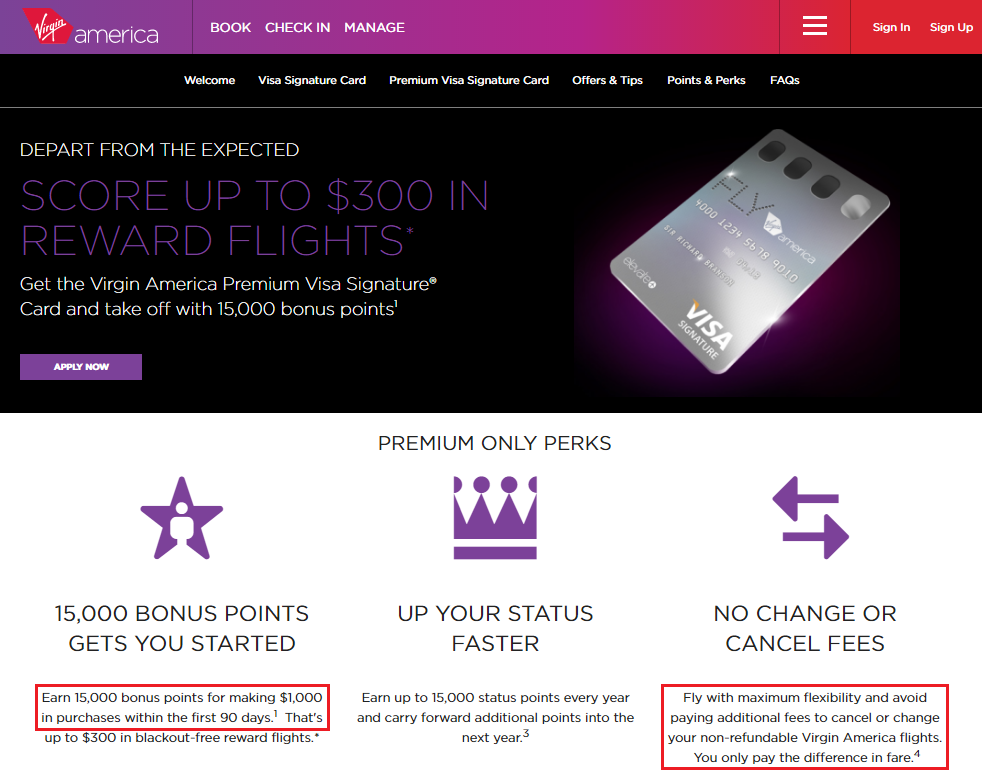

A few months ago, I did a status match to Virgin America gold elite status and have a few upcoming flights on Virgin America. I like their 2 credit cards issued by Comenity Bank, but I need to decide which credit card is better. For the record, each Virgin America Mile is worth 2.2 CPP. Here are the 2 credit card options:

- Comenity Virgin America Visa Signature Credit Card comes with 10,000 Virgin America Miles after spending $1,000 in 3 months ($49 annual fee) (10,000 Virgin America Miles = $220)

- Comenity Virgin America Premium Visa Signature Credit Card comes with 15,000 Virgin America Miles after spending $1,000 in 3 months ($149 annual fee) (15,000 Virgin America Miles = $330)

Both credit cards provide a $150 discount off a companion ticket every year and earn 3x on Virgin America flights. I don’t really care about elite status, so the status points do not mean anything to me. The one big perk of the premium credit card is the ability to cancel or change flights for free (you just pay the difference in airfare or have the canceled flights credit your Virgin America travel bank for future flights). Since the premium credit card has a 5,000 mile higher sign up bonus (worth $110) plus the ability to change or cancel flights for free makes the premium credit card worthy of the $100 higher annual fee.

