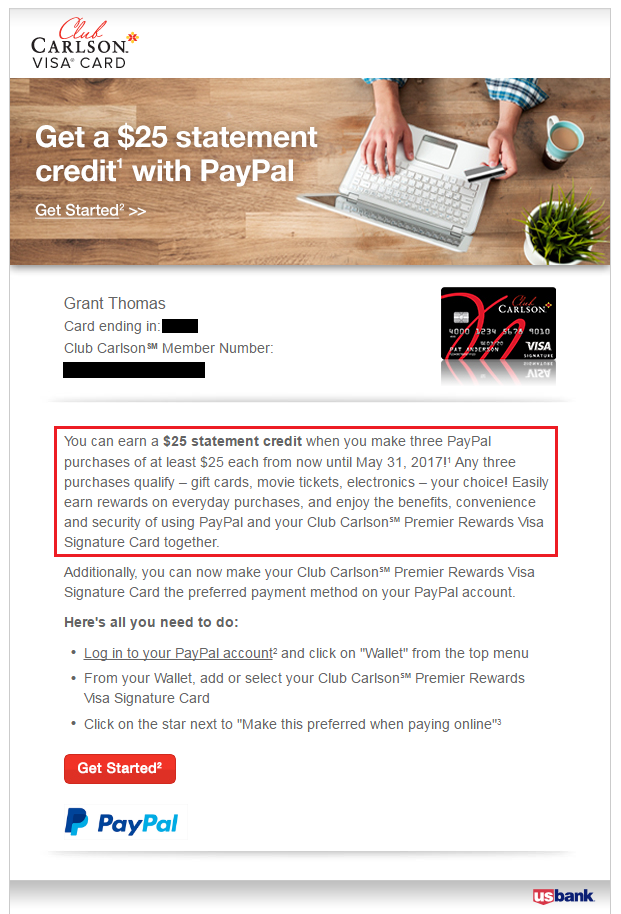

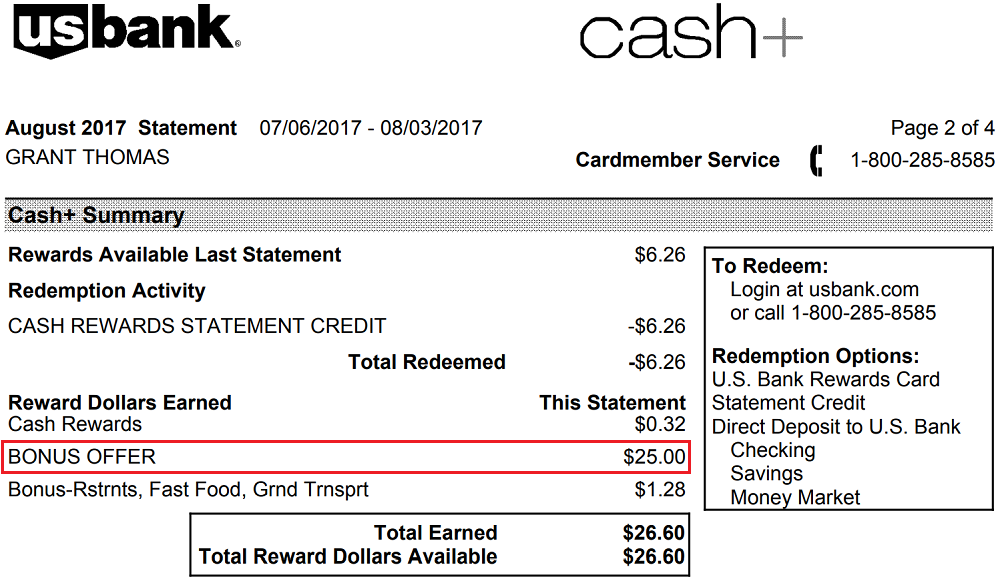

Good morning everyone. At the end of March, I wrote this blog post: Targeted Q2 Credit Card Offers Part 2: 10,000 JetBlue TrueBlue Points & US Bank Club Carlson $25 Statement Credit. Yesterday, I covered the first offer from that post: 5 Months Later, I Received 10,000 Bonus JetBlue Points from Barclays JetBlue Plus Credit Card Promo. Today, I will cover the second offer. It was a pretty simple offer: make 3 PayPal payments of $25 or more with your US Bank Club Carlson Credit Card and get a $25 statement credit.