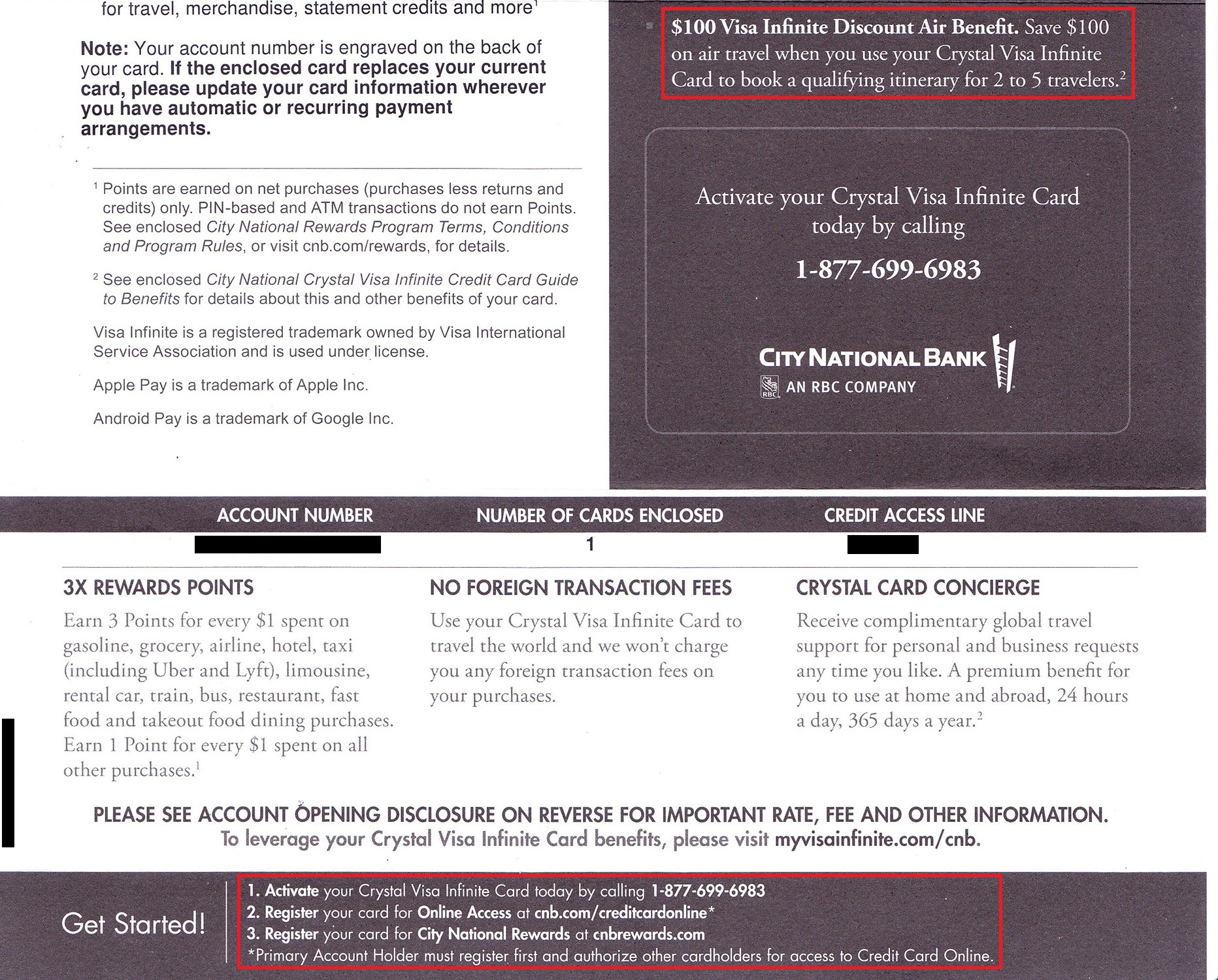

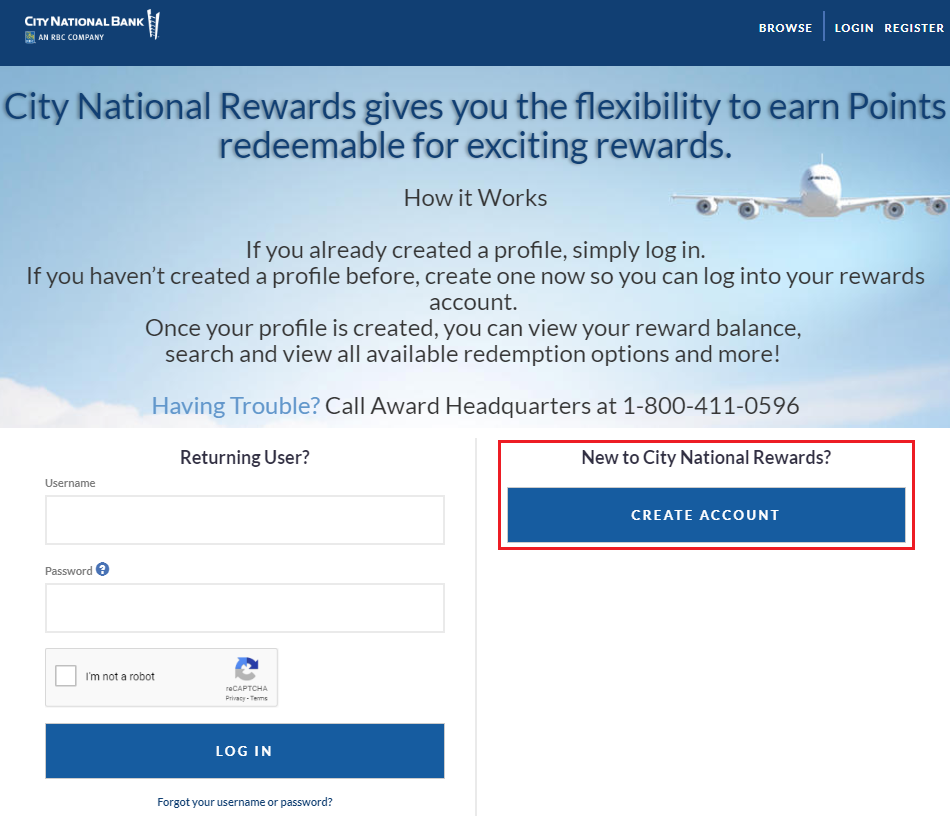

Good morning everyone. 2 weeks ago, I visited my local City National Bank (CNB) branch and applied for the City National Crystal Visa Infinite Credit Card. The credit card currently offers 75,000 City National Rewards Points after spending $5,000 in 3 months, plus $250 airline credit per cardmember, unlimited Priority Pass access, the Visa Infinite $100 companion travel discount, and much more. Please check out Frequent Miler’s post and Doctor of Credit’s post to learn more about this credit card.

