Good afternoon everyone and let me be the first (or maybe the tenth) to wish you a very happy New Year! Fresh off the heels of reviewing my 2025 travel predictions (including 7 wins and plenty of misses), it’s time to look ahead. From airlines and hotels to credit cards and loyalty programs, here are my overly ambitious (and occasionally wishful) predictions for what 2026 has in store for the miles and points community.

Airline Predictions:

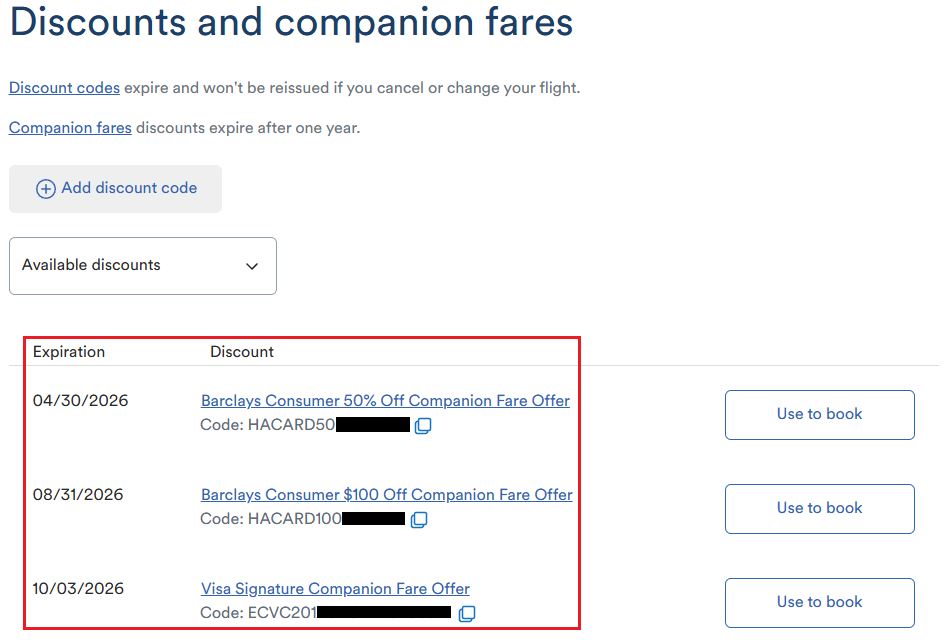

- Alaska Airlines will change the Global 25K Companion Award into a Global 25K Award Discount (valid for a single passenger).

- Alaska Airlines, American Airlines, or Delta Airlines will launch a debit card.

- Southwest Airlines will not award Rapid Rewards Points on Basic Fares.