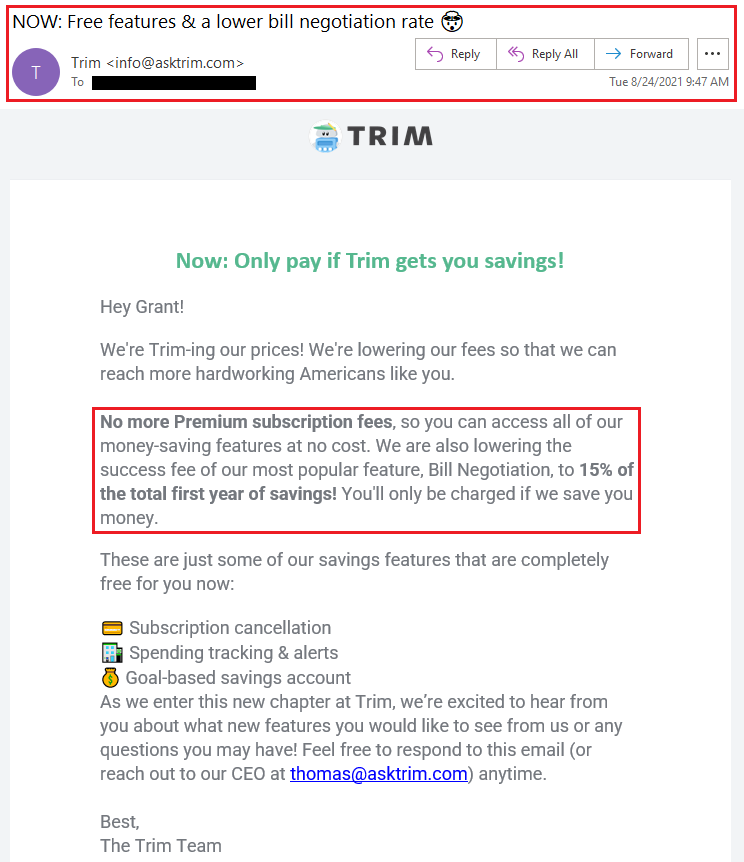

Good afternoon everyone, I hope your week is going well. I just received this email from Trim announcing that the bill negotiation fee is being slashed from 33% down to 15%. As a reminder, Trim will reach out to your utility company (cable, TV, internet, and phone) on your behalf and negotiate a lower monthly cost or get you a 1 time courtesy credit. In exchange for negotiating a lower rate, Trim takes a cut of the savings. For more info, please read my most recent Trim post: Trim Saved Me Another $57 on My Comcast Xfinity Cable Bill ($167 Saved Lifetime). In addition to the lower bill negotiation fee, Trim is also making their premium subscription features free which include monitoring and cancelling subscriptions, spending and tracking alerts, and a goal-based savings account. I will show you how to set up a Simple Savings Account that offers a 4% interest rate on the first $2,000 deposited.