Good afternoon everyone. A few weeks ago, I did a mini app-o-rama and applied for 3 credit cards: Capital One Venture X Credit Card, Chase IHG Rewards Premier Business Credit Card (read post), and Bank of America Alaska Airlines Credit Card (read post).

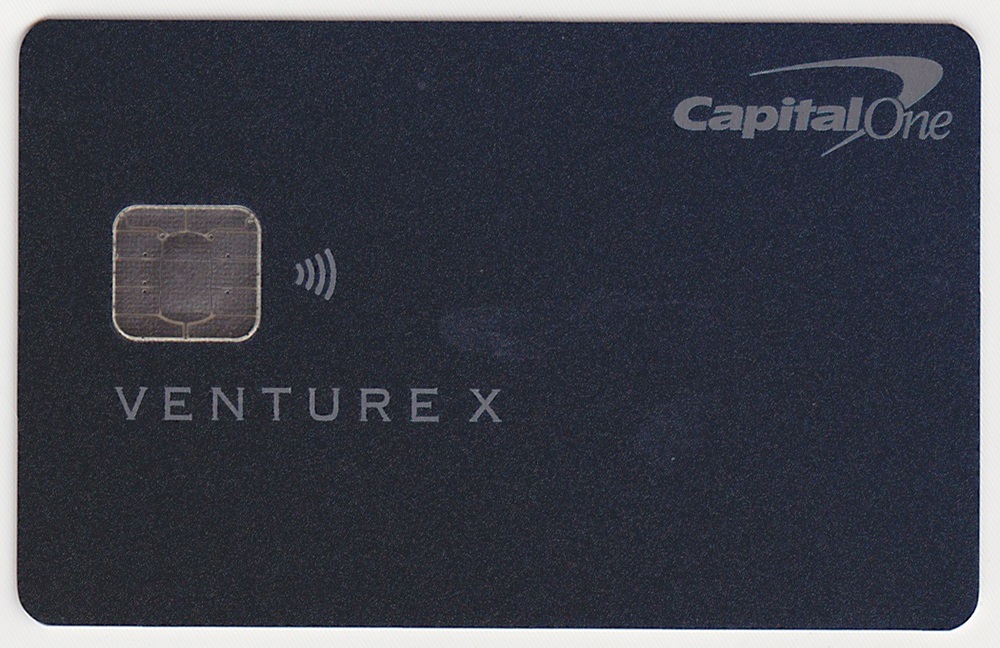

In this post, I will show you the Venture X card art, welcome letter, brochure, and the online activation process. First things first, here is the front and back of the Venture X. It is not very flashy and looks very simple. On the back, there is a key icon. I figured out that you can hold the card up to the screen when you sign into the Capital One app to complete the Two Factor Authentication.

