Good afternoon everyone, I hope you had a great weekend. Yesterday, my dad asked me about his Hyatt Free Night Certificate (FNC). He told me he just booked a Hyatt stay using the FNC but wasn’t sure if he got a good deal on the hotel stay. I asked him when the FNC expired, but he didn’t know or remember. I told him how to figure out when the Hyatt FNC posted to his account and how to find out when the FNC expired. I figured this post would be helpful to others who are in the same situation. It is really easy to find out, here is how.

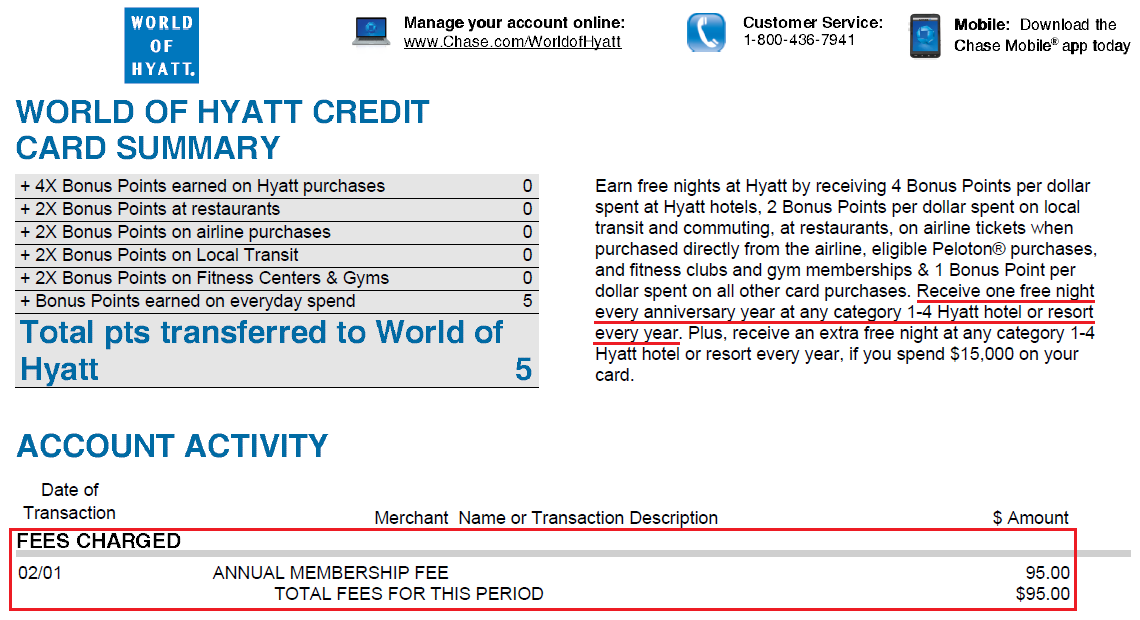

Figure out when your $95 annual fee is charged to your Chase World of Hyatt Credit Card. For Laura’s card, her $95 annual fee posted on February 1, 2025. You can find this charge using the Chase website, Chase app, or by looking at your credit card statements.