Good morning everyone. A few weeks ago, I did a mini app-o-rama and applied for 3 credit cards: Capital One Venture X Credit Card (read post), Chase IHG Rewards Premier Business Credit Card, and Bank of America Alaska Airlines Credit Card (read post).

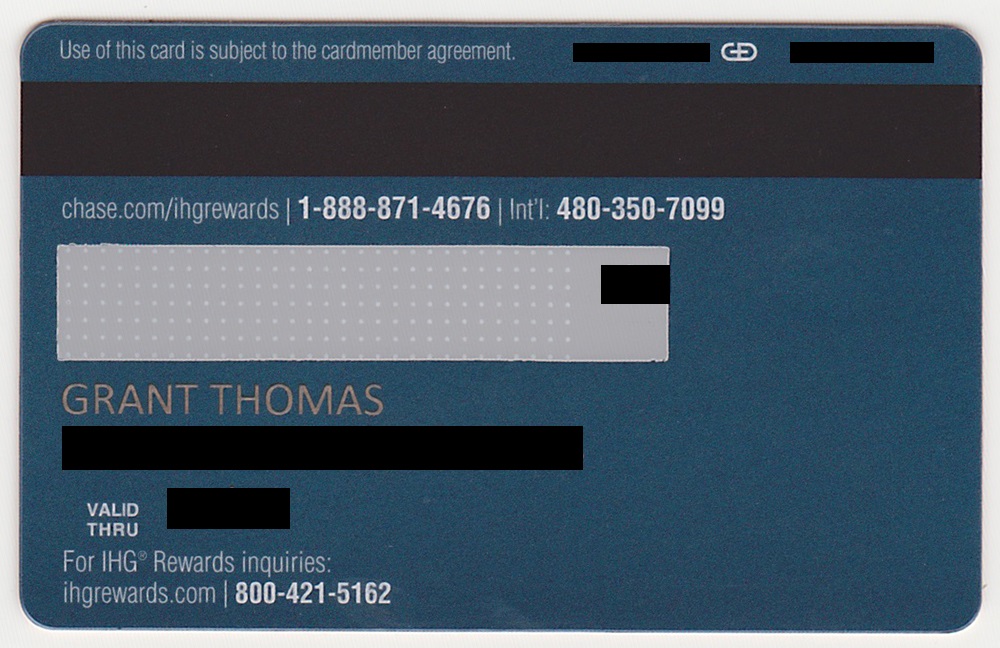

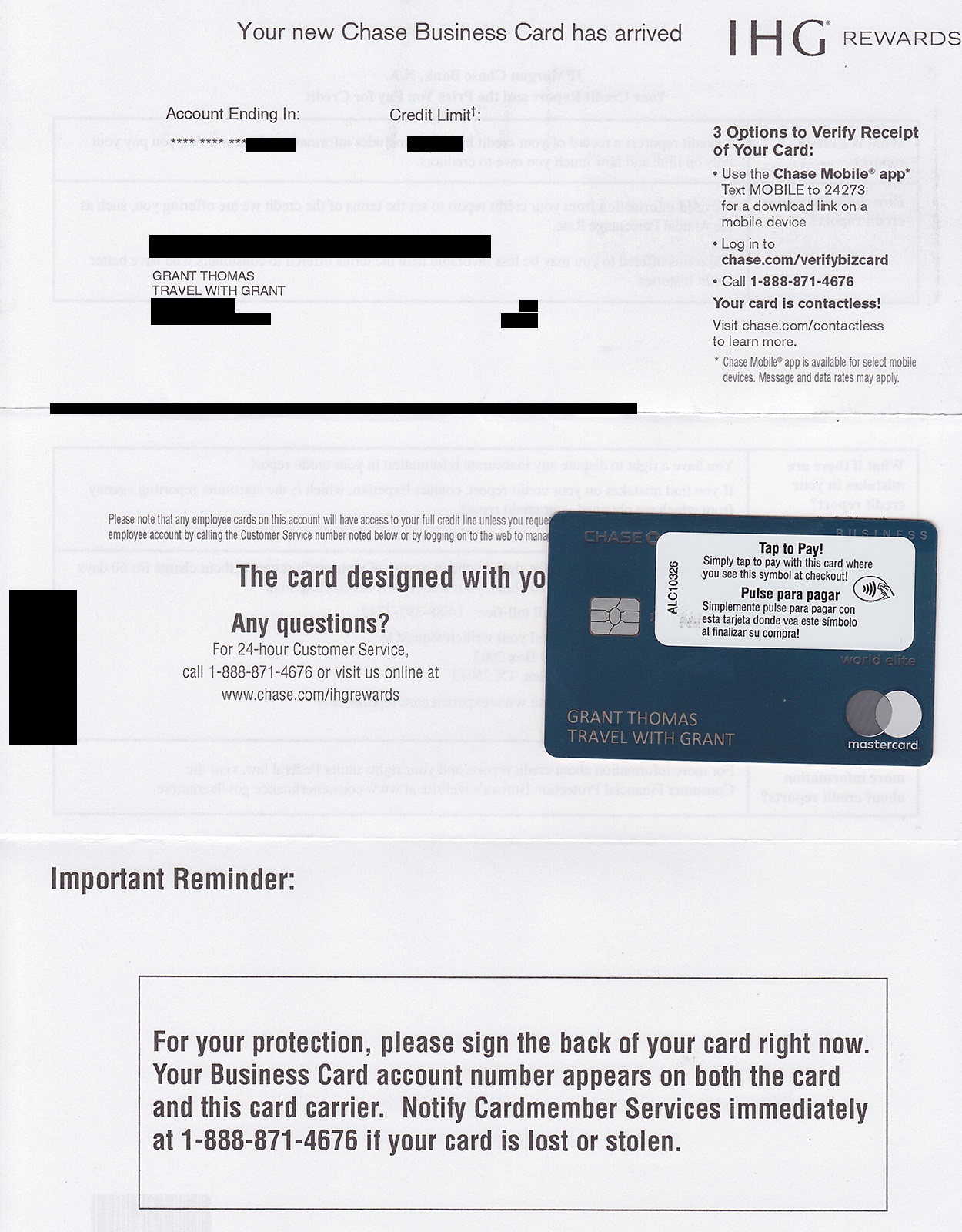

In this post, I will show you the Chase IHG Rewards Premier Business card art, welcome letter, brochure, and the online activation process. First things first, here is the front and back of the card. It is clean and nicely designed. It has a very similar style as the Chase IHG Rewards Premier Credit Card.

