Warning: if you are just starting out with rewards-earning credit cards, please do not apply for several credit cards at the same time. You are responsible for your credit history and credit scores. You have been warned…

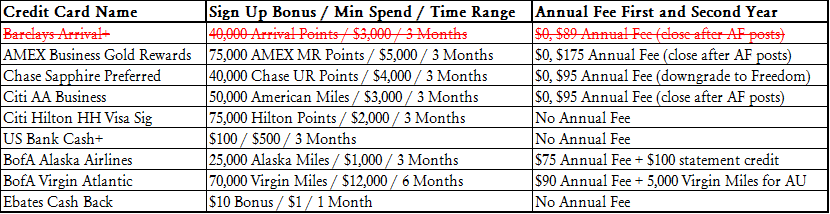

Good evening everyone. Last month, I wrote July 2015: My 8 Credit Card App-O-Rama Game Plan and I shared my plans/reasoning for applying for the below 8 credit cards.

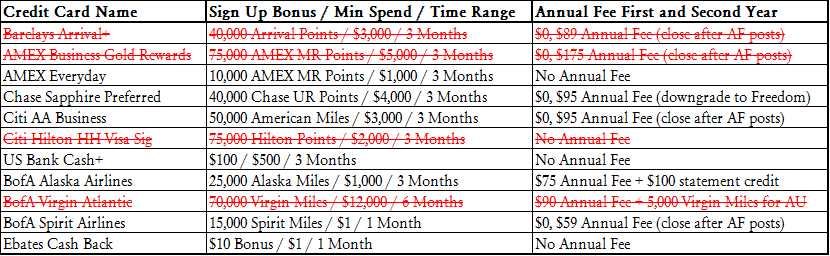

After listening to your feedback and suggestions, I decided to make some changes to my App-O-Rama plan. The table below shows the 7 credits that I ended up applying for. Here are my reasons for not applying for a few of the credit cards:

- The Barclays Arrival Plus Credit Card was not available for new applications on my App-O-Rama date.

- I couldn’t get the targeted 75,000 offer on the AMEX Business Gold Rewards Charge Card, so I decided to wait for a better public offer.

- I forgot that Citi’s “8 Day Rule” applies to personal and business credit cards, so I decided to apply for the Citi American Airlines Business Credit Card instead of the Citi Hilton HHonors Visa Signature Credit Card.

- I decided to go for the Bank of America Spirit Airlines Credit Card instead of another Bank of America Virgin Atlantic Credit Card.