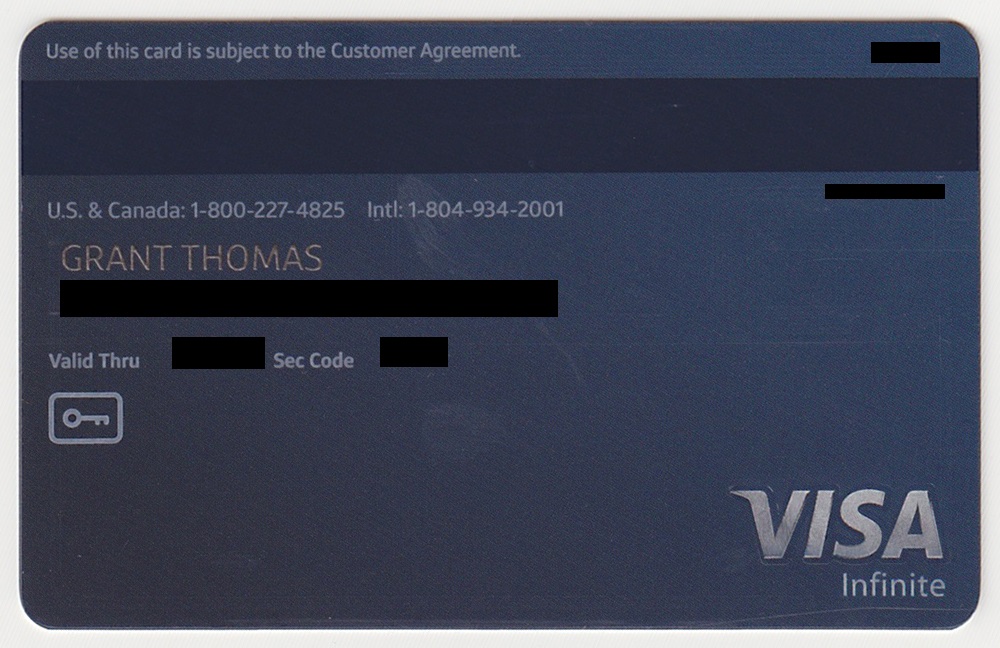

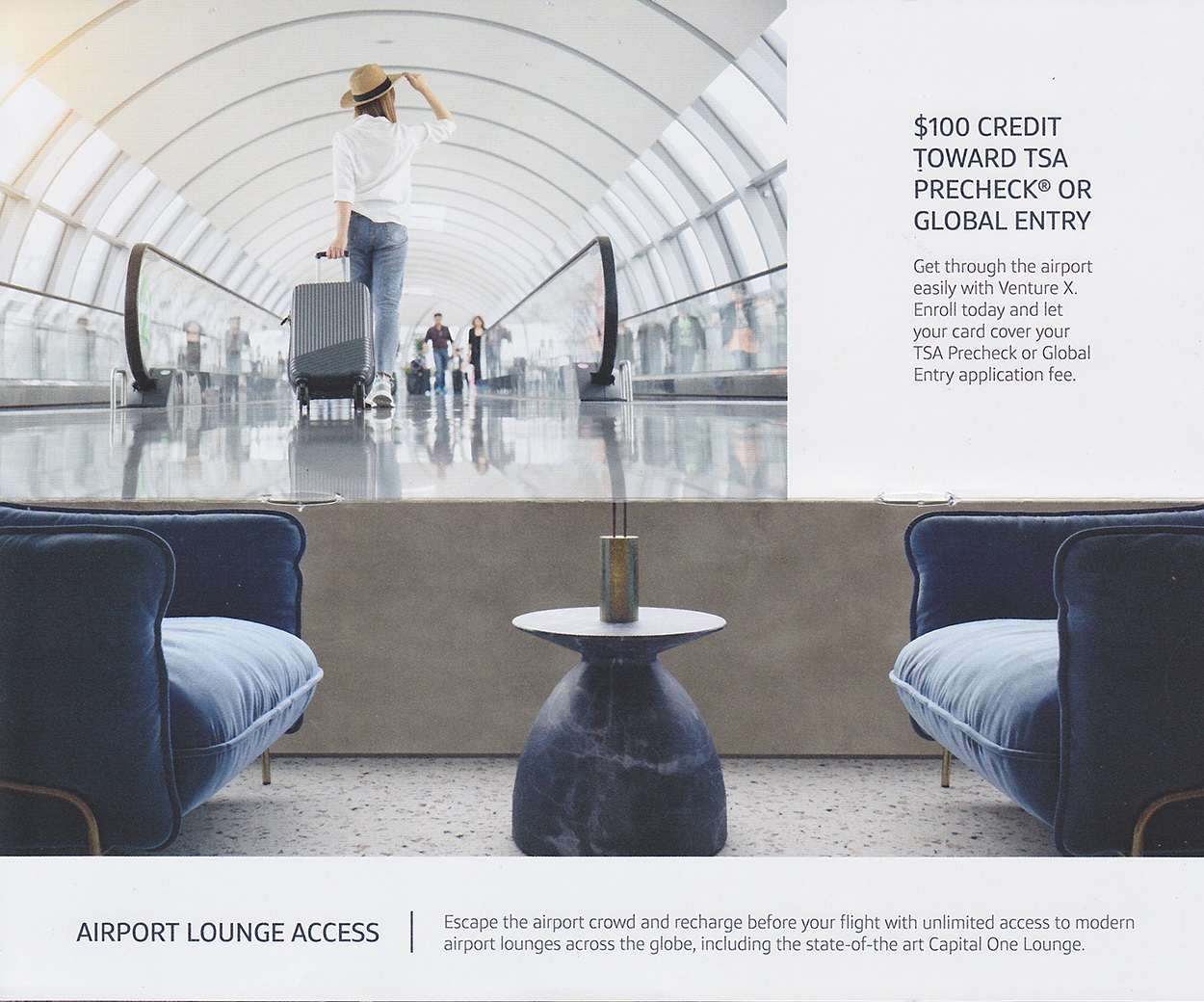

The Capital One Venture X Credit Card currently offers 75,000 miles after spending $4,000 in 3 months along with a $300 annual travel credit which has to be used through the Capital One Travel portal. You also receive 10,000 miles each anniversary, worth $100 toward travel, which partially offsets the $395 annual fee. This credit card also comes with Global Entry / TSA PreCheck credit, but I have more Global Entry credit than I know what to do with.

