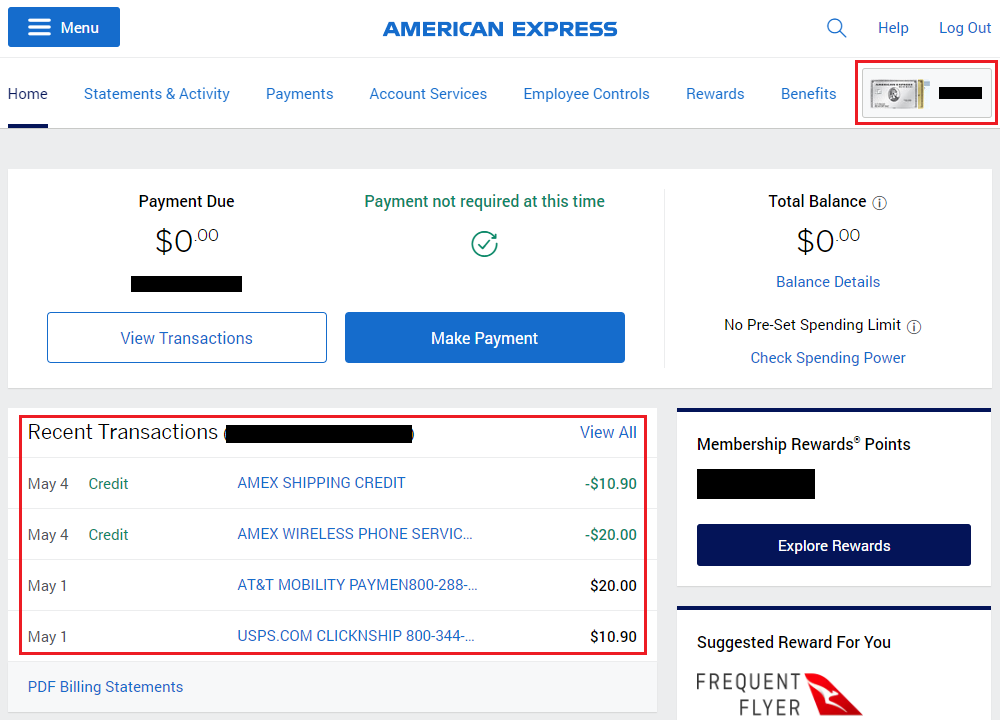

Good afternoon everyone. At the end of every year, I write a post like I Paid $4,043 in Credit Card Annual Fees in 2022 – Was it Worth it? In that post, I shared how much I paid in credit card annual fees and how much value I received from credit card benefits, targeted spending offers, and retention offers. 99% of the time, I get more value out of a credit card than the cost of the annual fee (otherwise I would have closed or downgraded to a cheaper or no annual fee credit card). One of the key parts of my credit card strategy is to call every time a credit card annual fee posts to my account. 90% of the time, I do not get any retention offer or a retention offer that does not excite me (like 0% APR for 12 months or 0% balance transfers). But about 10% of the time, I do get a decent retention offer that I happily accept. Like the old saying goes, you miss 100% of the shots you do not take.