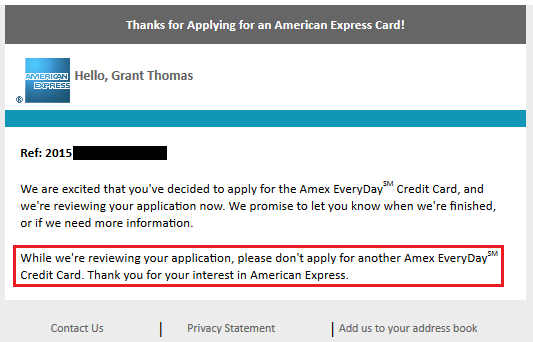

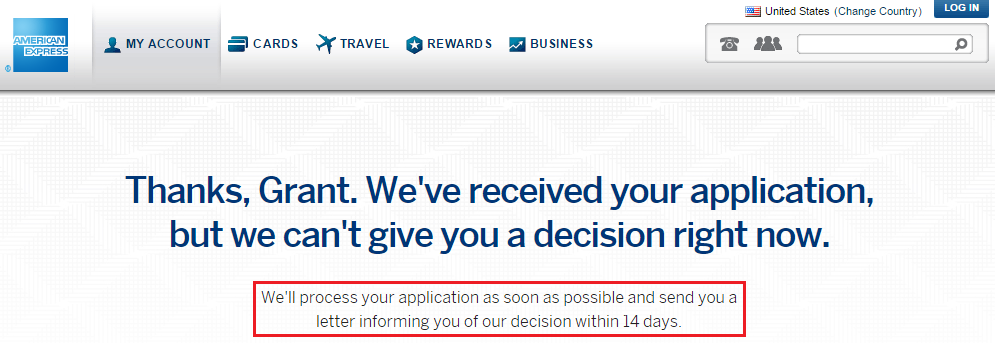

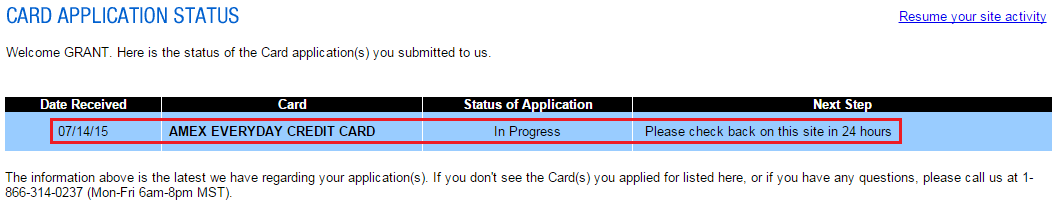

My first application was for the AMEX Everyday Credit Card and I got a pending decision online.

I went to American Express’s online application status website (link) and checked the application. It showed as “In Progress”. I then called the American Express reconsideration department (phone number found on Doctor of Credit), but the rep told me to wait a few days and American Express would contact me if they had any questions.

I also received an automated email from American Express that they received my application and were processing the request.

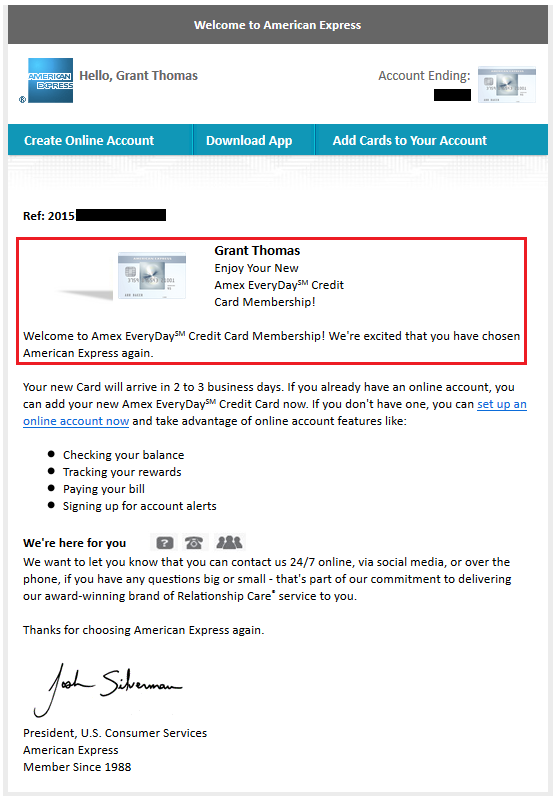

A few days later, I received a phone call from American Express. The rep wanted to verify that I applied for the credit card and to verify my mailing address. After a short call, the rep approved me for the credit card with a $10,000 credit line. 1 for 1 so far. Great start!

FYI, the American Express online application status website also showed the card as approved.