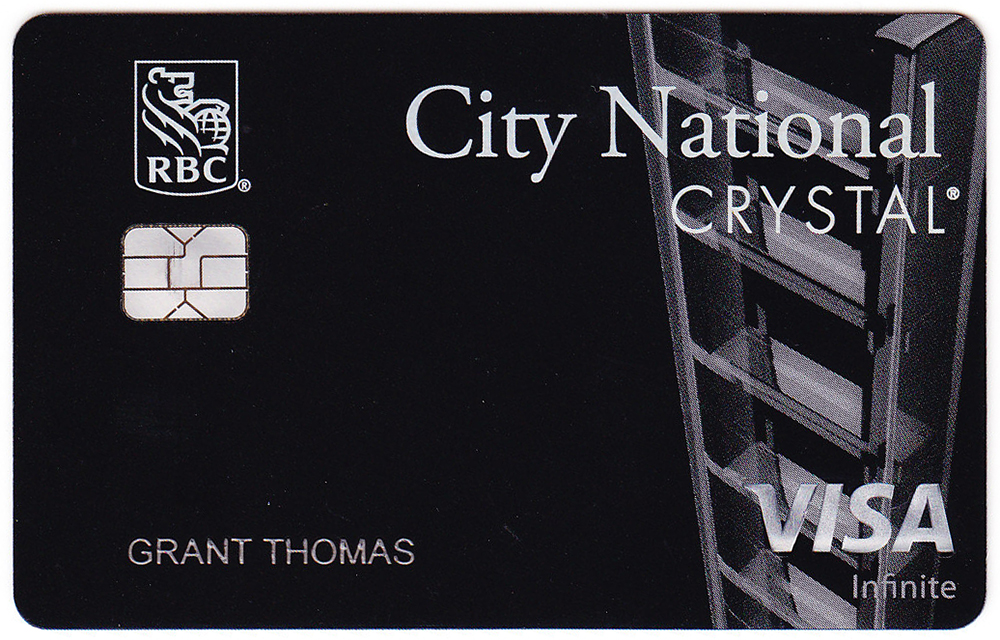

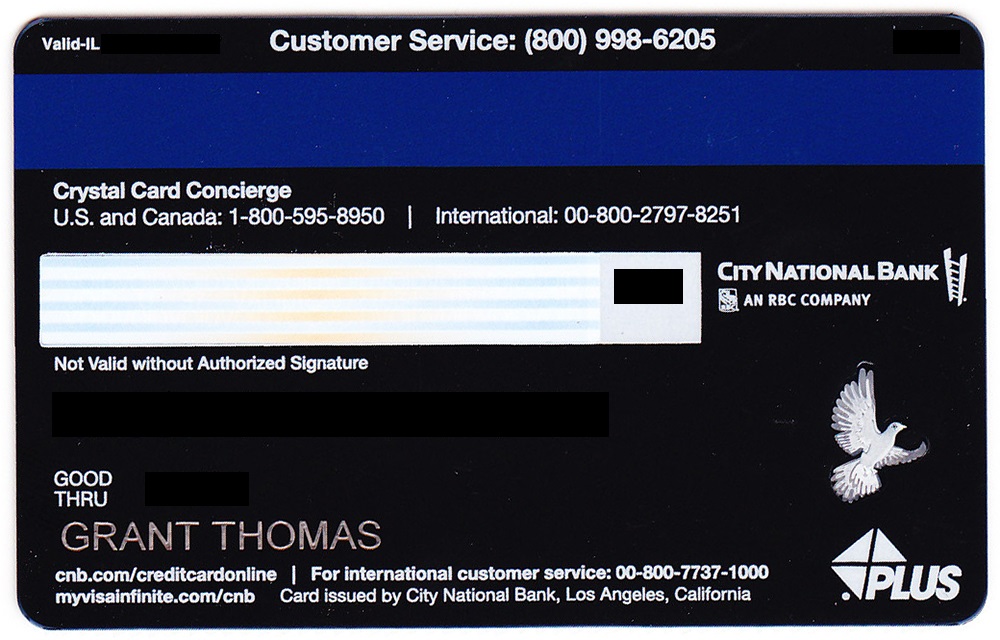

After waiting more than a week without hearing if I was approved or denied, I called CNB to check the status of my application. I was told that I was approved for the credit card on November 2 and the credit card would arrive soon. 2 days later, I received the credit card via FedEx on November 6. In this post, I will go through the unboxing process, show you my welcome letter, show you the brochure, and where to sign up for online access and to start earning City Nation Rewards Points. But first, here is the card art from the front and back of the City National Crystal Visa Infinite Credit Card. The credit card information is on the back, but when I blacked it out, you cannot see where it used to be.