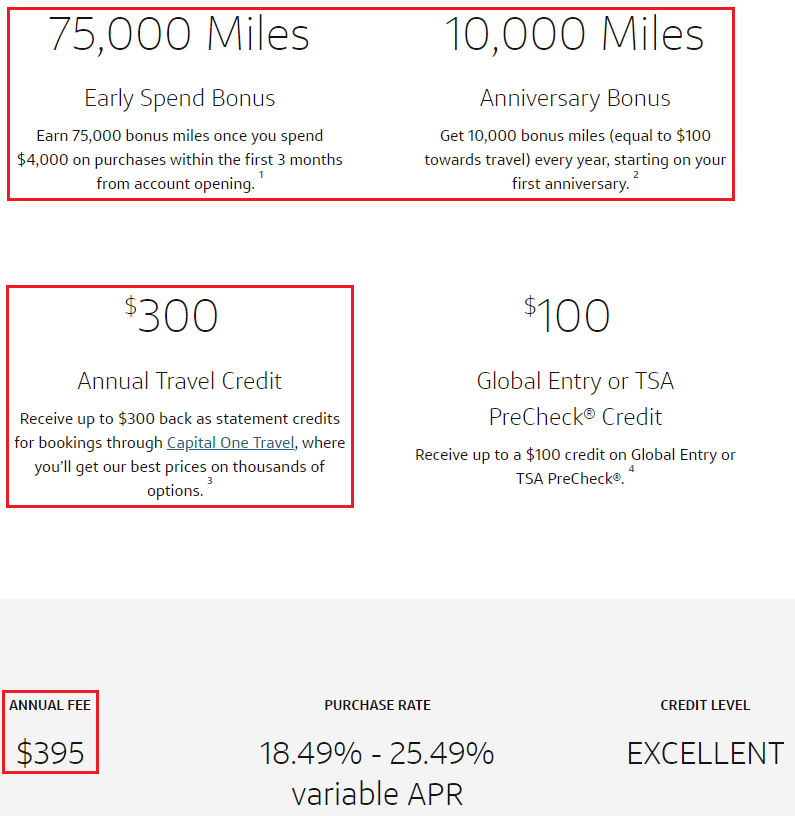

I was instantly approved for the Venture X and received this welcome email.

