Updated 12/1/22 at 4pm PT: Marcus is currently offering 3.00% APY and if you sign up with a referral link, like mine (https://www.marcus.com/share/GRA-IT7-LURK), you will get an extra 1.00% APY boost for the first 3 months, bring you to 4.00% APY for the first 3 months.

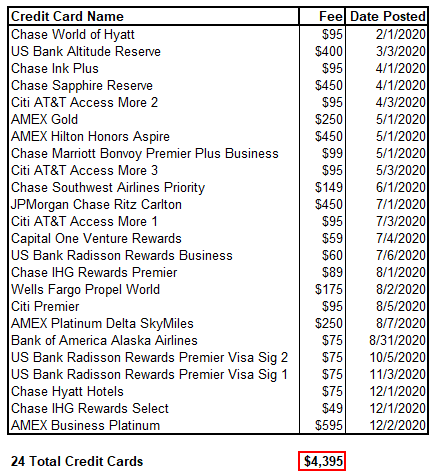

Good morning everyone, I hope your MLK Jr. Weekend is off to a great start. In my post How Much Money Did I Make from Bank Account Bonuses in 2020?, I made a measly $800 from bank account bonuses in 2020. I decided to hit the ground running in 2021 and have opened a few new savings, checking, and brokerage accounts in January (worth around $1,500). My interest was piqued yesterday when I read Doctor of Credit’s post Marcus $100 Bonus for New & Existing Savings Customers with $10,000 Deposit (.50% APY).

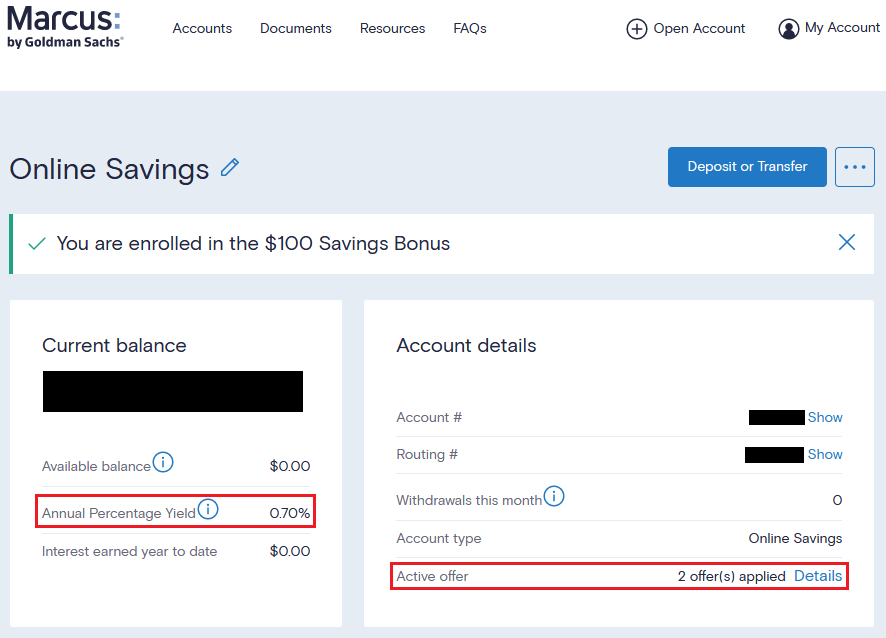

My brother, who is a big fan of bank account bonuses, told me to use his referral link to join Marcus first (I would get a 0.2% APY boost for the first 3 months) and then to enroll in the $100 Marcus savings account bonus which is available for new and existing customers. By stacking both deals, I will get 0.7% APY and the $100 bonus all at the same time. As you can see, my Marcus account shows 0.7% APY and has 2 active offers applied. Continue reading this post for step by step instructions on how to stack both of these deals.