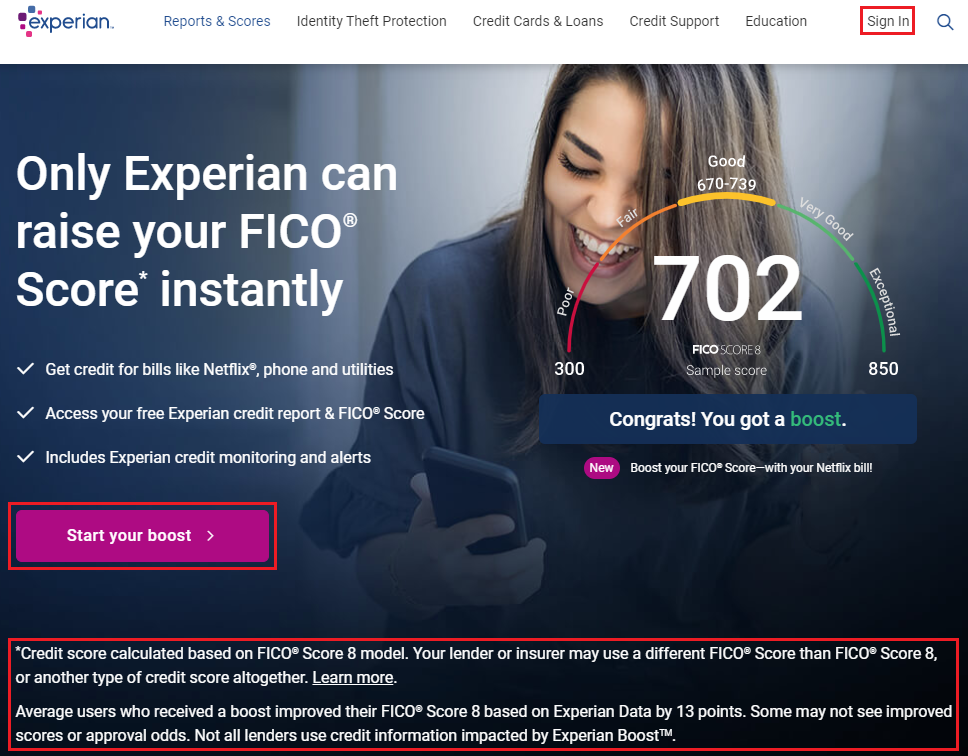

Good morning everyone, happy Friday! I’m sure most of you have seen the Experian Boost commercials on TV or online, but how many of you have actually checked to see if it would boost your Experian credit score? According to the Experian Boost small print, the average credit score increase is 13 points (which is not a lot), but it’s better than nothing. Speaking of nothing, some customers may not see any score increase at all (which is what happened to me). The last thing to keep in mind is that this will not improve your Equifax or TransUnion credit scores and some financial institutions may use a different FICO score or model. Your credit score will not increase 100 points with Experian Boost, so keep your expectations in check.

The entire process took about 10 minutes and involved logging into my Experian account and linking my financial institutions that I use to pay recurring bills (like Netflix, phone and utilities). After you link your financial accounts to Experian, Experian Boost will scan your accounts and recent statements to find recurring bills. Once they find recurring bills, you will be asked if you want to add those recurring bills to your credit report, which may or may not increase your credit score. In this post, I will walk you through all the steps. To get started, go to the Experian Boost page and sign in or create an account by clicking the Start Your Boost button.