Good morning everyone. Last week, I applied for the Chase Ink Business Unlimited Credit Card and I was instantly approved. I have a few large bills to pay in the coming weeks, so I decided to apply for this card. The current sign up bonus is 75,000 Chase Ultimate Rewards Points (equal to $750 cash back) after spending $7,500 in 3 months which fits perfectly with my upcoming purchases. In today’s post, I wanted to share the card art, welcome letter, benefits booklet, activation process, and the process of moving credit limits around between business credit cards.

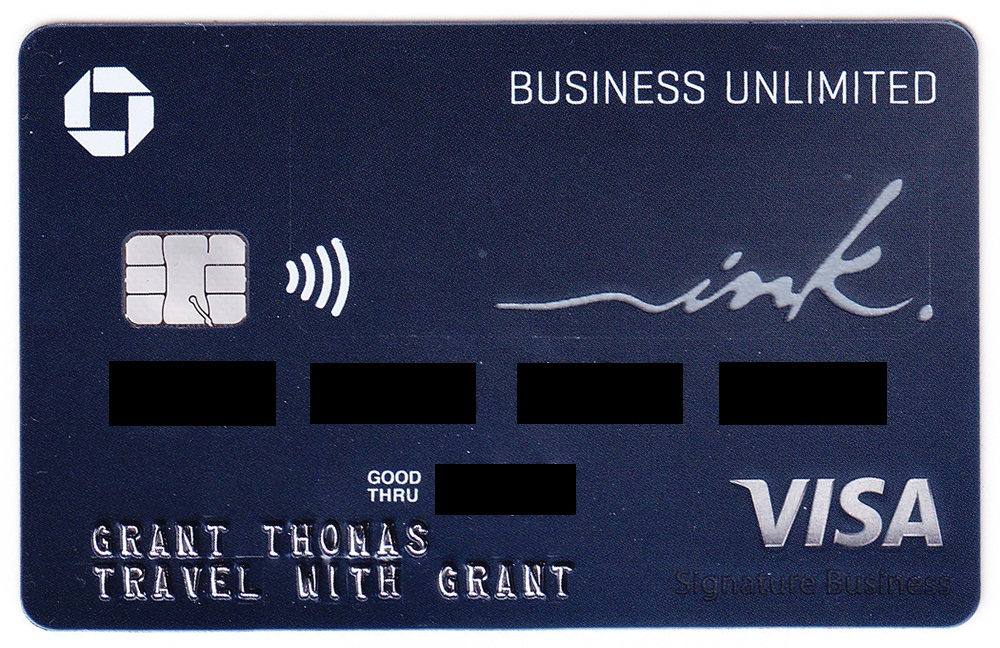

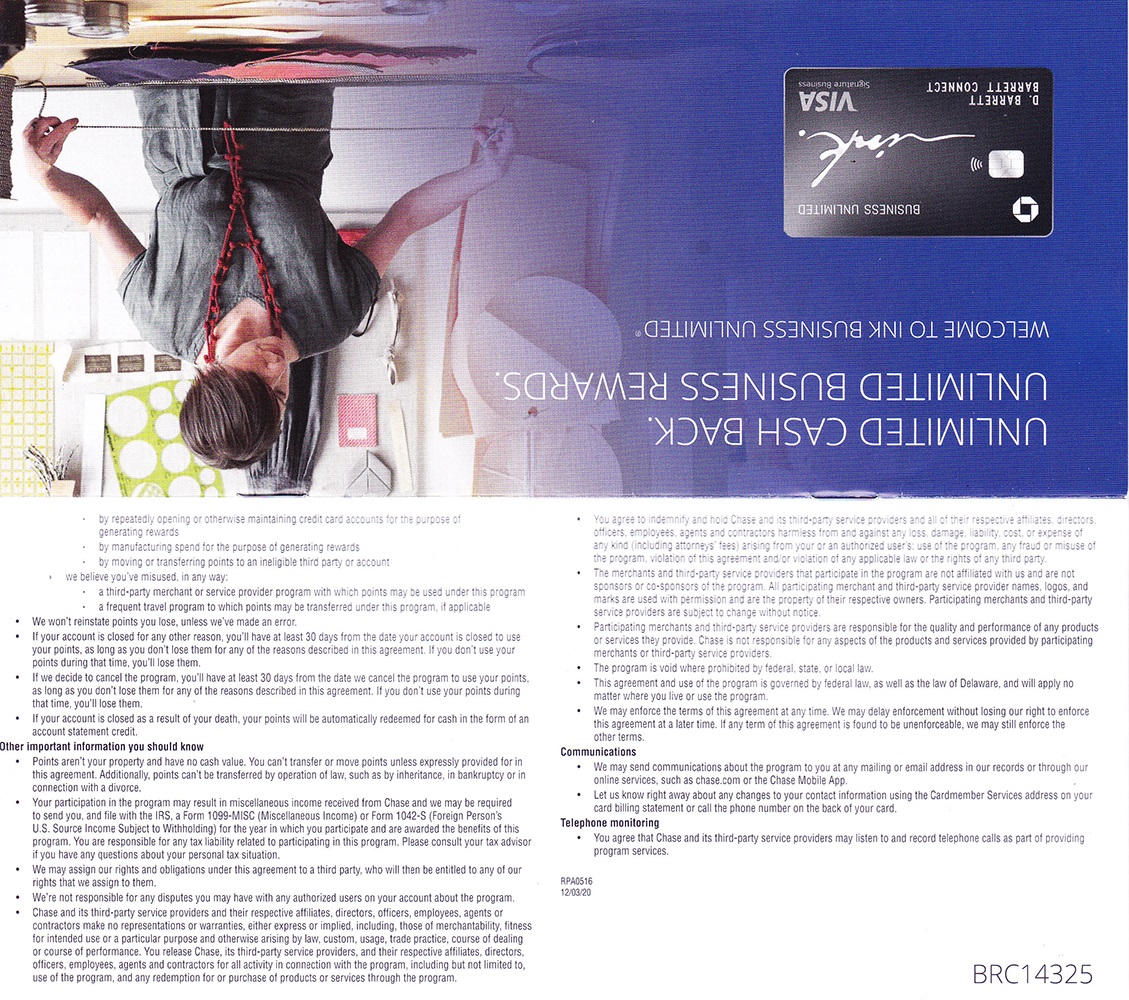

Here is the front and back of the Chase Ink Unlimited. The card design is clean, simple and very similar to the design of the Chase Ink Cash and Chase Ink Plus.

