Updated 10am PT on 7/9/20: Arcadia Power changed their name to Arcadia, so I updated the logo and changed references of “Arcadia Power” to “Arcadia” in this post. Arcadia has also improved their website, so some of the screenshots in this post are out of date.

Good morning everyone, I hope your weekend is going well. Last month, Doctor of Credit wrote a post about Arcadia stating that you could use this service to pay your electricity bill with a credit card and not be charged a fee. I have been paying a $1.35 fee per payment to PG&E (Pacific Gas & Electric) for the last few years, so I was immediately interested. For the last few years, I have been using my US Bank Cash+ Credit Card to earn 5% cash back on utility bills (as far as I know, Chase Ink Business credit cards do not earn 5x on electrical utilities bills, just phone / internet / TV utility bills). With the $1.35 fee per payment, as long as my payment to PG&E was greater than $27 ($27 x 5% = $1.35), I would come out ahead. If I could continue earning 5% with my US Bank Cash+ Credit Card to pay my PG&E bill and avoid the $1.35 fee, I would definitely use Arcadia. I am happy to state that that is exactly what happened with my recent PG&E payment via Arcadia. If you are not an Arcadia member, please use my referral link to create a free account. Thank you!

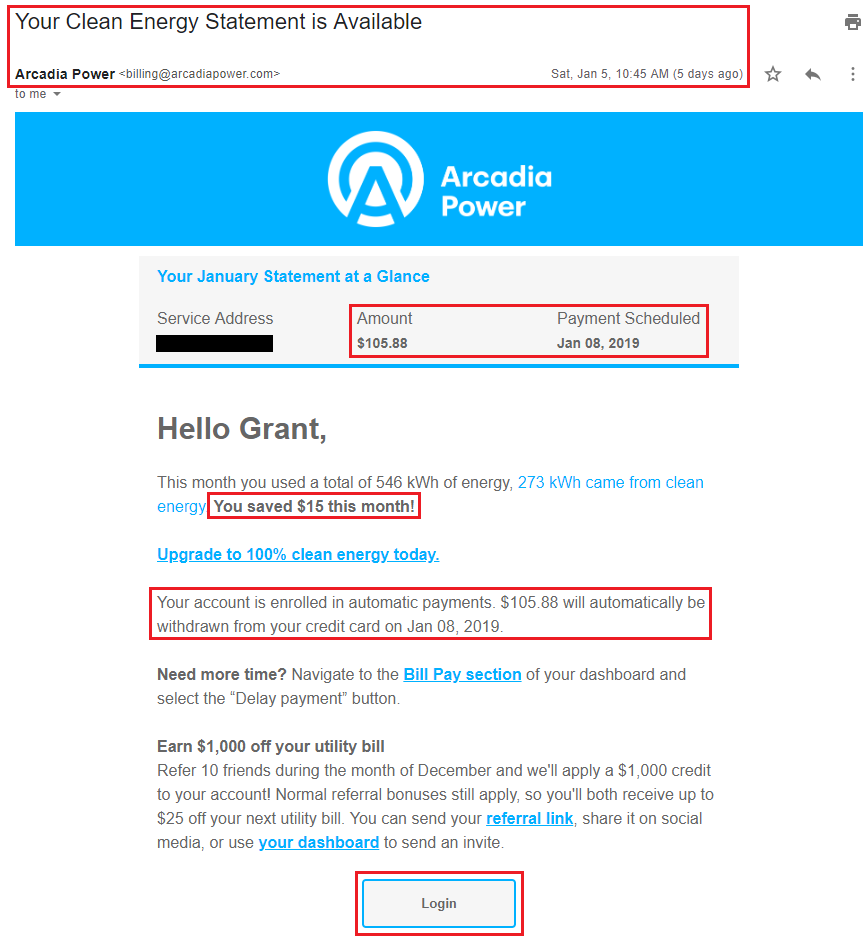

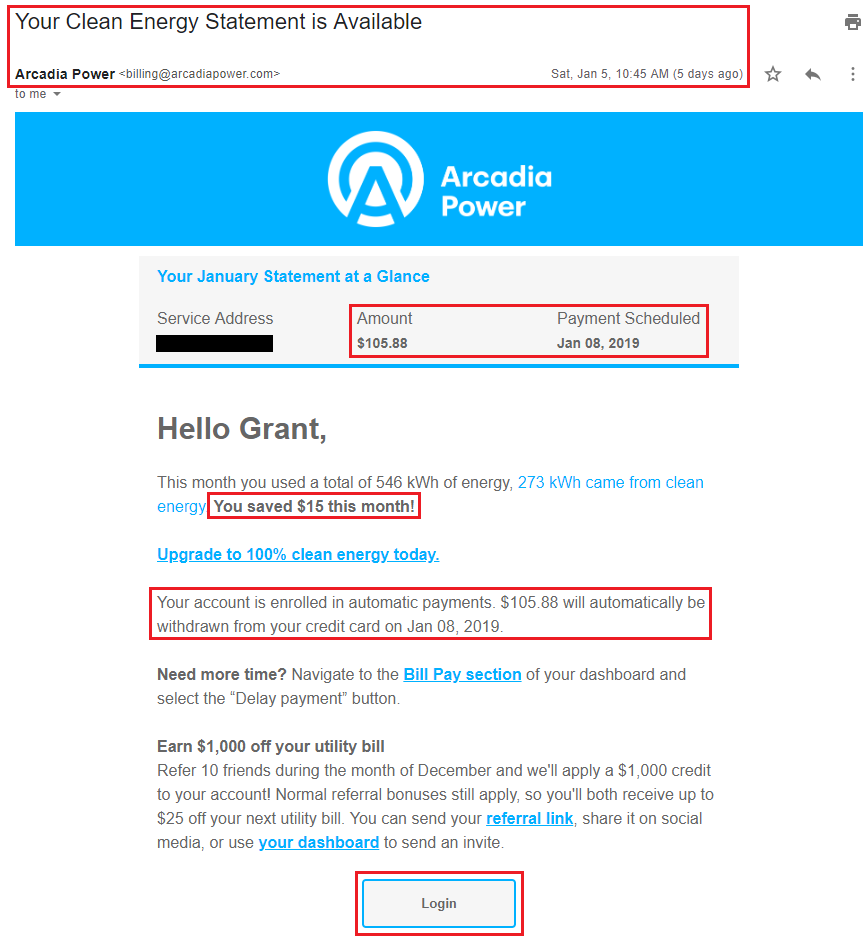

I received this email from Arcadia on January 5. In the email, it says I saved $15 (my Arcadia first payment bonus) and owe $105.88. My card on file (US Bank Cash+ Credit Card) would be charged on January 8. I didn’t need to do anything else.

Continue reading →