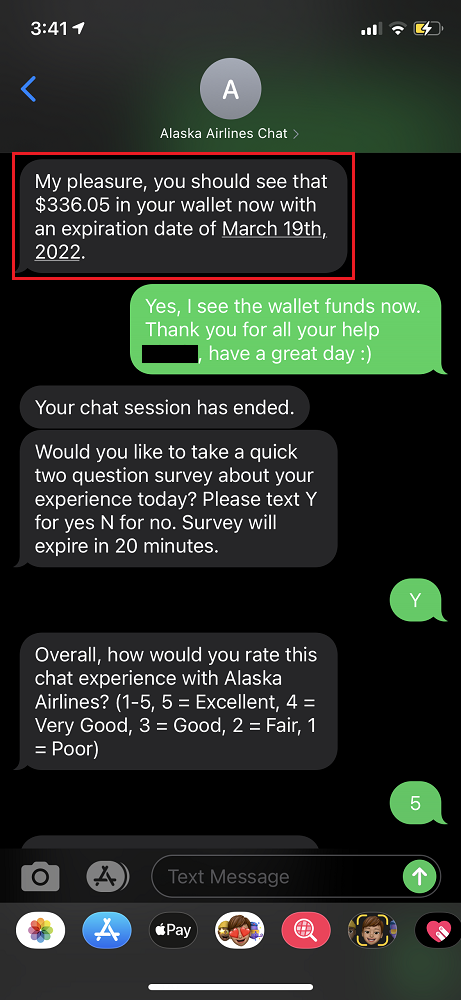

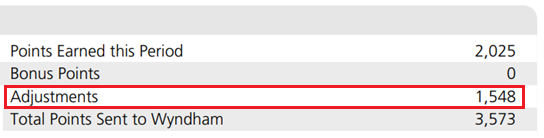

Good morning everyone, I hope you had a great weekend. Long story short, I booked an Alaska Airlines flight using my Citi ThankYou Points (1.25 cents per TYP value until April 10). A few weeks later, I decided to cancel the flight. Since I didn’t book the flight directly with Alaska Airlines, I wasn’t able to cancel the flight online. When I called Alaska Airlines, the recording said that I could text Alaska Airlines instead. Alaska Airlines then sent me a text (820-08) and I responded directly to the text. The agent was very helpful and was able to cancel my flight and apply the travel funds to my Alaska Airlines wallet. The whole process took less than 10 minutes and couldn’t have been easier. If you’ve never texted Alaska Airlines before, I recommend saving the text number (820-08) to your phone.