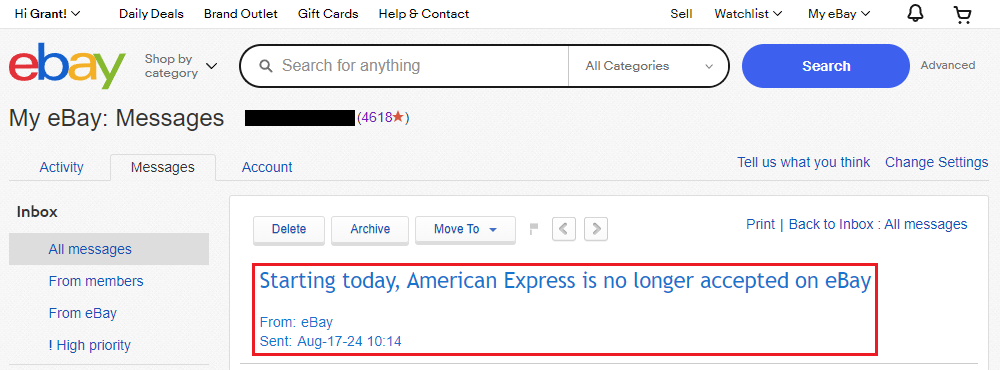

Good morning everyone, I hope your weekend is off to a great start. Unfortunately, if you were planning on shopping on eBay with your American Express cards today, you will run into an issue. Effective today (August 17, 2024), American Express cards are no longer accepted on eBay as a form of payment. This announcement came out of nowhere, but it sounds like the decision came from eBay’s side, instead of AMEX’s side. But, there is a workaround if you add your American Express card to your PayPal or Venmo account.