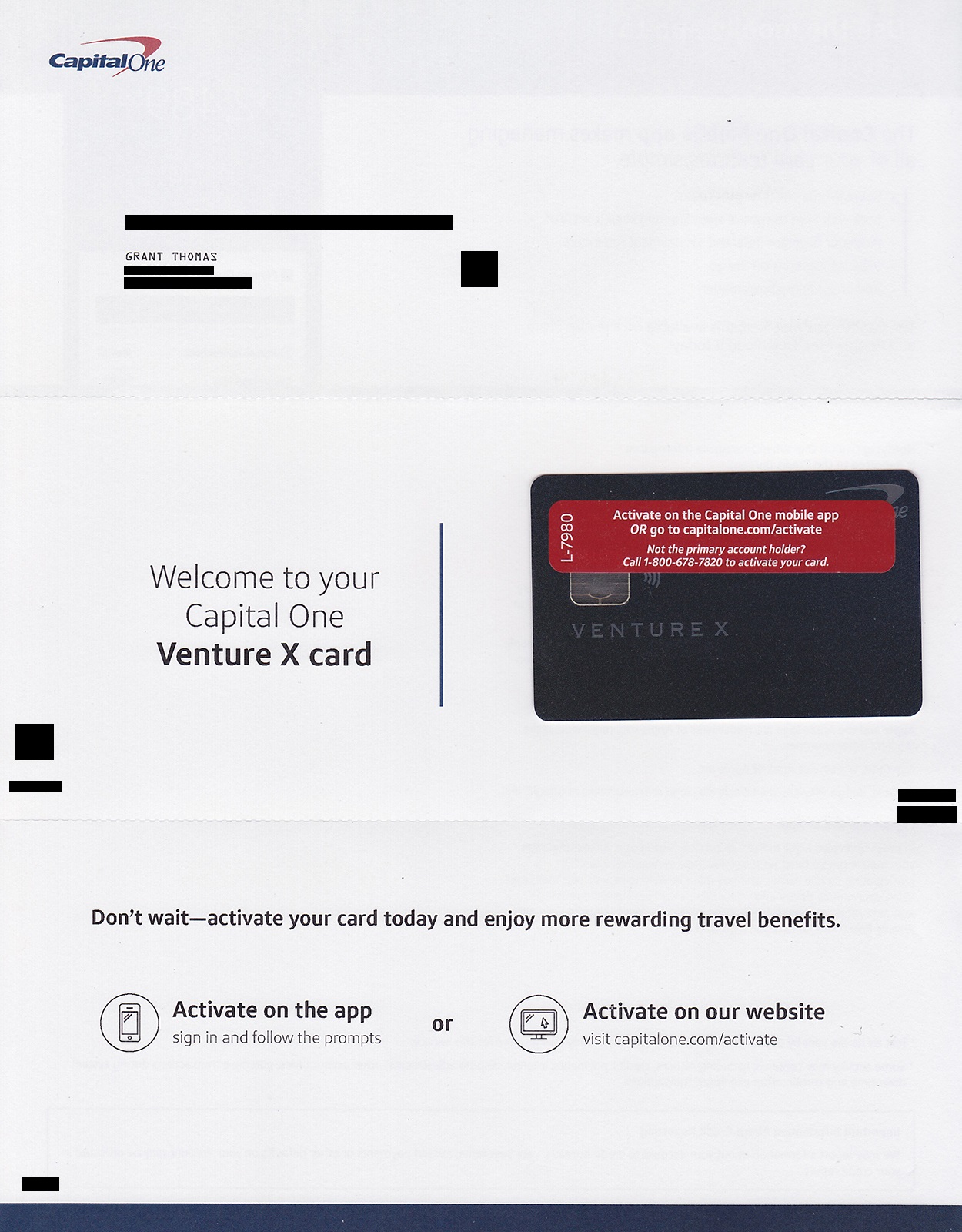

Capital One automatically expedited the Venture X to me via FedEx 2 Day Air and here is the front and back of the welcome letter.

Here is the brochure that came with the Venture X that highlight the credit card benefits. I went to the Capital One Lounge at DFW a few weeks ago and it was great. I look forward to visiting more Capital One Lounges when they become available.