Let’s back up a few days to when I got this FedEx email. I had no idea who Mike Davis was, what TSYS Card Productions was, or why they were sending me something.

The next day, I received a small white box from FedEx with my new City National Crystal Visa Infinite Credit Card securely packaged inside.

The packaging is very nice, but I was confused for a moment why the new credit card had a RBC logo.

Behind the credit card slot, there was a thick packet of terms and conditions. I didn’t scan any of the terms and conditions paperwork, since that is usually available online from the bank.

There was also a long welcome letter with details of my new credit card. At the bottom of the letter, there were 2 websites listed. I will go into more detail about each website later on in this post.

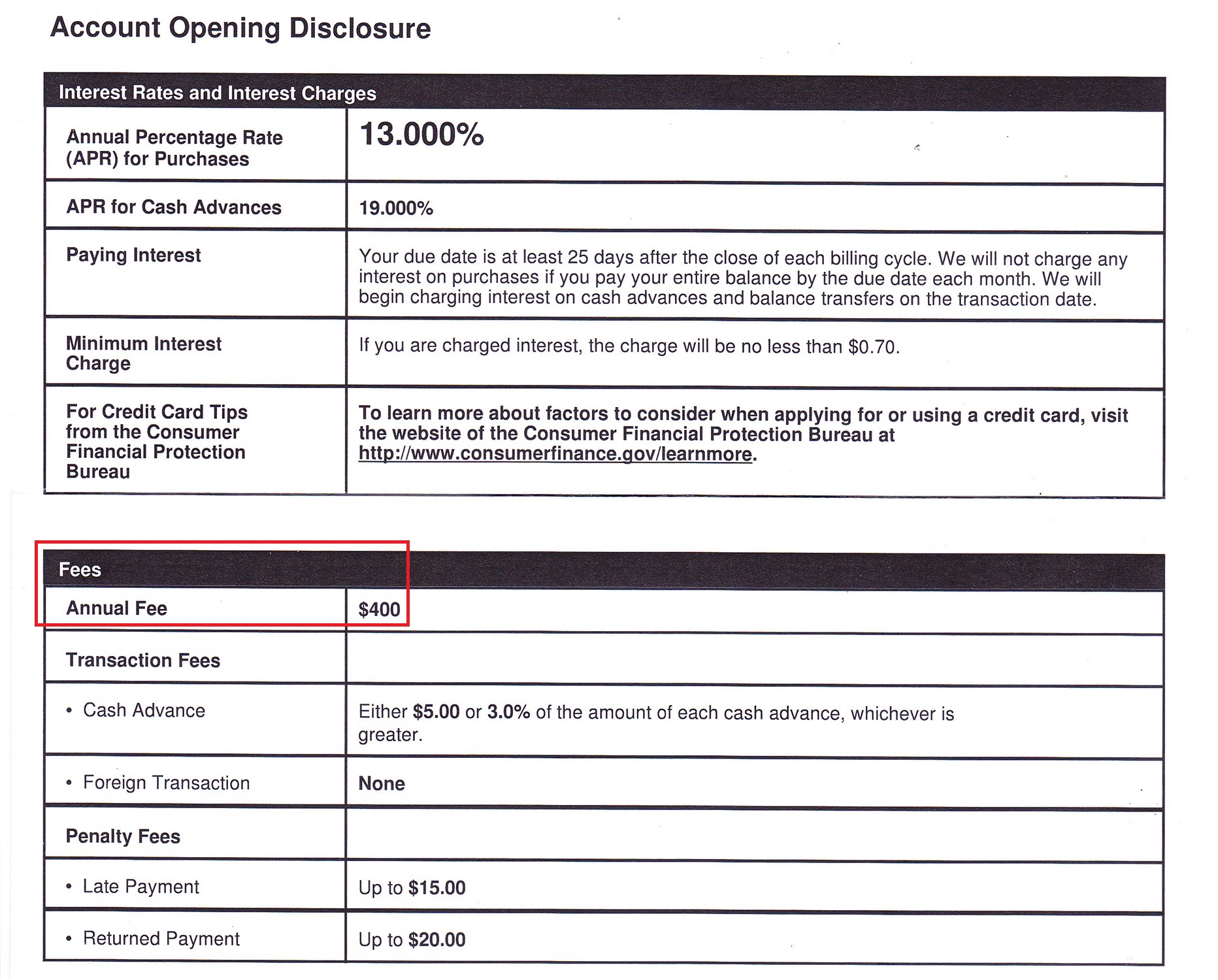

On the back of the welcome letter, there was information regarding the annual fee and, interest rates, and penalties.

To view your recent activity, pay bills, set up alerts, and more, you need to set up your CNB Online Access. First time visitors will need to enter their credit card number to create an account.