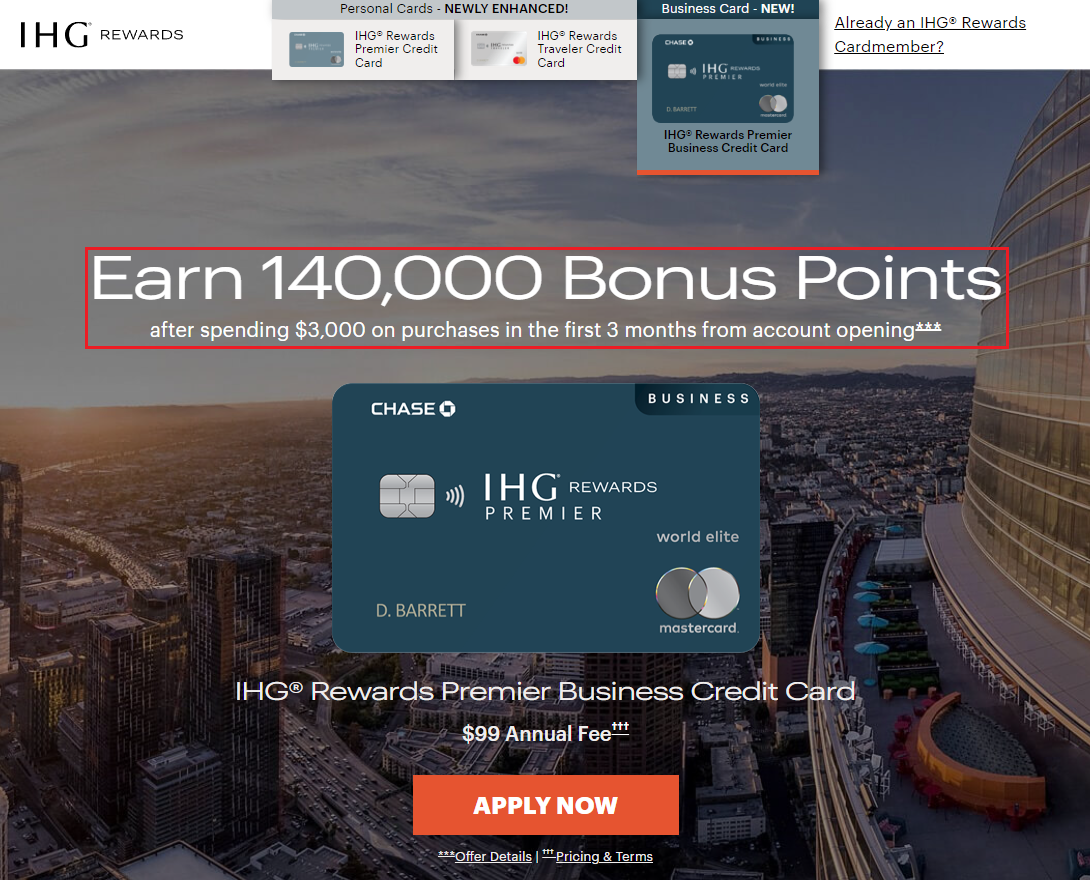

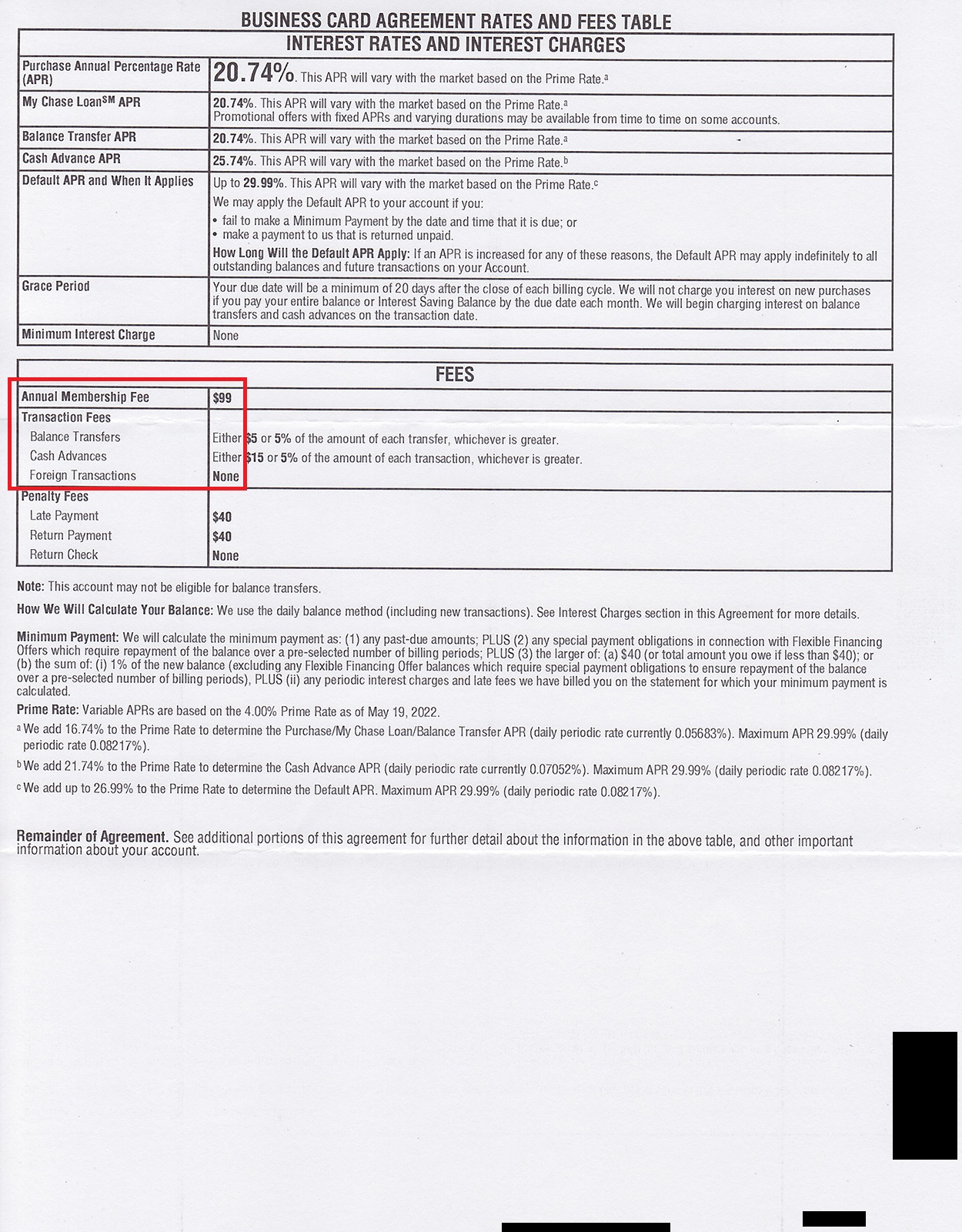

The Chase IHG Rewards Premier Business Credit Card currently offers 140,000 IHG Rewards Points after spending $3,000 in 3 months and comes with a $95 annual fee.