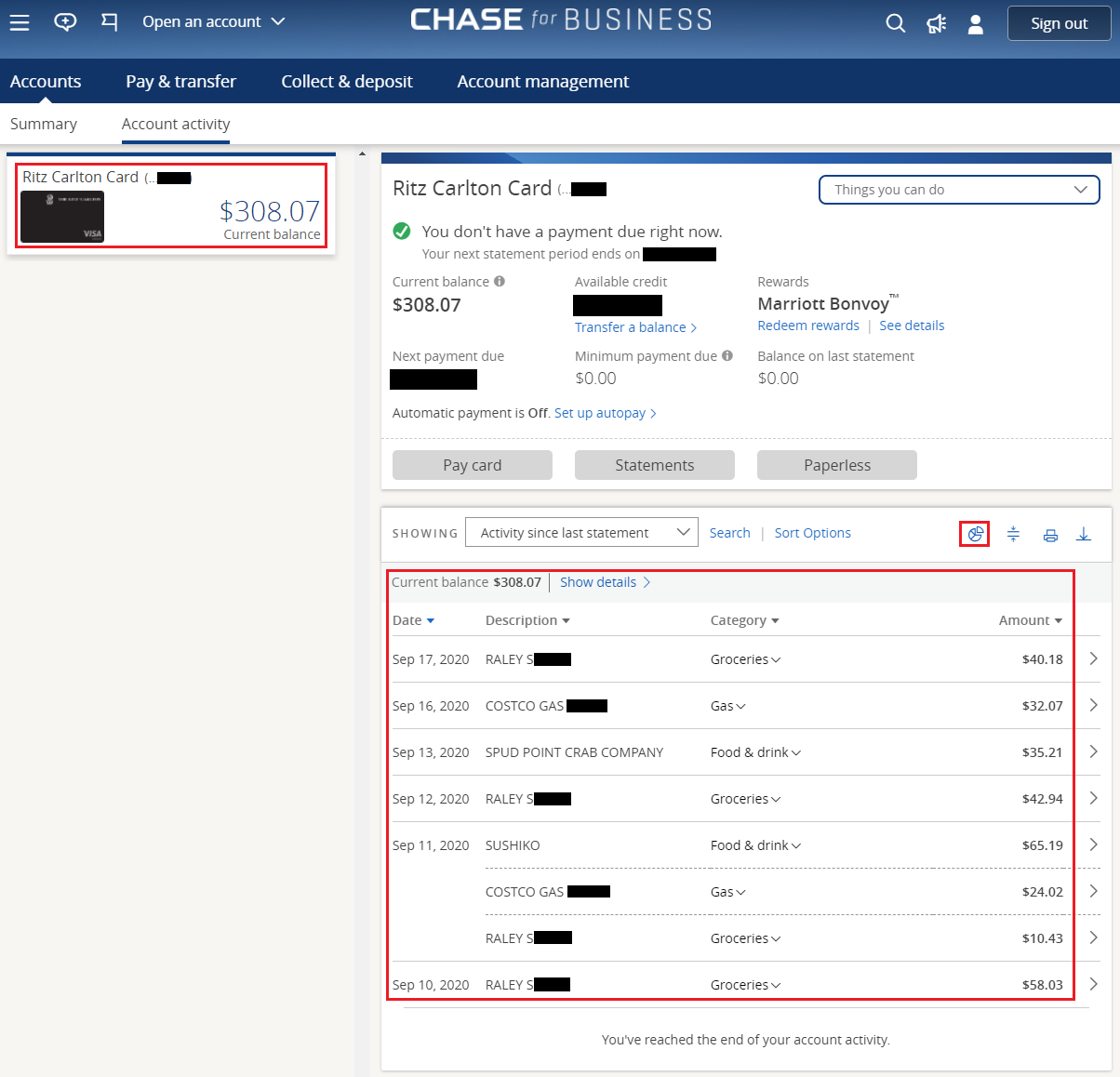

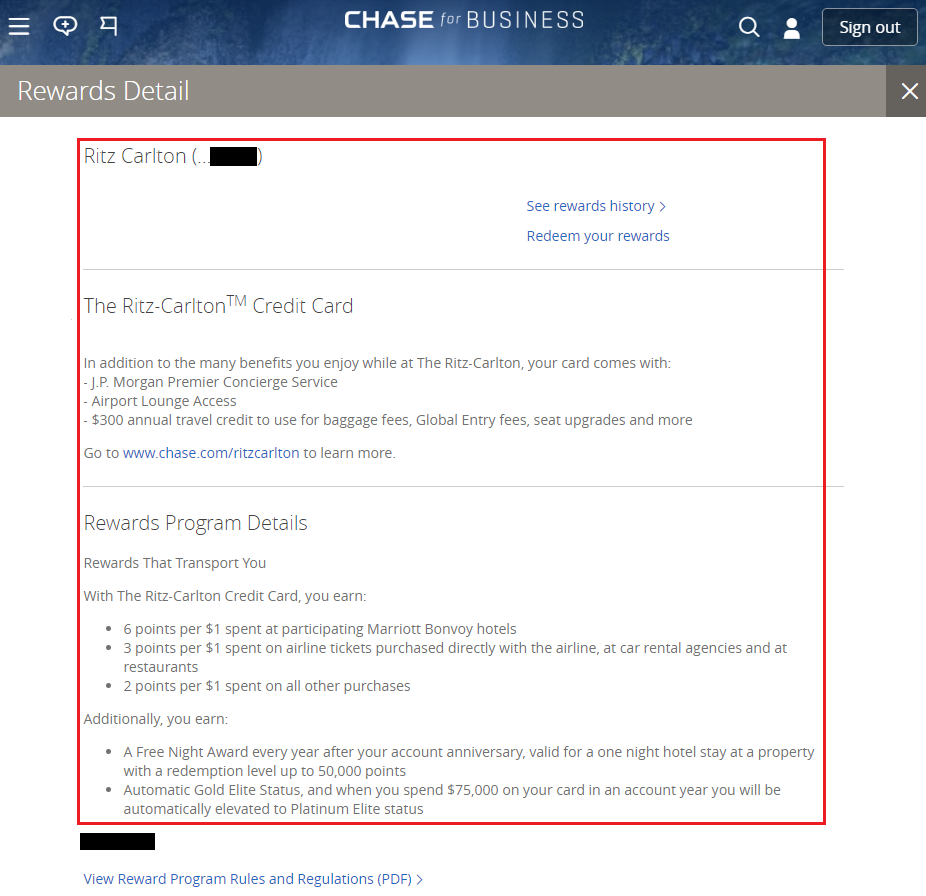

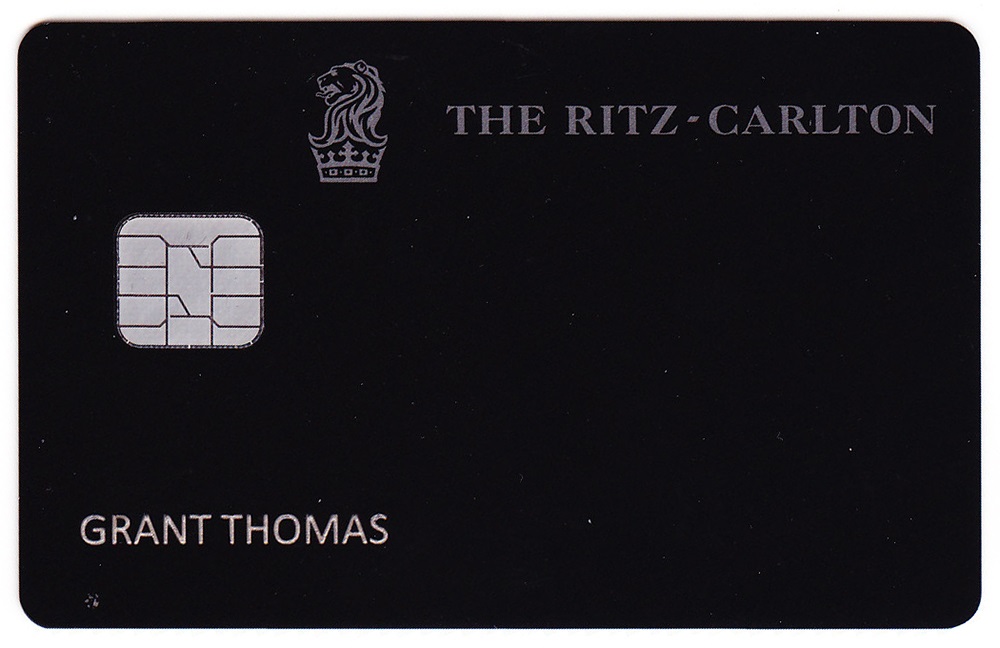

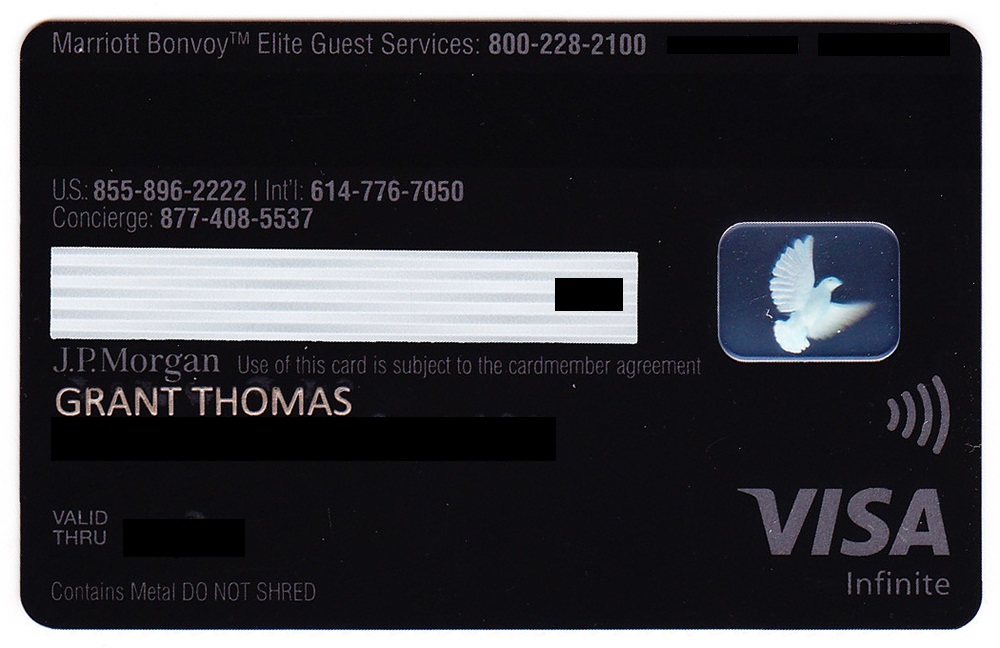

Most of the time, the retention offer will post within a few weeks or by the time the next credit card statement closes. But sometimes it doesn’t, so you may need to follow up to see what is going on. This is exactly what happened to me regarding 2 retention offers I recently received from Chase. I called in early July about the $450 annual fee on my JPMorgan Chase Ritz Carlton Credit Card and explained that I was