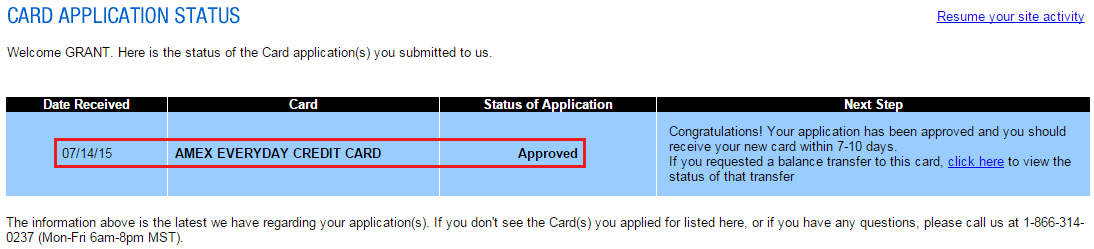

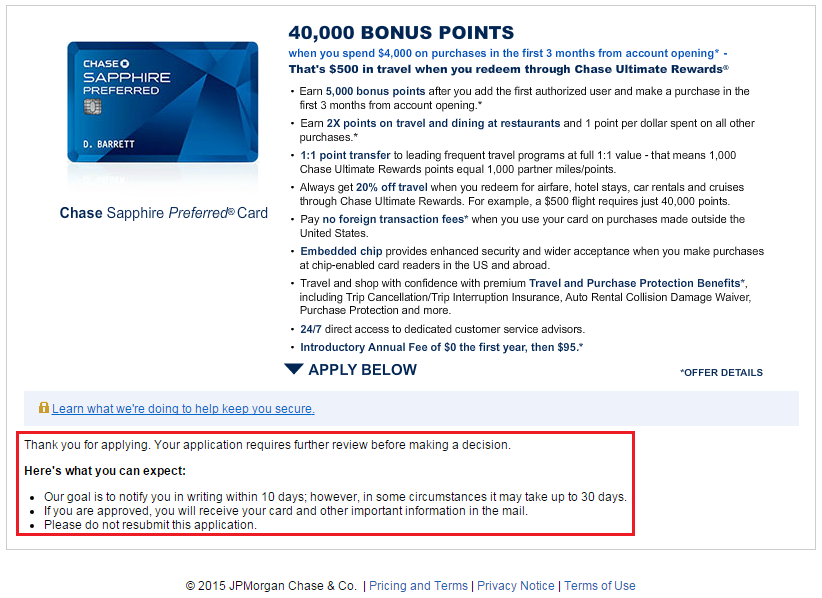

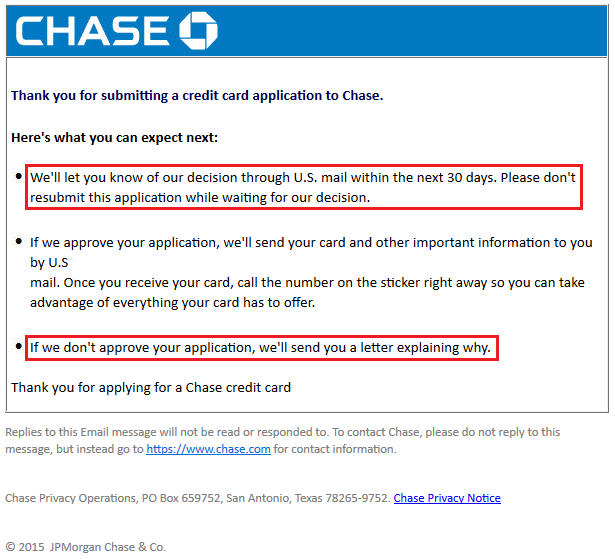

The second card that I applied for was the Chase Sapphire Preferred Credit Card. I received a pending status on that application as well.

I also received the automated email from Chase regarding the application. I shared my experience *trying* to get approved for this credit card in this post: My Unsuccessful Chase Sapphire Preferred Reconsideration Call, Visit, and Tweets. Ultimately, I was declined for having too many recent inquiries. I was 1 for 2 at this point.

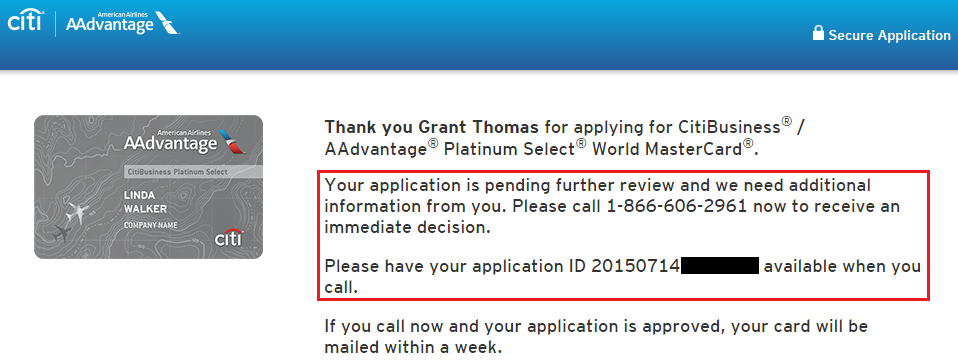

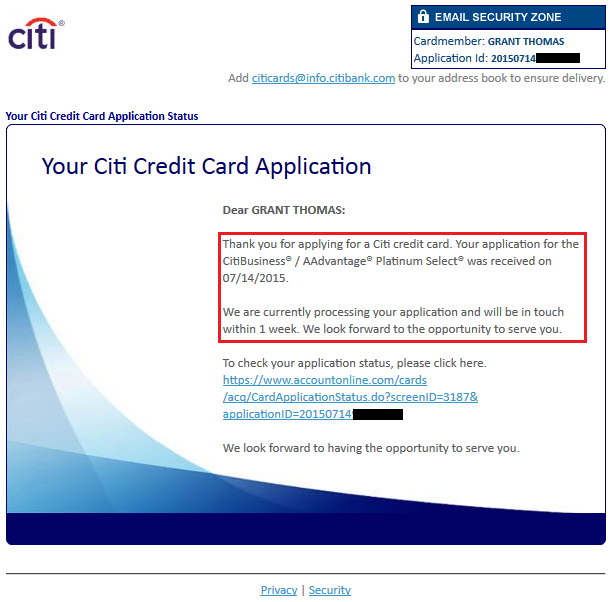

Up next was the Citi American Airlines Business Credit Card. I received another pending status and called the number listed on the screen.

