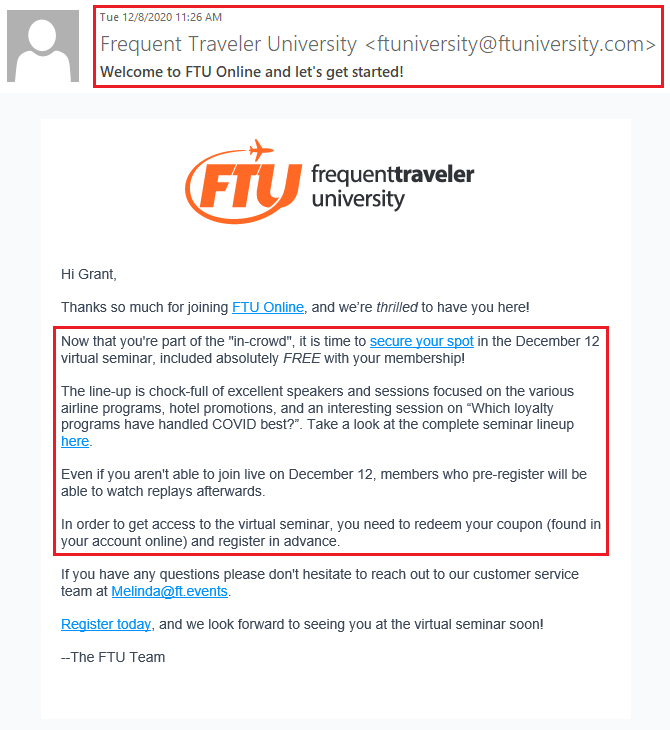

Good afternoon everyone, I hope your week is going well. If you do not have any plans this weekend, I highly recommend attending the FTU Virtual Seminar this Saturday, December 12 from 11am to 3pm ET (8am to 12pm PT for those on the West Coast). Here is the full schedule of speakers and presentations. You can either watch the FTU Virtual Seminars live on Saturday or watch the recording later, but you need to register before the event begins. Tickets to the FTU Virtual Seminar are free if you have a FTU Online Annual Membership or $25 for non-members. I highly recommend signing up for the FTU Online Annual Membership (read Buy a $49 Frequent Traveler University (FTU) Online Annual Membership & Attend First Virtual Seminar December 12). The FTU Online Annual Membership is currently $49 but will go up to $129 on December 12.

Assuming I persuaded you to attend the FTU Virtual Seminar or better yet, purchase a FTU Online Annual Membership, the next thing you need to do is register for the FTU Virtual Seminar before December 12. I assumed (incorrectly) that I was automatically registered for the FTU Virtual Seminar when I purchased my FTU Online Annual Membership, but that is not true. You still need to register for the FTU Virtual Seminar if you want to live stream or watch the recording. In this post, I will walk you through the steps to register for the FTU Virtual Seminar.