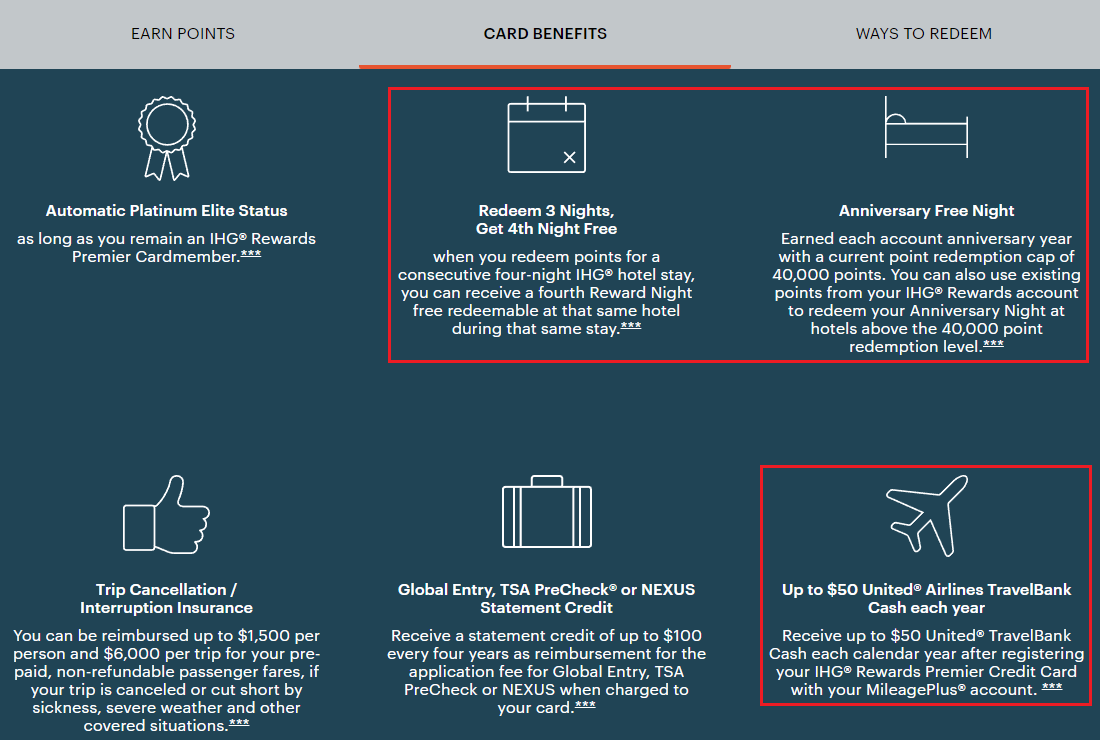

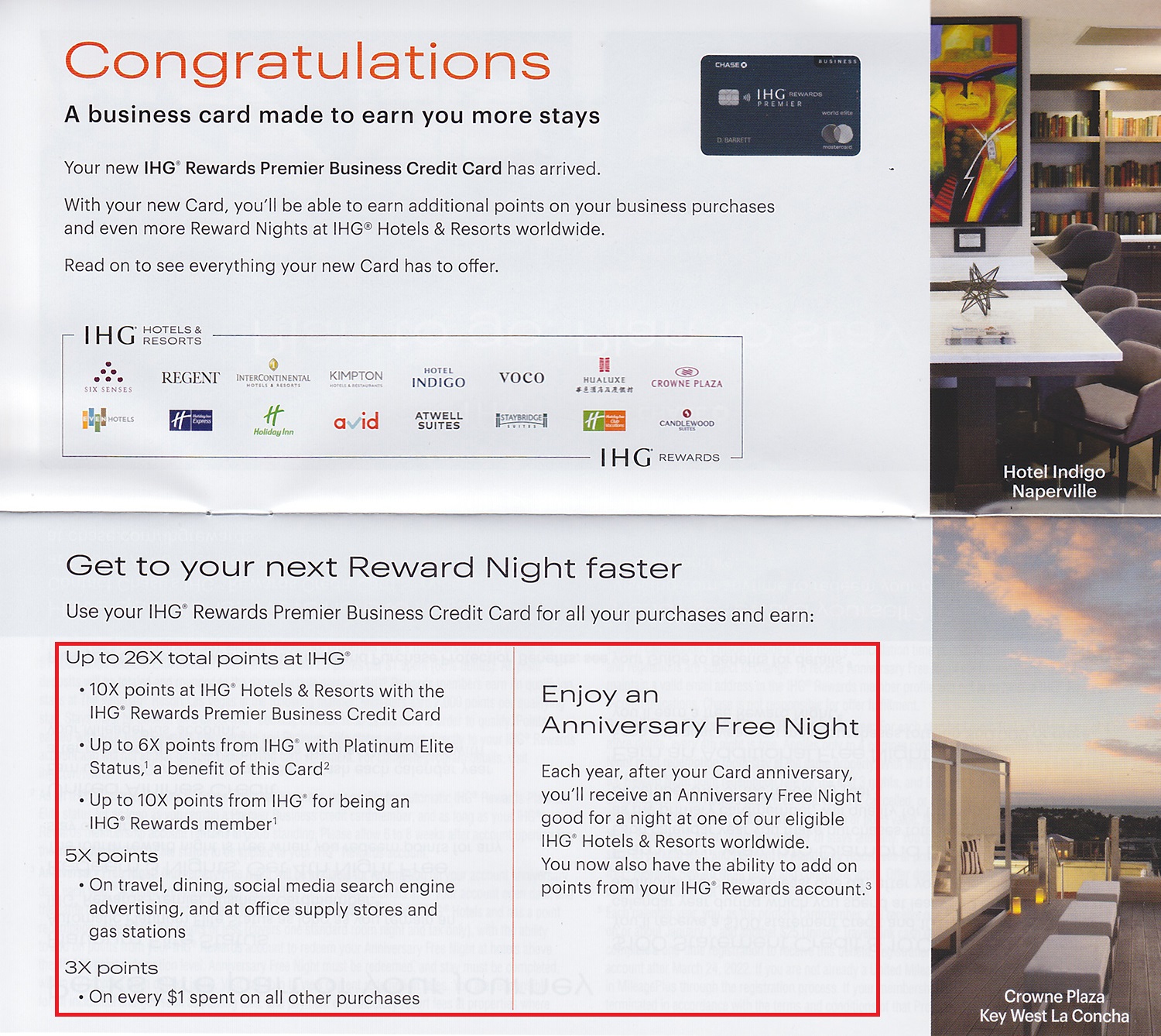

This credit card comes with IHG Rewards Platinum Elite Status (same as IHG Premier), access to the 4th Night Free benefit (same as IHG Premier), a 40K Free Night Certificate with the ability to top up to book a higher category hotel (same as IHG Premier), $50 United Airlines TravelBank Cash (same as IHG Premier) and also comes with Global Entry / TSA PreCheck credit, but I have more Global Entry credit than I know what to do with.

I was instantly approved for this credit card and received this welcome email. This might be the most lackluster welcome / congratulations email ever.

About a week later, my new credit card arrived. Here are the pages of the welcome letter.