I also received an automated email from Citi regarding the application.

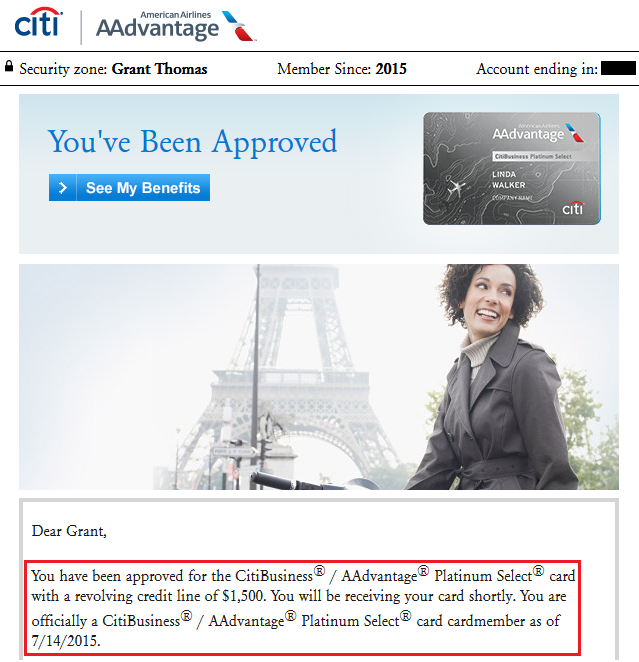

After providing my application ID, the rep approved me for the credit card, but only with a $1,500 credit line. She acknowledged that $1,500 was very low for a business credit card but she recommended that I cycle the credit line as much as I needed for my business. She also stated that I could request a credit line increase later on, if I needed it. With Citi, you cannot transfer credit lines between personal and business credit cards, so that option was off the table. Now I was 2 for 3.