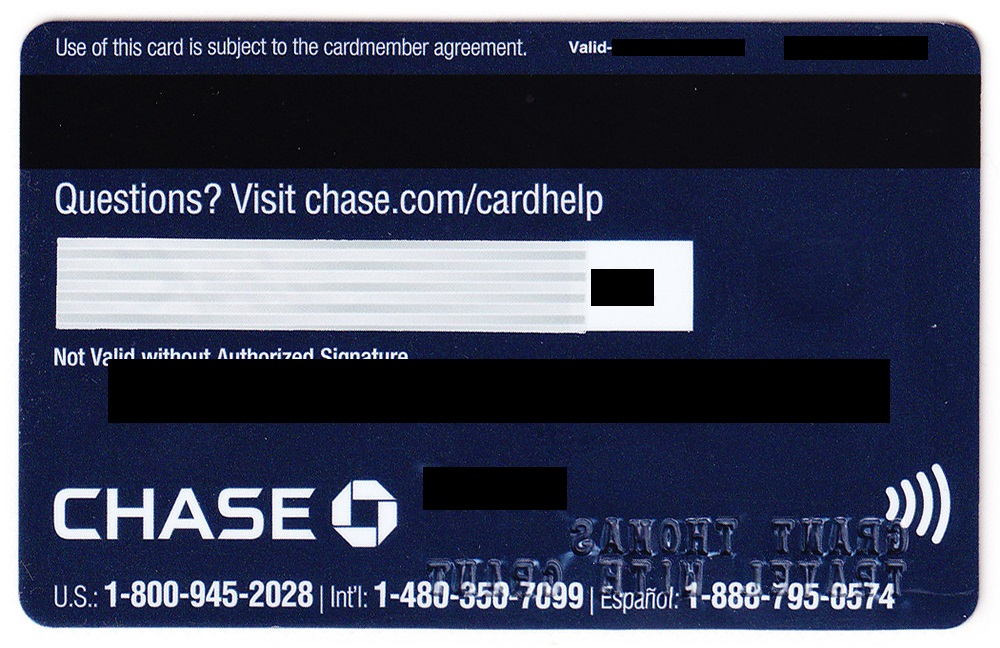

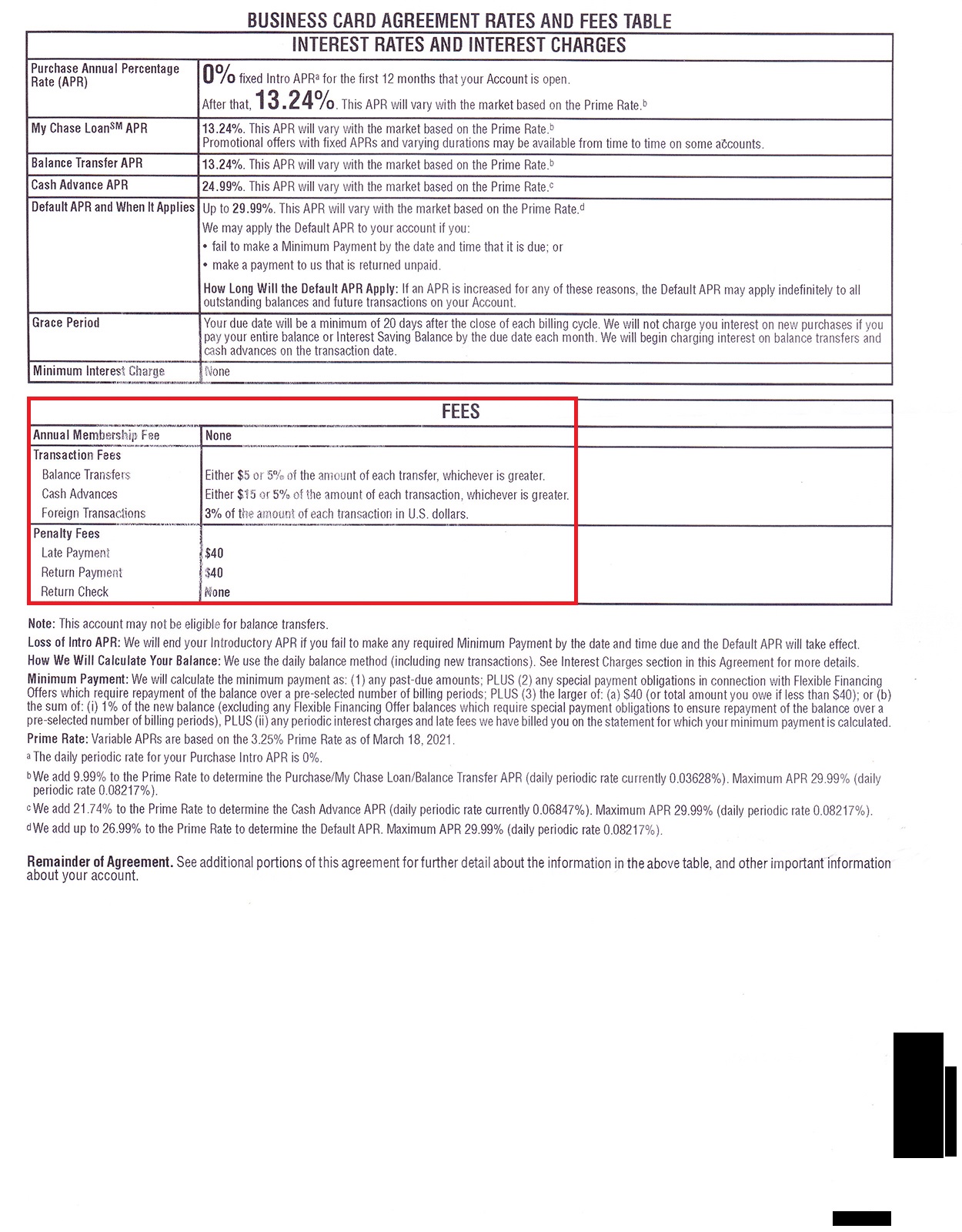

Here is the welcome letter and rates/fees/interest letter. This card has no annual fee but does charge a 3% foreign transaction fee. I was approved for this card with a $3,000 credit limit, but the minimum spending requirement is $7,500, so that is why I needed to move (aka reallocate) some of the credit on my existing Chase business credit cards to my new Chase Ink Unlimited.