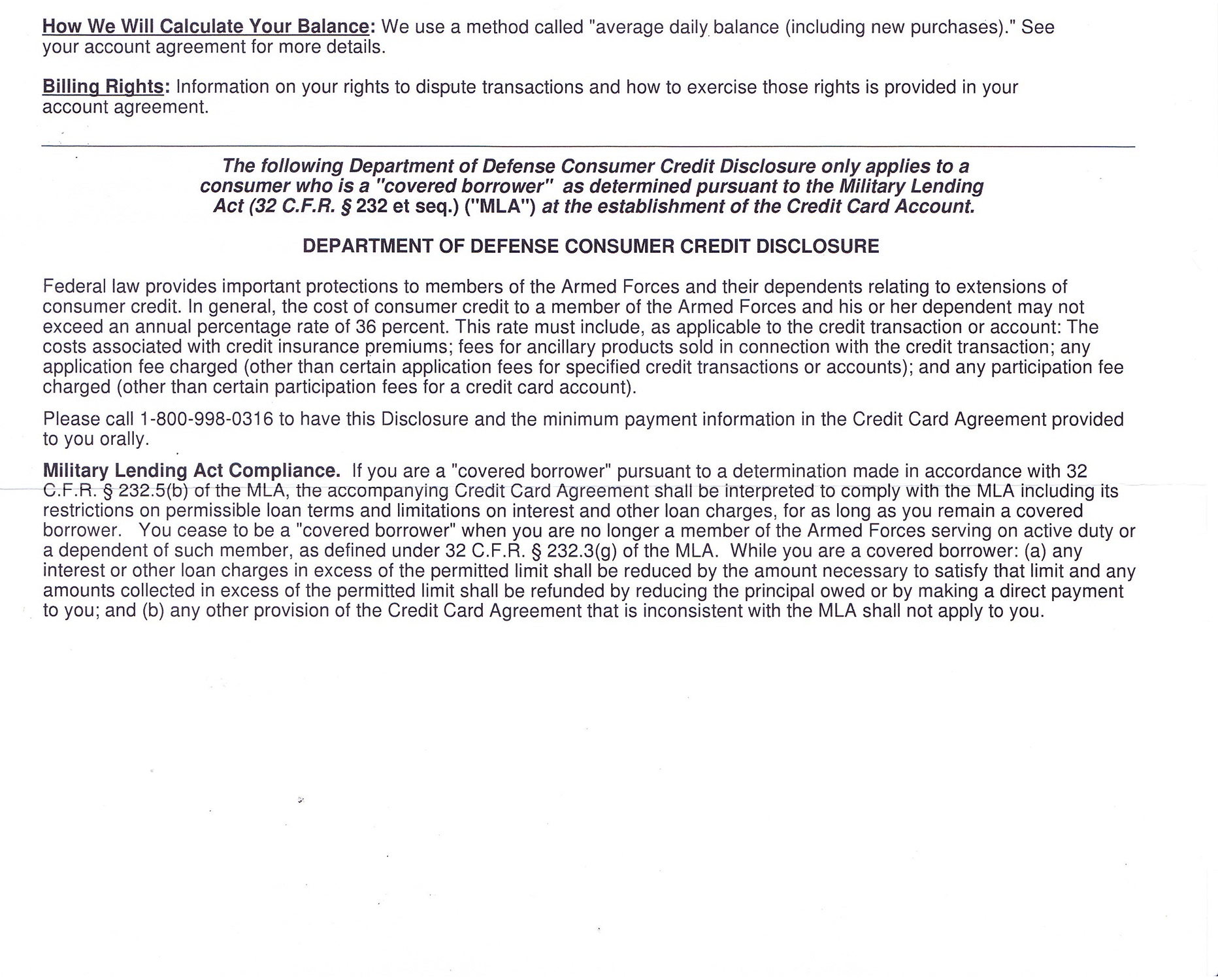

After you set up your CNB Online Access, you need to register for City National Rewards. To get started, click the Create Account button. This is where you can see your earning activity and redeem your points. Creating accounts at both websites took 2-3 minutes each and was very straightforward.

Lastly, here is the 6 page brochure that came with the credit card.

I plan on paying for some auto mechanic work on my car and paying property taxes via Plastiq, so that should get me pretty close to the $5,000 minimum spend requirement. I also plan on adding 3 other authorized users to take advantage of the $250 airline credit available per cardmember, per calendar year. I don’t have any plans in mind for the 75,000 City National Rewards Points, but I will probably redeem the points for $750 in travel. If you have any questions about the CNB City National Crystal Visa Infinite Credit Card, please leave a comment below. Have a great day everyone!

P.S. If you liked this post, I recommend reading my other credit card unboxing posts (sorted by date):

Congrats

Thank you Abe :)

Do they require ssn for aus?

The rep said that full name, date of birth, and SSN is needed for authorized users.

Can someone from out of state go into a branch and apply? What information did you take with you? Thanks!

I believe so, as long as you apply in branch, I don’t think you have to live in a state that has a CNB branch.

I brought a recent pay stub, drivers license, recent bank statement, recent retirement (401k) statement, and a letter from my company stating my salary and title. I only think they needed my drivers license, pay stub, and bank statement.