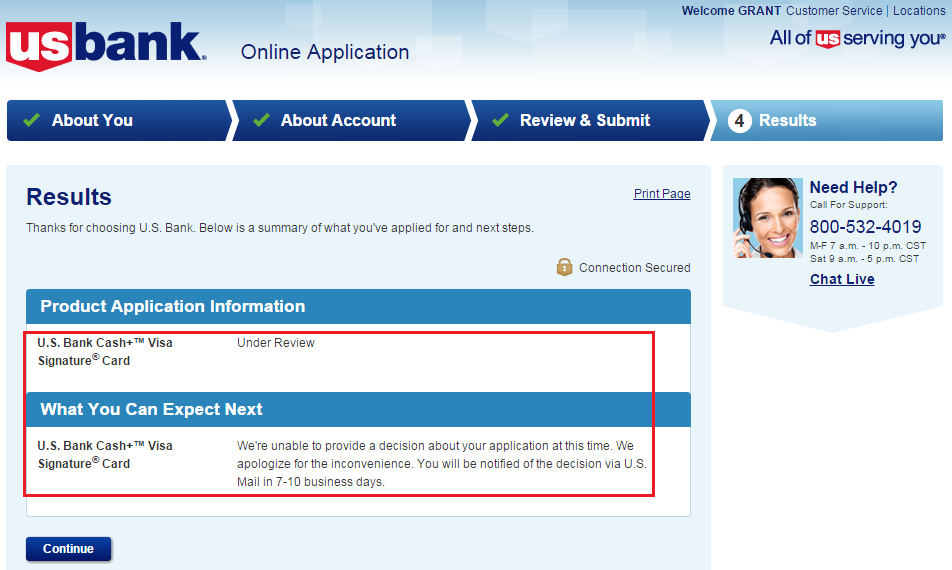

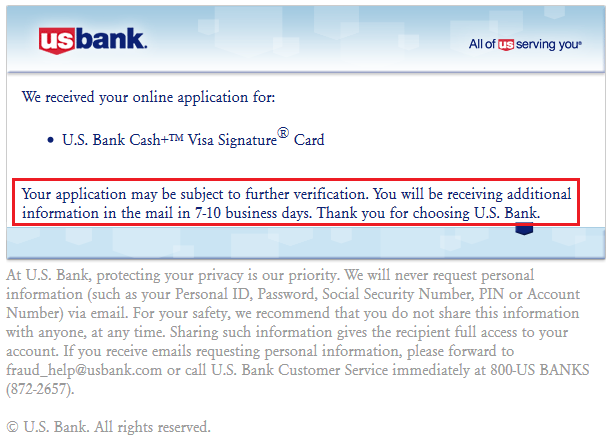

Up next was the US Bank Cash Plus Credit card, which also received a pending status.

Calling the US Bank reconsideration department was not helpful and they told me to wait a few days for the credit department to either approve or deny my application.

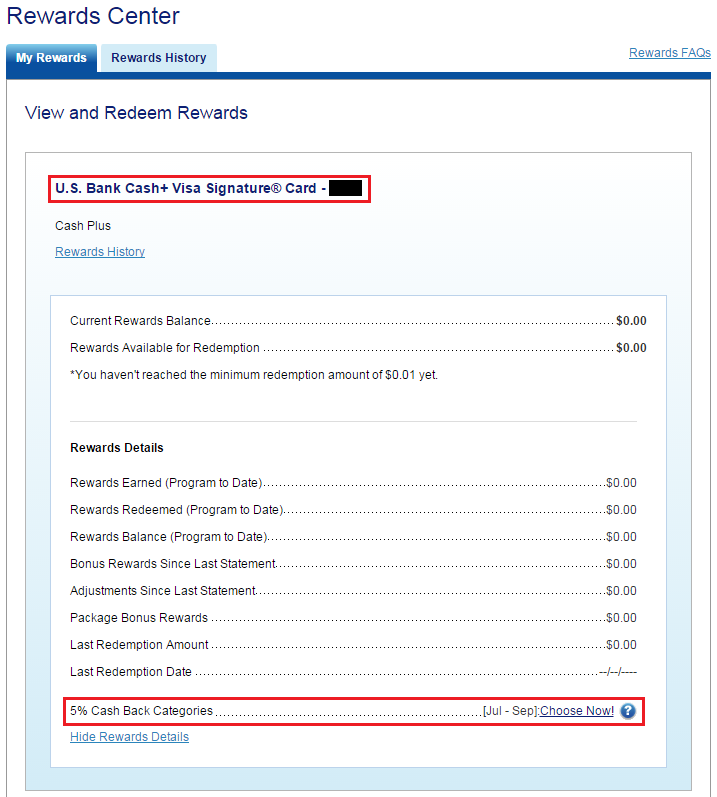

After receiving 2 denial letters from US Bank and making 2 more reconsideration calls, I was approved for the credit card after offering to move $5,000 from my US Bank FlexPerks AMEX Credit Card to the US Bank Cash Plus Credit Card. Even though the credit card has not arrived yet, I see the card in my US Bank online account and I can even pick my categories before receiving/activating the credit card. If there is any interest, I can write a blog post about my tumultuous experience getting approved for my 5th US Bank credit card. Now I was 3 for 4.

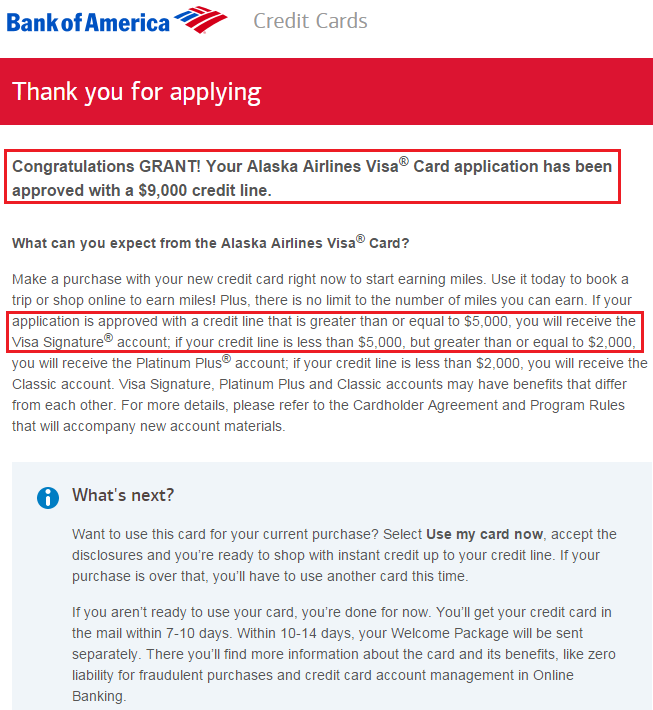

Up next was the Bank of America Alaska Airlines Airlines Credit Card, which I was instantly approved for with a $9,000 credit line. I love instant approvals. I was 4 for 5 now.