-

-

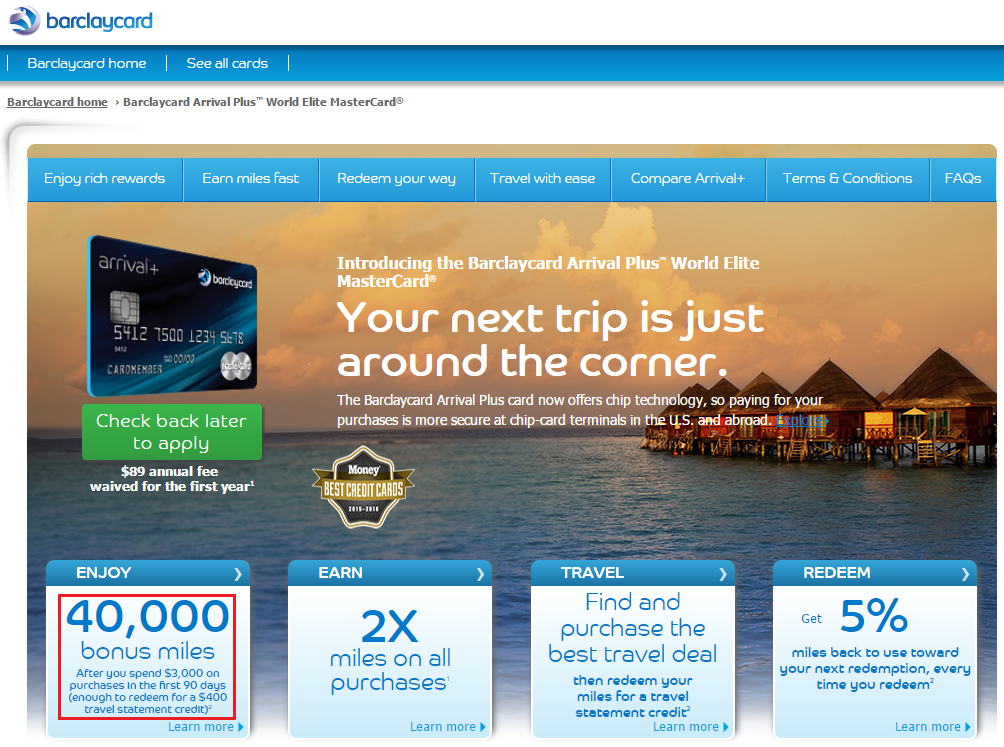

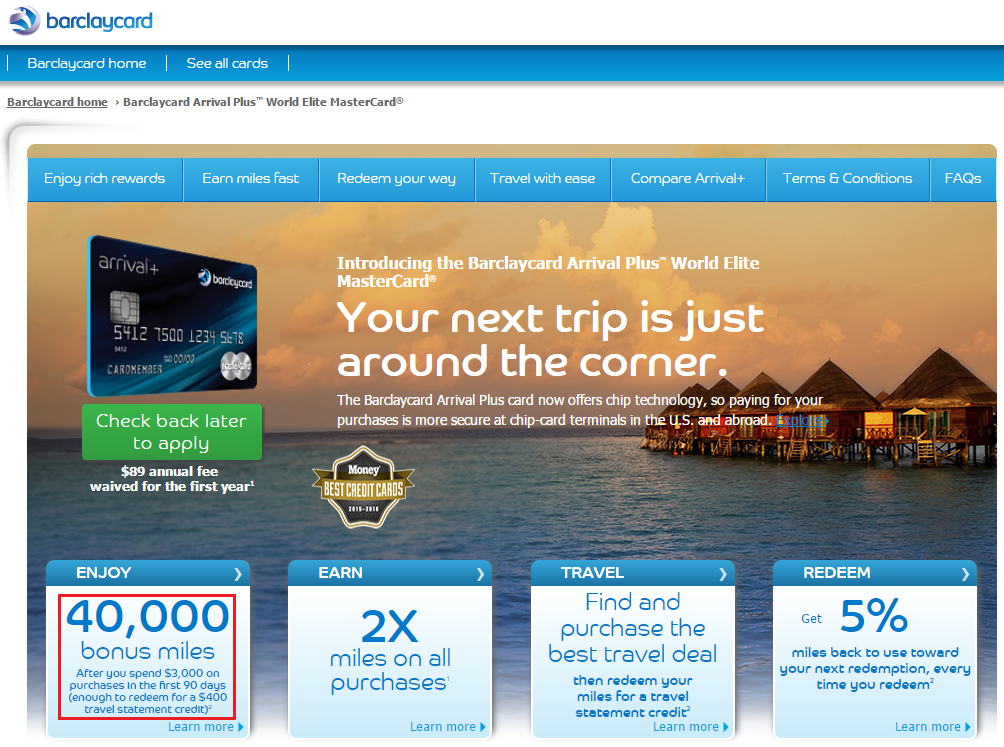

Last but not least, I am considering apply for the Barclays Arrival+ World Elite MasterCard. Why? I am 0/6 on Barclays credit card approvals, so I want to see if that streak can be broken. I need to spend $3,000 in 3 months to get the 40,000 Barclays Arrival points sign up bonus, which is worth $400 in travel (no annual fee the first year). Is this currently the best Barclays credit card to apply for?

I left out American Express since I am currently waiting for a good offer on the American Express Platinum Business Charge Card. I currently have the personal platinum charge card, but I have never had the business charge card. Is there any other increased sign up bonus I am missing? If you have any questions, please leave a comment below. Have a great day everyone!

P.S. If you are interested in applying for any of the credit cards mentioned in this post, please check out my credit card affiliate links. Thank you for your support and good luck with your application!