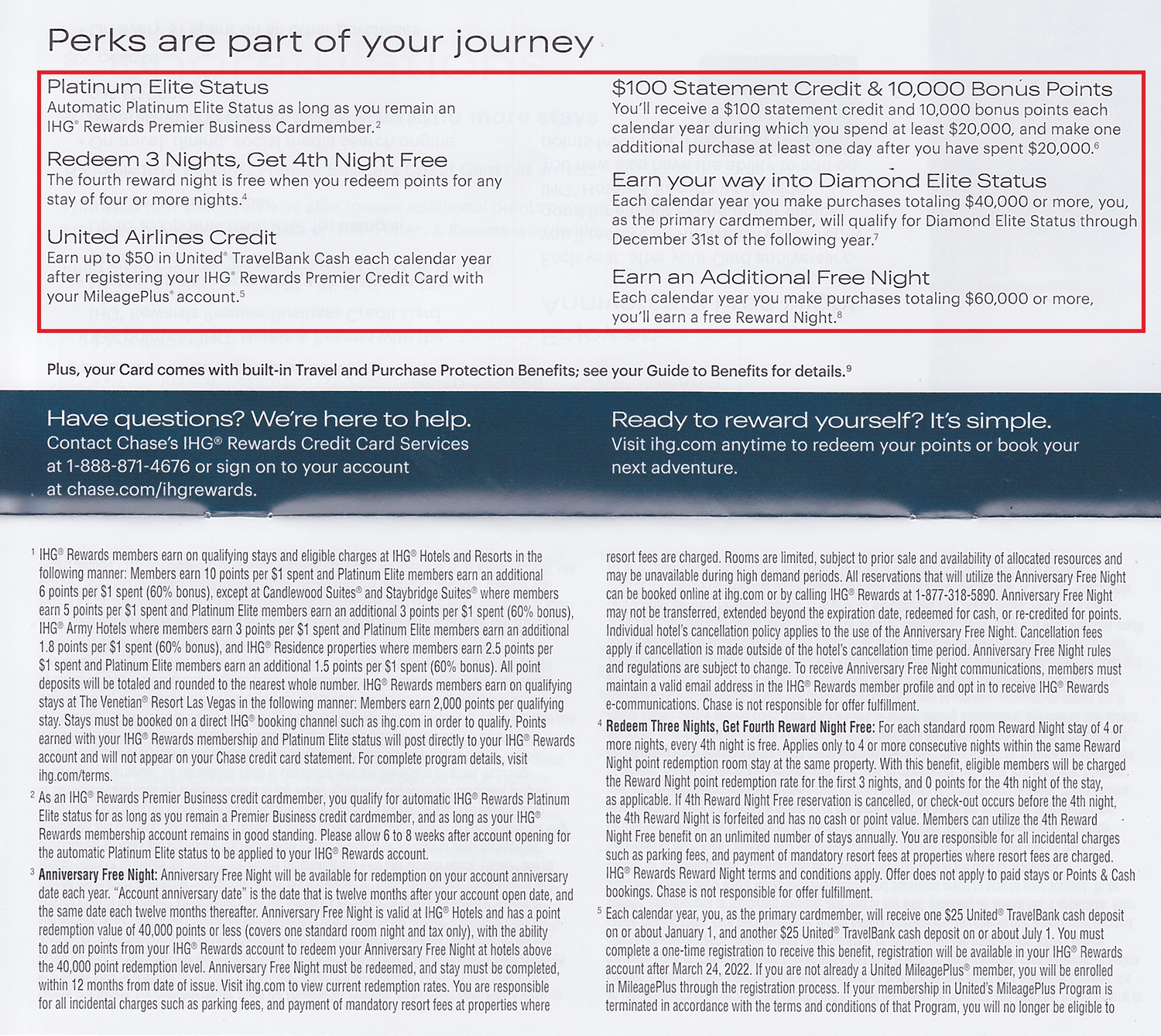

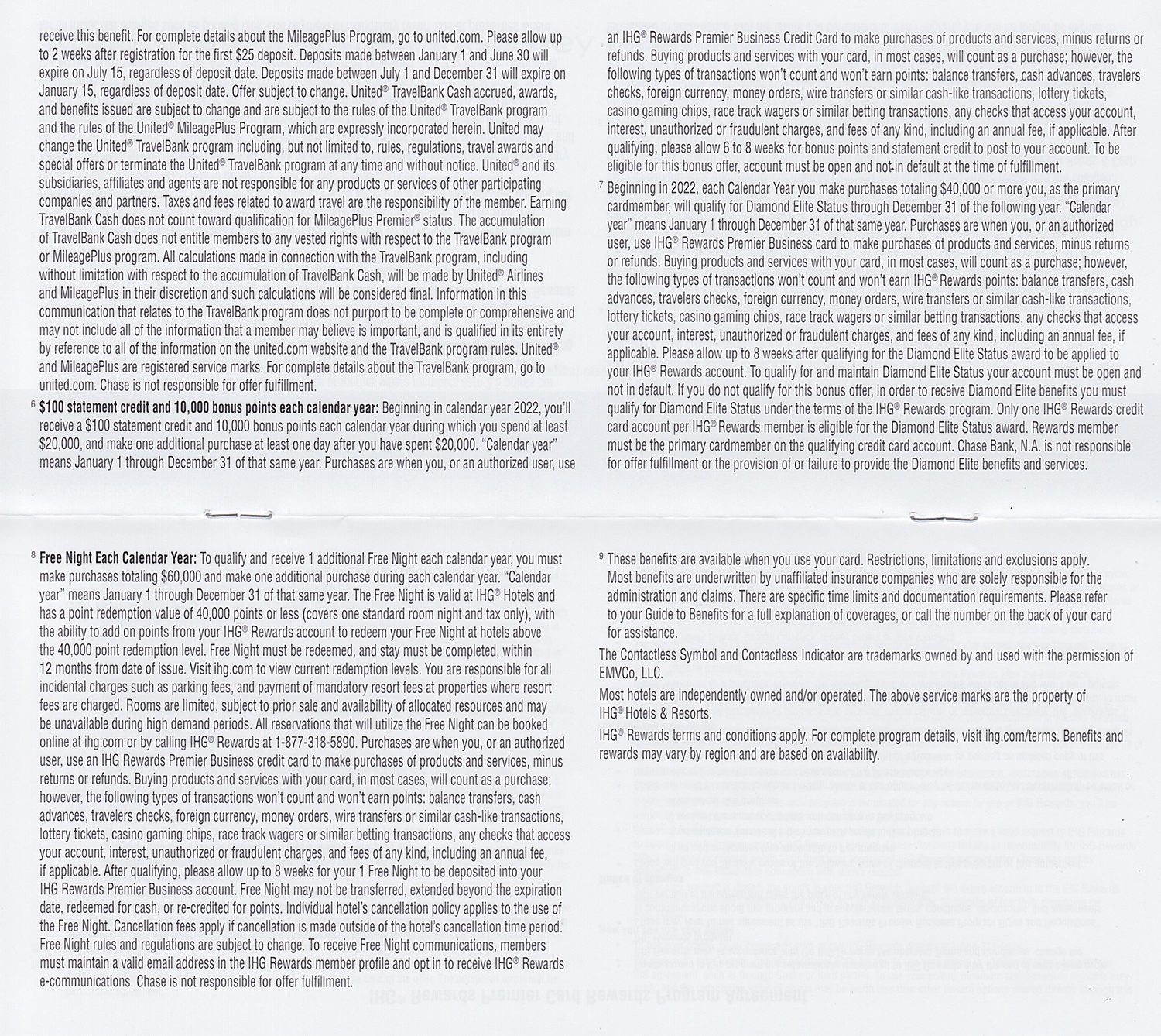

Here is the brochure that came with the card that highlight the credit card benefits. You can earn up to 26 points per dollar at IHG hotels, that is impressive.