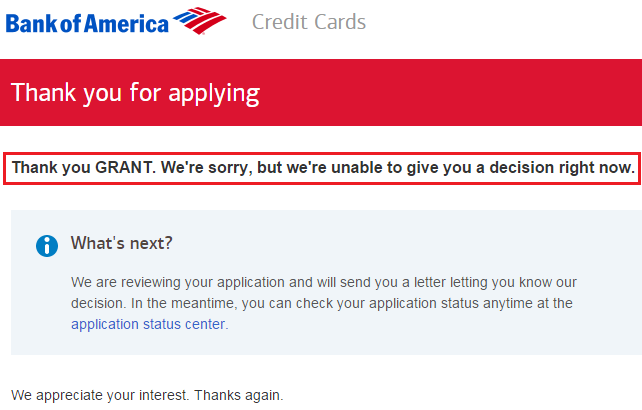

Since Bank of America combines hard pulls on the same day, I tried my luck with the Bank of America Spirit Airlines Credit Card. I received a pending status and called Bank of America’s reconsideration department. They were unwilling to approve me even after I offered to transfer credit lines or completing close my other Bank of America credit cards. Fortunately, this story has a happy ending which I shared here: App-O-Rama Update: Overturning Bank of America’s Spirit Airlines Credit Card Denial Letter. I was 5 for 6 now.

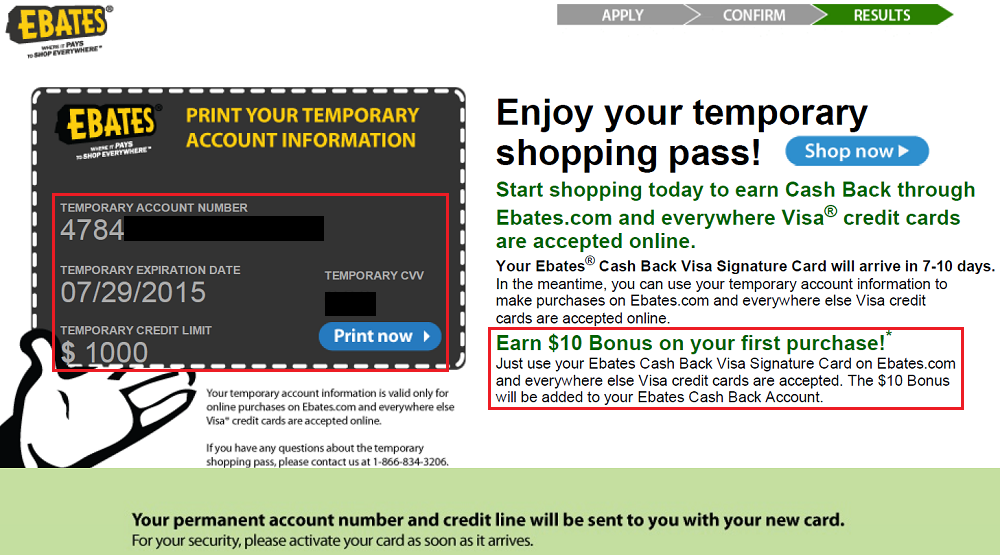

Lastly, I applied for the Ebates Cash Back Credit Card and thankfully I was instantly approved. If you are instantly approved for this credit card, they give you a temporary credit card number with a $1,000 credit line which you can use before your card arrives. I bough a discounted Peet’s Coffee gift card from Raise.com to activate the $10 bonus after my first purchase.