you should write up the detail and process of applying as it is more important to most churners. also, the 250 travel credit, is it per calendar year or membership year?

Grant said in his post that the $250 is per calendar year. Look at the last paragraph.

According to DOC, the $250 travel Credit is per card member and per calendar year.

See my response to Sam regarding the required documents.

I agree with Sam and Choi, I’d love to know what info that asked for in detail.

There were 4 pages to fill out by hand, asking a variety of questions about your finances, retirement balances and liquid assets.

Your box came from TSYS? Does that mean that this credit card is operated by TSYS on behalf of City National Bank? I’m not a big fan of how TSYS operates the rewards programs on Navy Federal Credit Union’s credit cards. I’m particularly concerned about the redemptions for airfare. Is that done exclusively through the TSYS website?

I don’t know the exact relationship between TSYS and CNB, but I think CNB has TSYS prepare and send new CNB CCs to cardholders. I do not believe the CNB rewards program is run by TSYS.

Pingback: Ultimate Guide to CNB City National Crystal Visa Infinite Credit Card Benefits [Very Long Post]

Pingback: I Just Froze My 3 Credit Reports: Here's Why & What I Learned

Pingback: CNB City National Rewards Points Now Worth 1.35 Cents Per Point (CPP) Toward Flights, Hotels, Rental Cars & Activities

About how much personal income are they looking for? About how much checking or savings balances they look for? Thanks!

Personal income of $80k+. I don’t have much in checking, but they asked about retirement account balances.

What is the card material? Is it hefty like the AmEx Platinum or CSR?

Not as heavy as the AMEX Platinum, but a little thicker than the CSR, so somewhere in between :)