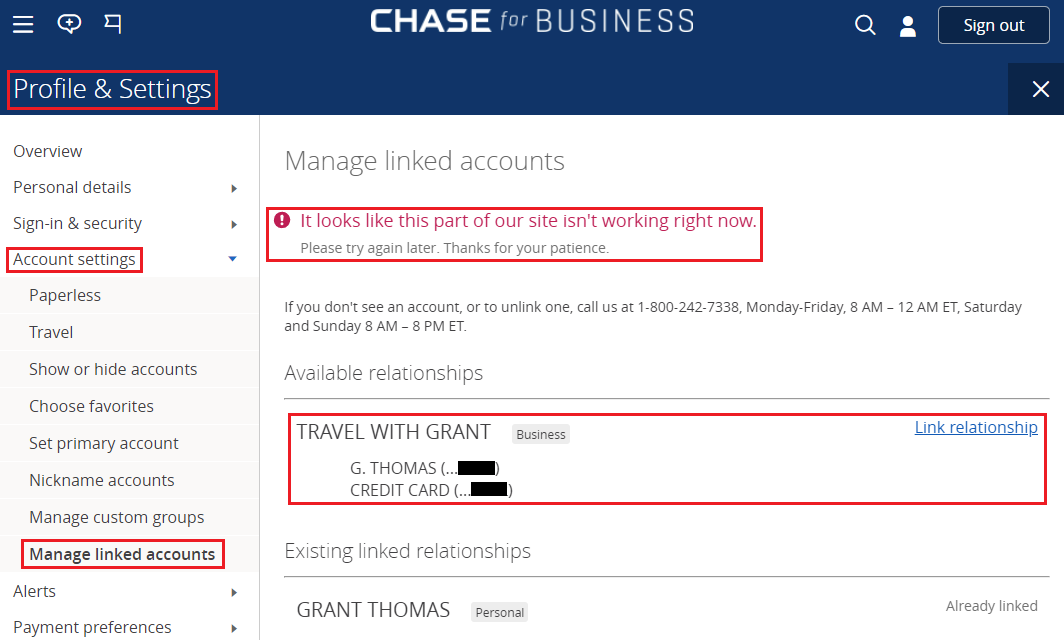

Activating the credit card was easy, but adding it to my Chase online account turned out to be difficult. My Chase online account has personal credit cards, business credit cards, and a business checking account, so there are a lot of accounts. I called Chase to ask for help. The rep walked me through the steps to go to Profile & Settings, then click Account Settings, then click Manage Linked Accounts, and then click Link Relationship next to my new card. Unfortunately, the Chase website couldn’t link the relationship. After trying a few times from different browsers, the Chase rep transferred me to the technical team who was able to manually add the new credit card to my Chase online account.

I have a few large upcoming purchases to make which should make it easy to complete the minimum spending requirement. I don’t have an immediate use for the IHG Rewards Points, but between my wife and myself, we have 3 other IHG personal credit cards that have annual fees that post around this time. This will allow us to have several IHG Free Night Certificates that are issued and expire around the same time, making it easier to book several nights back to back. If you have any questions about the Chase IHG Rewards Premier Business Credit Card, please leave a comment below. Have a great day everyone!

P.S. If you liked this post, I recommend reading my other credit card unboxing posts (sorted by date):

I love most of what you write but can you explain to me why a credit card has to have an “unboxing” column? I mean, you take it out of the envelope, register it and you are good to go. What’s the big deal?

Like I said, I love most of what you write, but I’ve never understood this whole “unboxing” thing.

I’ll go away and leave you alone. Looking forward to more great TRAVEL blogging. :-)

Hi Patrick, I appreciate your feedback. I know these unboxing posts are kind of strange, but I think there are a few people out there that like to read them and see what the credit card looks like. It is also helpful if you threw away the brochure and want to look at them again. Trust me, I have some better travel blogging posts coming soon :)

Pingback: Unboxing Capital One Venture X Credit Card: Card Art, Welcome Letter, Brochure & Online Activation Process

Can you apply for a business card even if you don’t really have a business? Also, having opened a Citi bank card recently, will I be denied because I just recently opened that account?

Hi James, yes, you can use your name as your business name and say that you are a sole proprietor. Bank of America has rules called the 2/3/4 rule that may impact your ability to apply for another credit card recently. Read this article to learn more: https://www.doctorofcredit.com/httpswww-doctorofcredit-combank-america-312-rule-credit-card-approvals-contribute-data-points/

I also saw somewhere that if you already have an IHG personal credit card, you are not eligible for the sign up bonus points if approved for the business card.. Is that true?

Hi James, according to the landing page, it says “If you currently have an IHG Rewards Credit Card from Chase, or you earned a new cardmember bonus on that credit card within the last 24 months, you are not eligible to receive another of the same credit card.” I think the key part is the “you are not eligible to receive another of the same credit card”. Since I’ve never had the Chase IHG Business CC, it sounds like I am eligible for the CC and sign up bonus. That is how I understand the sign up bonus language.