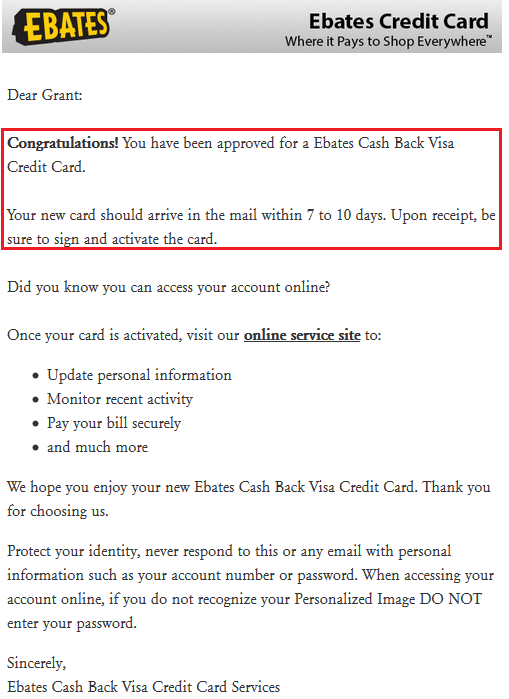

Here is the approval letter for my Ebates Cash Back Credit Card.

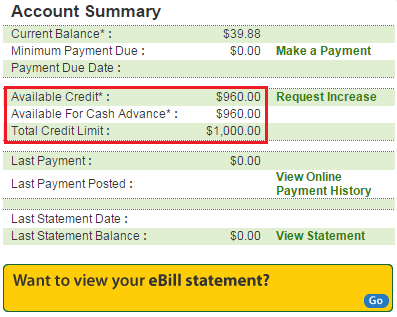

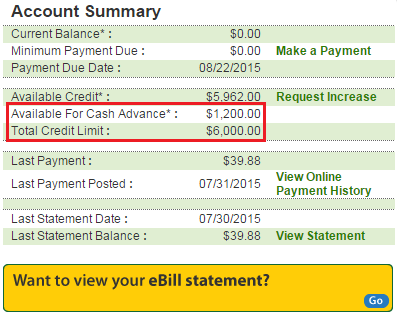

When I received the credit card, I activated the card and created an online account at the same time. The first time I logged into my Ebates Cash Back Credit Card account, it only showed me a $1,000 credit line. That was pretty low, considering that the credit card is a Visa Signature, which means that the credit line should be $5,000 or higher. The following day when I logged into my Ebates Cash Back Credit Card account, I saw that the credit limit was now $6,000. I believe the $1,000 limit is the temporary limit that you get when you are approved for the credit card and the real credit limit is activated as soon as you activate the credit card. Apparently there is a short lag between showing the temporary credit limit and the approved credit limit. If that happens to you, don’t freak out, just wait a few hours and check your online account again.

After the dust settled and all the reconsideration calls were made, I ended up being 6 for 7 on my App-O-Rama. I just updated my list of active credit cards and my new total is 32. If you have any questions, please leave a comment below. Have a great day everyone!

Which categories do you suggest for US Bank+ card?

That is the question for another post. I looked at it but I don’t have an exact answer. Do you have any suggestions?

Probably depends on what you have close? My guess would be Office Supply and or Groceries and or Pharmacies… ?? But I wanted to see what you advise on picking.

My struggle is to find cash back categories that differ from credit cards rewards from other credit cards. There is no point of going out of my way when I have other credit cards that get the same rewards. Does that make sense?

Yep. Totally.

I will look into this issue and take a hard look at the options.

I think dept stores & electronics stores is probably the way to go if you’re going to MS and max them out. Otherwise, if you’re using it for daily spend, obviously pick the categories you need. ;) Back when it had restaurants as a category, it was the only way I was getting 5% cb on restaurants. Now I only get 2x TYP/Hyatt/United points :(

Electronics Stores was my first thought since Newegg is on the list and the sell various gift cards. I guess department stores also works, but I haven’t checked out the local stores in Walnut Creek to see what the GC situation is like.

Hi, I recently went on yet another app myself! 5 out of 7 so far. 2 new Amex: Hilton Honors & green charge card. (hubby has platinum, so 1 of those was enough). BOA, Neiman Marcus & Lowe’s. Got “we need more verification from Citi and called twice. So I guess I have to wait & see what they want. US Bank was the same email you received. Not sure if they do recons? Will try and see if it is a big no. My stats: Fico 775, 736 & 733. EQ actually went up when Lowe’s hit. Oldest account: 28yrs. No baddies on any reports. I don’t have as many as you.lol I did cancel one cc so far and looking at canceling others that I haven’t used in a while and aren’t very old. I tried 3 times before this for a Citi card and always get an instant denial. Not sure why? Never tried for US Bank until now. Have all the names except the CSP which we know I can’t app for until my accounts are 2 yrs old. Don’t predict a problem with Chase. Anything I’m doing wrong that would make Citi keep denying me? Seems a thorn in my side. Now I want a Citi card more than ever just to prove I can get it!