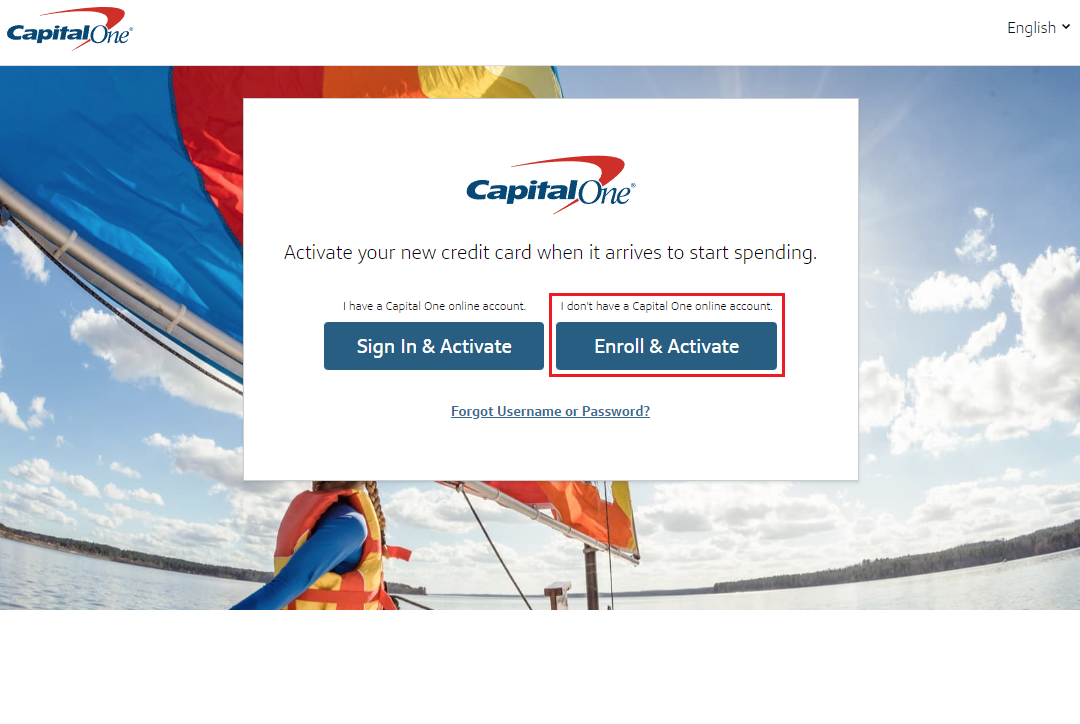

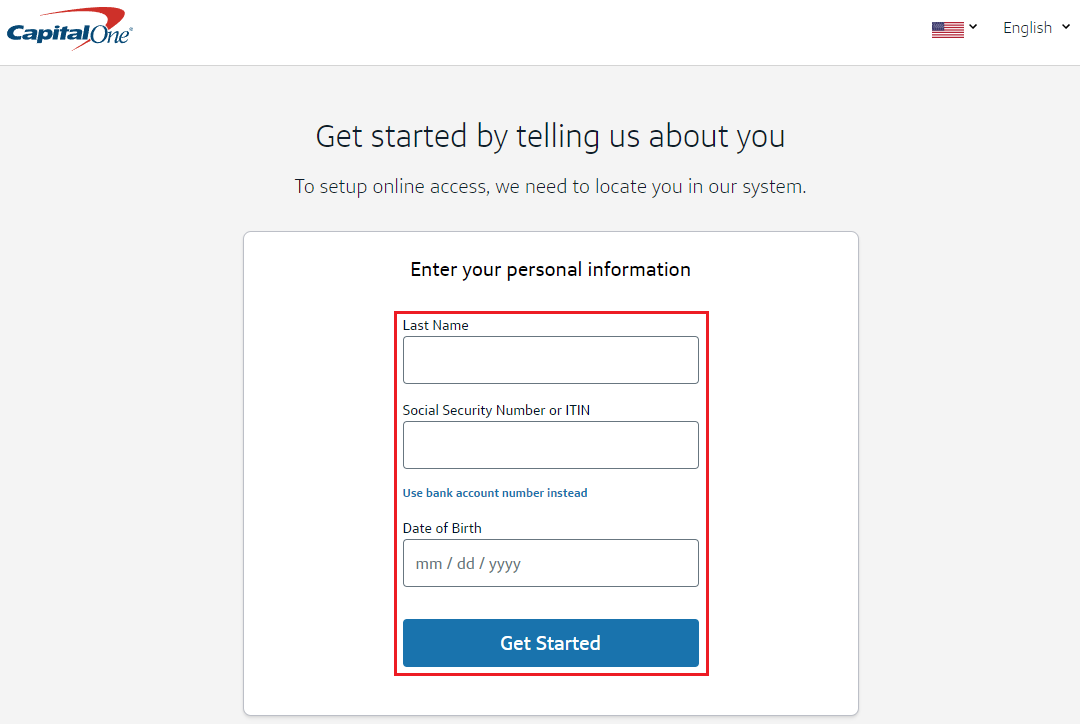

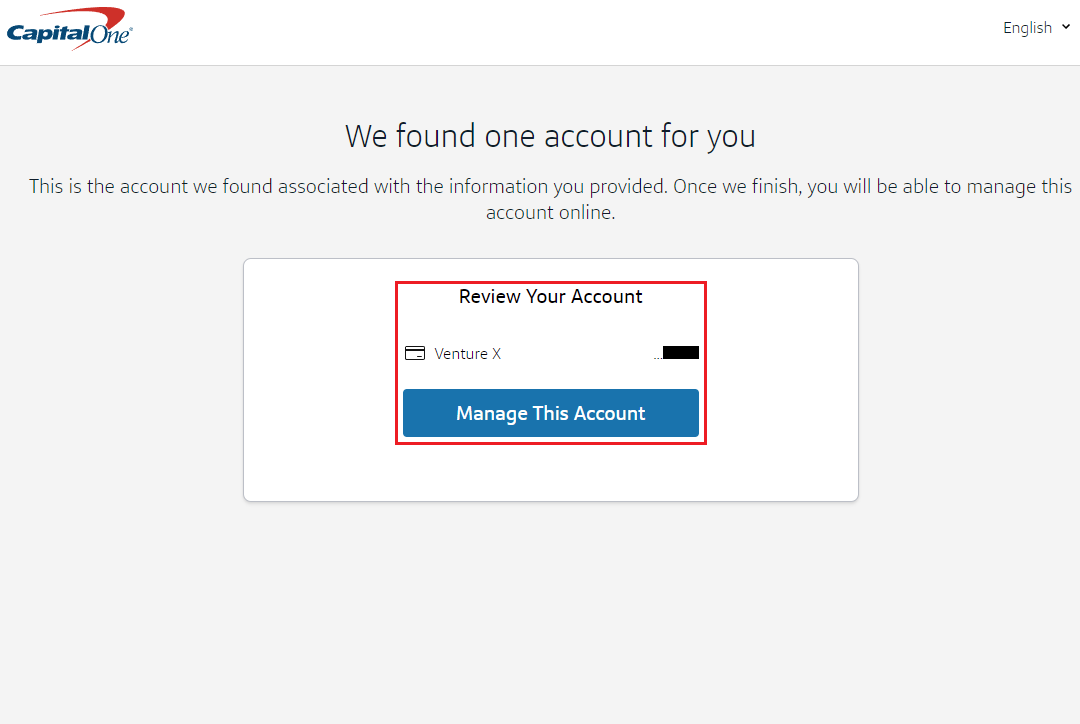

Activating the Venture X was pretty easy, but not intuitive. When I went to the Activate link, I first clicked the Sign In & Activate button since I have an existing Capital One Spark Miles Business Credit Card. But that road was a dead end. I then clicked the Enroll & Activate button, entered my personal information, and was able to find my Venture X account.

