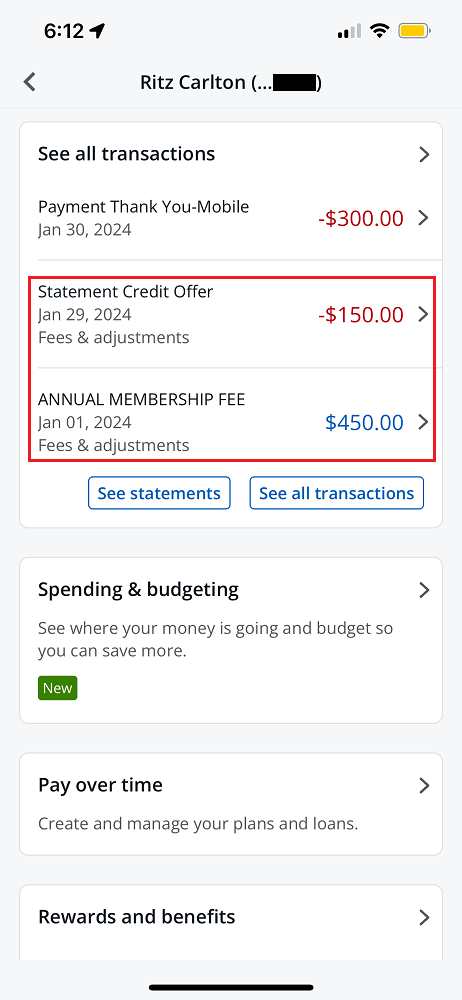

Good afternoon everyone, I hope your weekend is going well. A few weeks ago, I had to cancel a few international business class awards due to a scheduling conflict, so I wanted to share the various cancellation processes, timelines, and fees involved. If you find yourself in a similar situation, you will know what to expect from the process. In this post, I will cover my experience cancelling award tickets with Delta, Korean Air, and Air France / KLM. You can read about my experience cancelling award tickets with Avianca LifeMiles and Singapore Airlines.

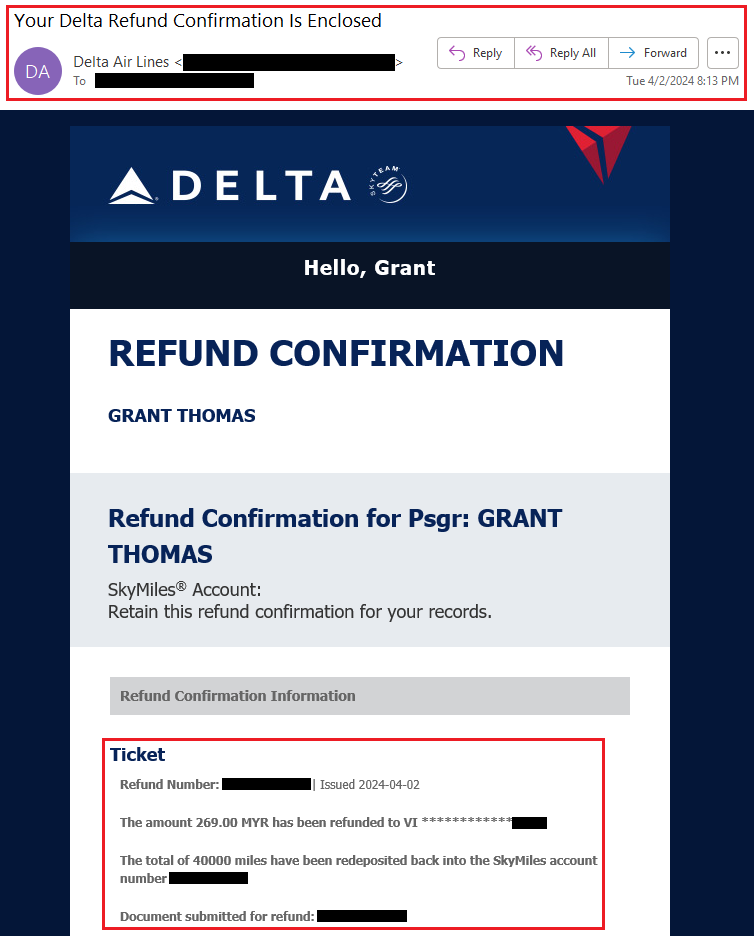

40,000 Delta SkyMiles for Korean Air Business Class (KUL-ICN-UBN): Kuala Lumpur, Malaysia -> Seoul, South Korea -> Ulaanbaatar, Mongolia

I cancelled the award ticket on Delta’s website on April 2 and received this refund confirmation email.