Hmm, what are the reasons given for not approving you for a Citi card? You can try opening a Citi checking account to see if that improves your chances of being approved.

I don’t have the cash+ card. But I think best buy would be a good choice. Aside from merchant gift cards. Their 200$ visa gift cards cards come with 5.95$ fees. You earn 5% cash back plus 2% in rewards which equal to ~14$ return. This is ~8 profit per card and ~80 per quarter. Am I right? and once you pass 3500$ in spend you earn 2.5% in rewards which makes it like ~90$. Solid 360$ per year!

It depends on where you live. The Best Buy stores that I have visited in the Bay Area do not have $200 VGCs, but you make a good point about buying them if they are available.

Err… is the Ebates CC even useful?

Extra 3% cash back on all Ebates purchases, regardless of the base cash back rate.

I’ve been thinking about getting it for a year now…it would really help bump up ebates over TCB which has been my most-used portal lately. Which bureau did it pull?

I don’t really know, can I see on Credit Karma or Credit Sesame?

If you can get the extra 3% on AGCs, it would be awesome. Ebates is usually at 1% => 4% – fees? Interested to know about the cash advance situation…

A few people have confirmed that the AGC purchases do earn the extra 3% cash back. If you are worried about cash advance fees, just call the credit card company and tell them to lower your cash advance limit to $0 or as low as possible.

If it didn’t earn extra 3% it was worse compared to citi at&t access cards.

That would be true.

that’s great

That BofA Virgin Atlantic card looked fantastic, as my first travel goal is England next year. But it looks like that deal is gone as the current offer is only 20k miles. I just got approved for the Amex Everday Preferred and I have committed myself to only apply for 1 card per month until I get ramped up on my program. Bummed that I missed out on this one.

The 75,000 Virgin Atlantic is still available. Here is the direct link to the application page: https://www.applyonlinenow.com/USCCapp/Ctl/entry?sc=VACGCM#b

Thanks Grant!

I would be interested in hearing about the process of dealing with US Bank recon – I have a few cards with them and have a feeling it will get a lot more challenging going forward for me. Thanks!

Thank you for the vote, Elliot. If I get a few more people interested, I will write the post. Have a good night.

I would enjoy reading a post about the process it took to get approved for the Cash+ credit card.

Ok, second vote for the US Bank Cash Plus Credit Card reconsideration post. Let’s wait a few days for the card to come in the mail and I will start from the beginning :)

Hey Grant – Could you please link to any information on getting approved for a US Bank card? I know that in the past, you had to go through hoops to freeze other random reports. Is that still the case? Thanks!

My ARS and IDA credit reports are still frozen, so I think that is still an important step to getting approved for US Bank credit cards.

Probably YMMV. I didn’t have to freeze anything, but I applied in a branch. So, that might also make a difference.

Thanks for the data point. Glad your in-branch application was successful.

Thanks Grant…I’m getting ready for an app-o-rama in a week or so, this information is helpful.

Glad to help, Jeff. Which credit cards are you considering?

Grant, What am I doing wrong?!?! The last 2 BofA app for Alaska visa have been approvals for $2k & $1k, 6 months apart. I have one signature from very early last year.

It sounds like you might have too much credit with BofA, therefore they are not approve your new cards for the Visa Signature version (starting at $5,000 credit line). What’s your total BofA credit line from all your BofA personal and business credit cards?

Just the $5k signature from very early 2014 and $3k Platinum from 6mos ago. Fwiw, the latest AOR, I was instantly approved for Barclays Lufthansa, move credit to Citi Premier, and cxl Amex SPG personal (4 limit) for Hilton Surpass. Spoke too much on Chase call and was denied BA. Waiting on TD.

Thank you for sharing. You might want to lower both of your Alaska Airlines credit limits to $1,000 before applying for more Bank of America credit cards. You will have a better chance of getting instantly approved for a Visa Signature credit card.

Hey is this the second AA Biz card you applied for or the first? did you use an EIN or your SSN as a sole prop?

I only have 1 Citi AA Biz Card. I used my TWG EIN.