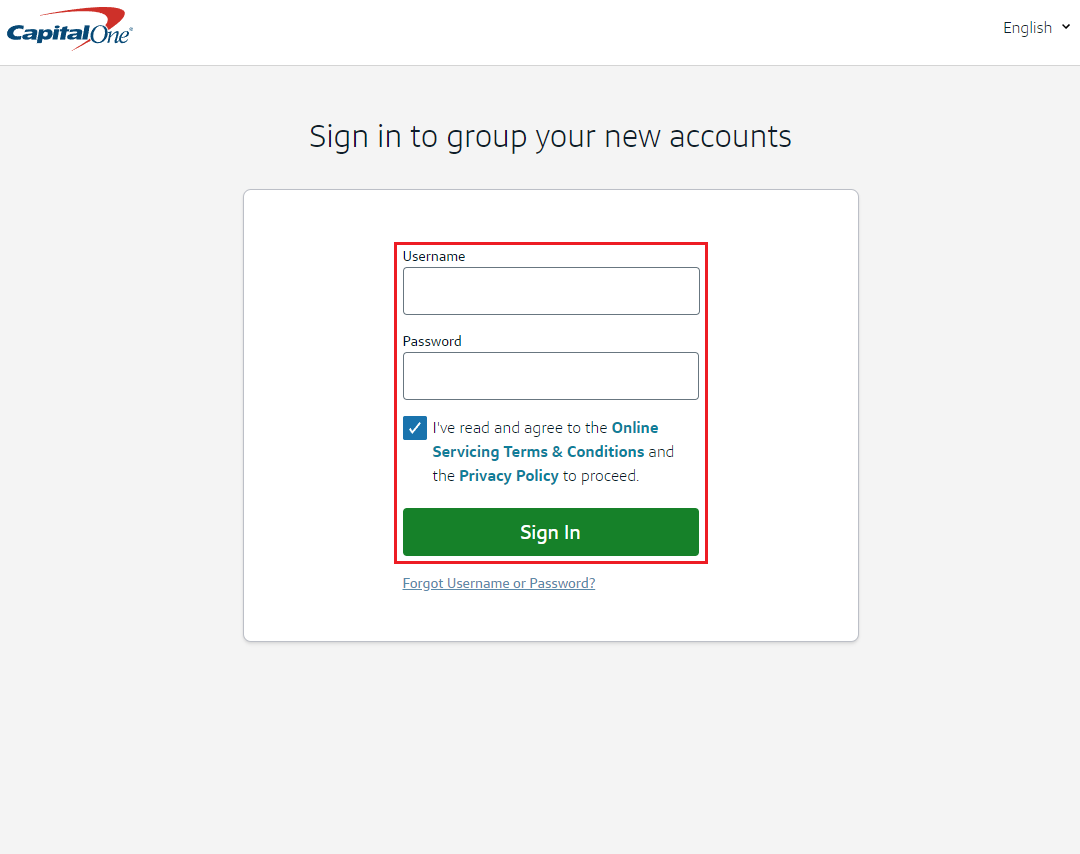

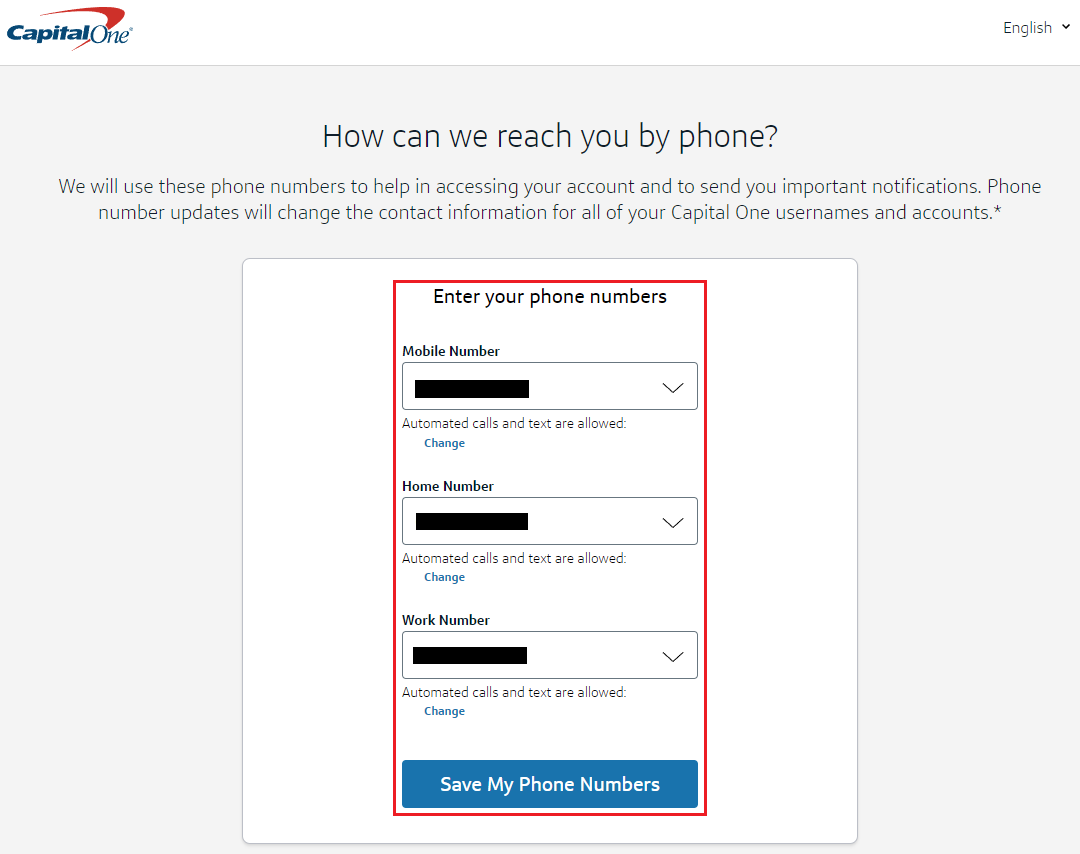

I then signed into my Capital One online account, verified my email address, and added my phone numbers.

