Updated 8pm PT on 3/15/19: Thank you to everyone who entered the giveaway. I wish I could give everyone codes, but I only have so many codes available. Here are the winners: Mike Saint, Bill Pisor, LAURAPDX, Brandon, Priscilla Ennis, Seth, Will, Stephanie Woods, iwantmoremiles, and Jim F. I will email the winners the codes. Thank you.

Good afternoon everyone. A year ago, I wrote AwardWallet Feature I Wish Existed: Keep Checking for Account Balance Changes. In that post, I wished there was a way for AwardWallet to constantly check a specific airline / hotel account to see when miles or points posted. This is super important if you transfer points from a transferable points currency (Chase Ultimate Rewards, American Express Membership Rewards, Citi Thank You Points, Capital One Points, or Marriott Bonvoy) in the hopes of booking an award flight before the award space disappears. Some transfers are instant, while others may take several hours or several days.

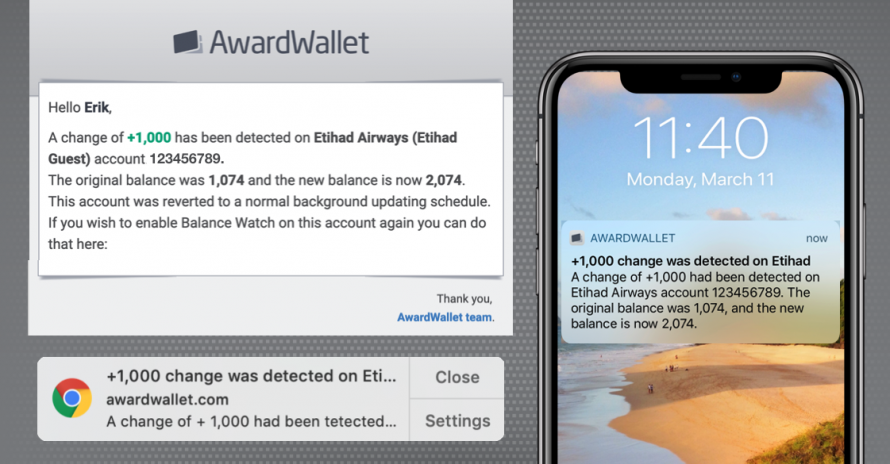

I am happy to report that AwardWallet took my idea and added the feature to AwardWallet. Here is a blog post describing Balance Watch and how the feature works:

“Balance Watch will monitor a loyalty account to let you know as soon as your points arrive. Once activated, AwardWallet will check your balance up to twenty-four times per day and send you a desktop, mobile, and email notification as soon as a change is detected.”