considering closing the credit card because the annual fee posted and I wasn’t getting enough value out of the credit card. The rep looked at the retention offers and said they could offer me a $150 statement credit if I kept the credit card open and paid the annual fee. I happily accepted the offer and patiently waited for the $150 statement credit to post. Unfortunately, nothing happened for 2 full months.

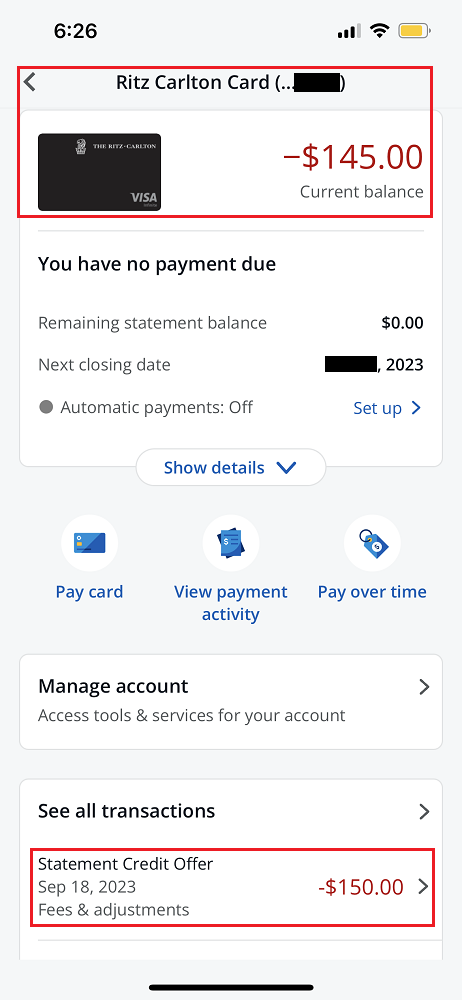

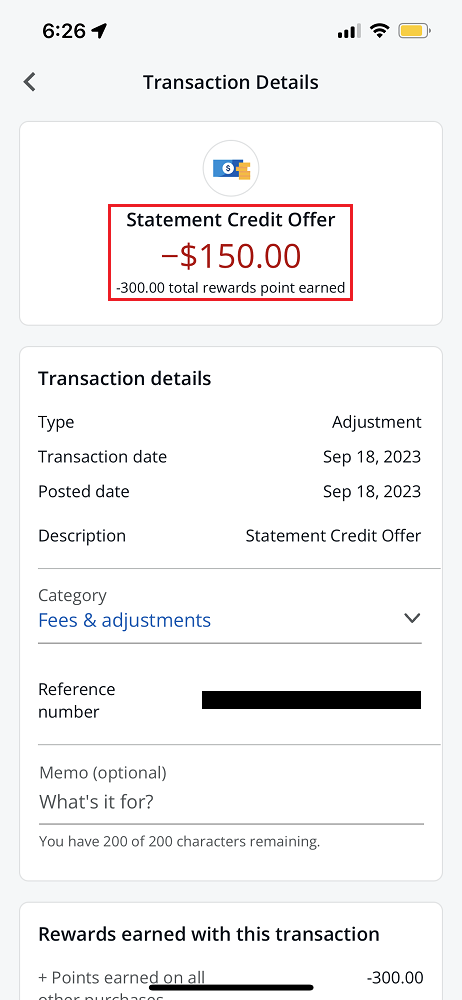

I called Chase in mid September and asked about the $150 retention offer and the agent said that they see the $150 retention offer statement credit as an option, but that the button to accept the offer was not pressed / selected. The rep was able to click / accept the offer and said that the $150 statement credit would appear in the next few weeks. A few days after the call, the $150 statement credit posted on September 18.

Mini Rant: I hate that a $150 statement credit on my Ritz Carlton credit card causes me to lose 300 Marriott Bonvoy points. I didn’t earn any points when I paid the $450 annual fee, so why am I paying 300 points when I receive a $150 statement credit?