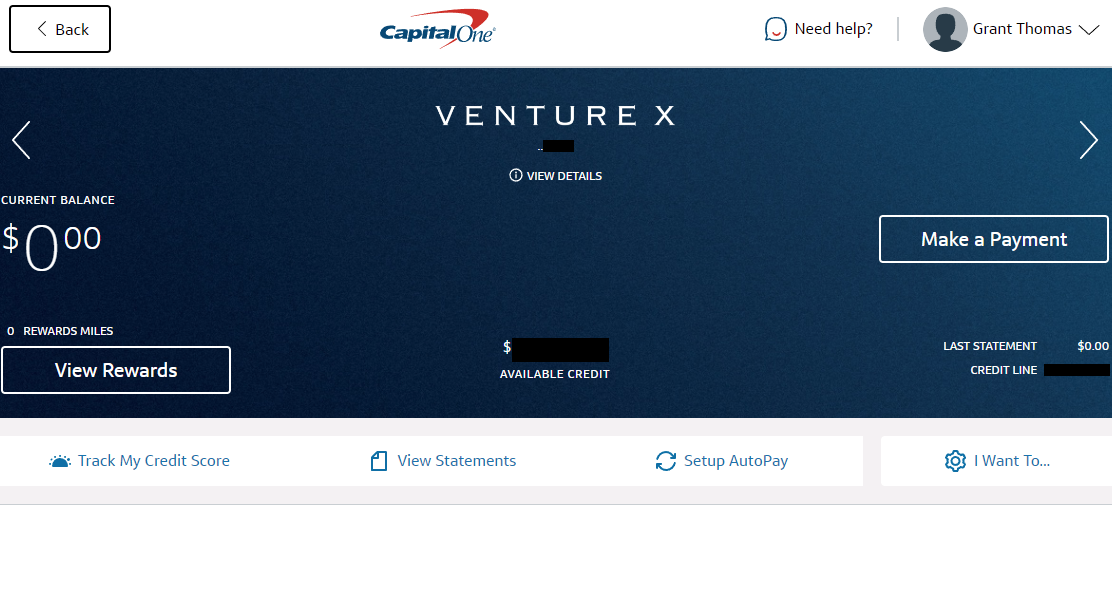

Success! My Venture X account was activated and now shows up in my Capital One online account.

I have an upcoming large purchase to make, so that will let me meet the minimum spending requirement in a single purchase. I don’t have an immediate use for the Capital One miles, but I will probably transfer the points to Wyndham Rewards to book another Vacasa Vacation Rental in Hawaii. If you have any questions about the Capital One Venture X Credit Card, please leave a comment below. Have a great day everyone!

P.S. If you liked this post, I recommend reading my other credit card unboxing posts (sorted by date):

Hi Grant,

Thank you for sharing your mini app o Roma. I too want to apply for the venture X card, but my partner got the card in February this year, and the offer was 100k points but spend 10k in 6 months. So we got the card but we both have been using the card to meet the minimum spending. Now we have fulfilled the 10k spending. It’s my turn to apply, but the welcome bonus offer reduced to 75k from 100k. Should I wait for the welcome offer to go back to 100k then apply? Or should I just apply now since it’s still a decent offer?

Thanks!

Hi Erik, great question. I think you might be waiting a long time for the offer to go back up to 100K. That might have been an initial promo, like when the Chase Sapphire Reserve first came out with the 100k offer. 75k for $4k spending is a pretty good deal. You save $6k of spending which you could put on a 2% cash back card and earn $120 cash back. 25K Capital One Miles = $250 – $120 = $130 difference in value you are missing with the 75k offer. Plus, you could easily get another great reward CC that has less than $6k of minimum spending requirement and easily get more than $250 value.

Have you had a chance to go to the DFW Capital One Lounge or use some/all of the $300 travel funds yet?

Hey Grant, I’m getting this card. Any suggestions on what to spend the 4k in 3 months?

Thanks

Hi Ryan, anything will work. I recently moved, so I spent a few thousand dollars on furniture, but you can prepay bills, pay taxes, use it for everyday spending, etc.

I’m surprised that you’re under 5/24, Grant! Did you do all the applications in one day?

Hi John, before this App-O-Rama, I applied for 9 business credit cards over the previous 2 years and only 1 personal credit card (CSP). All on one day for this App-O-Rama :)

Is Wyndham a transfer partner for Capital One miles? I didn’t see them listed on the website?

Yes, you can transfer Capital One Miles to Wyndham Rewards Points. It should be listed on Capital One’s transfer page.

Yes, you are correct, I don’t know how I missed Wyndham as a transfer partner. I know you just received the card, but do you think this is a keeper card and paying the hefty annual fee $395 when its time to renew?

It’s hard to know right now but I think it depends on how easy it is to use the $300 travel credit. If it’s easy, then the card is a no brainer for me to keep with the 10k anniversary miles (worth $100). I will also try for a retention offer and see what I get.

Pingback: Unboxing Chase IHG Rewards Premier Business Credit Card: Card Art, Welcome Letter, Brochure & Online Activation Process

Pingback: Unboxing Bank of America Alaska Airlines Credit Card: Card Art, Sign Up Bonus & Welcome Letter