Updated at 8:15am PT on 4/23/25: I completed the $5,000 minimum spending requirement and the 100,000 Chase Ultimate Rewards Points show as pending in my account – all before even receiving the physical card in the mail. You can also refer friends and family members to the CSP before receiving the physical card in the mail. See both updates below.

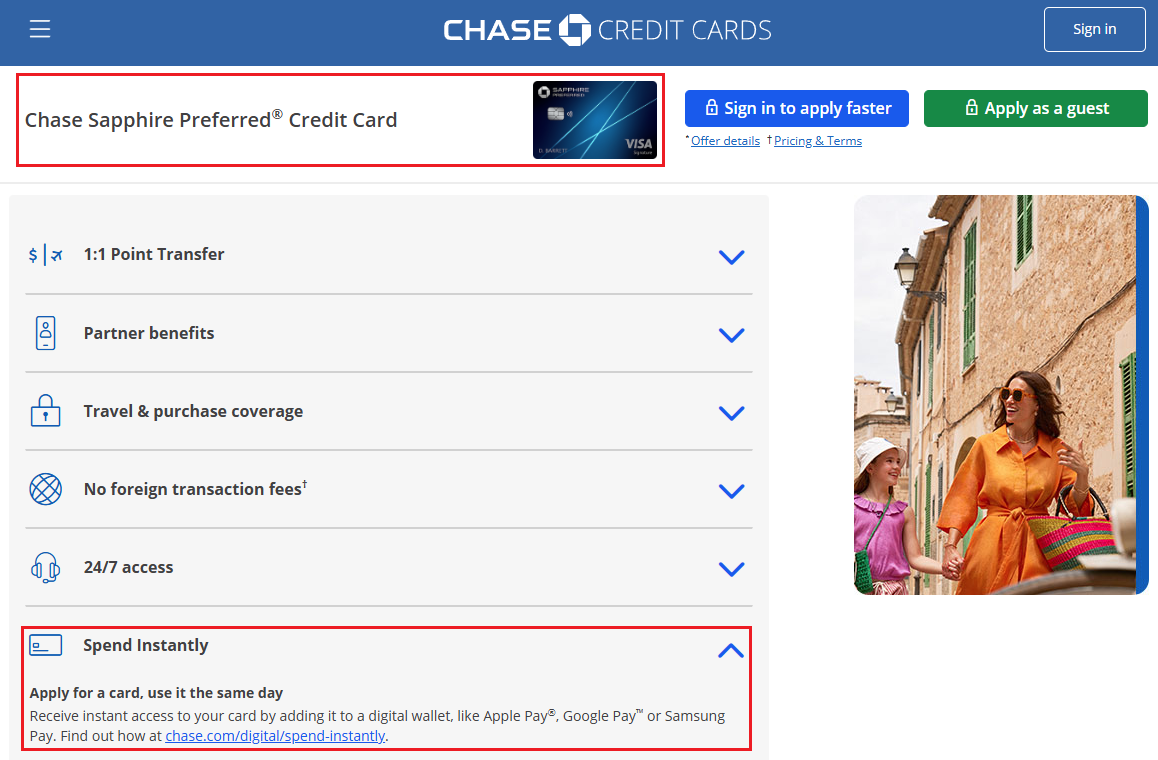

Good morning everyone, I hope your weekend is going well. Last night, I was looking into credit card options since Laura and I have some large purchases coming up in the next few months. While researching, I wanted to see if the Chase Sapphire Preferred Credit Card (CSP) (click here to learn more and apply) offers instant access to the card, and I was happy to find out that it does!

According to Chase: “Spend Instantly: Apply for a card, use it the same day. Receive instant access to your card by adding it to a digital wallet, like Apple Pay®, Google Pay™, or Samsung Pay.” You can check out the full details here chase.com/digital/spend-instantly. In this post, I will show you the process to add the CSP to your Apple Pay Wallet.