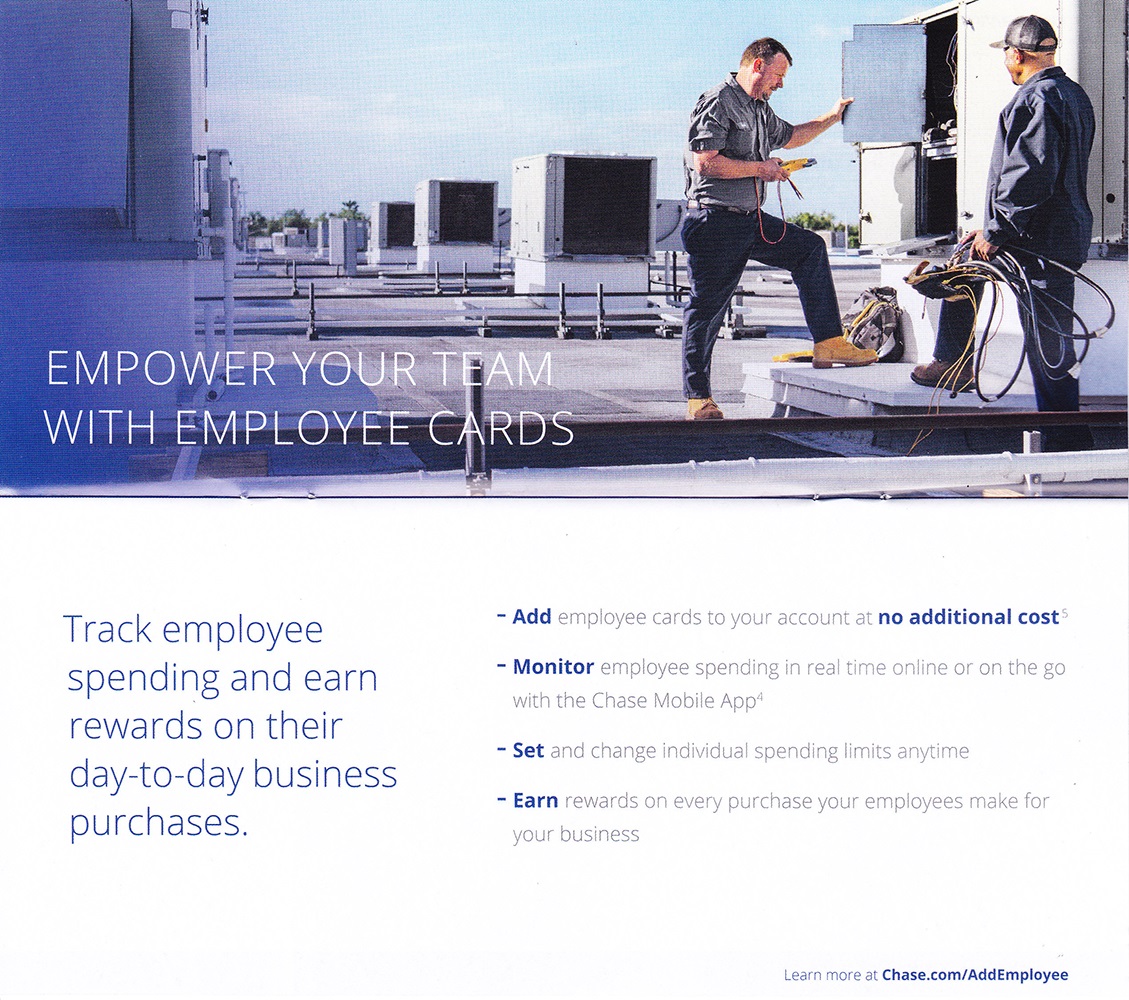

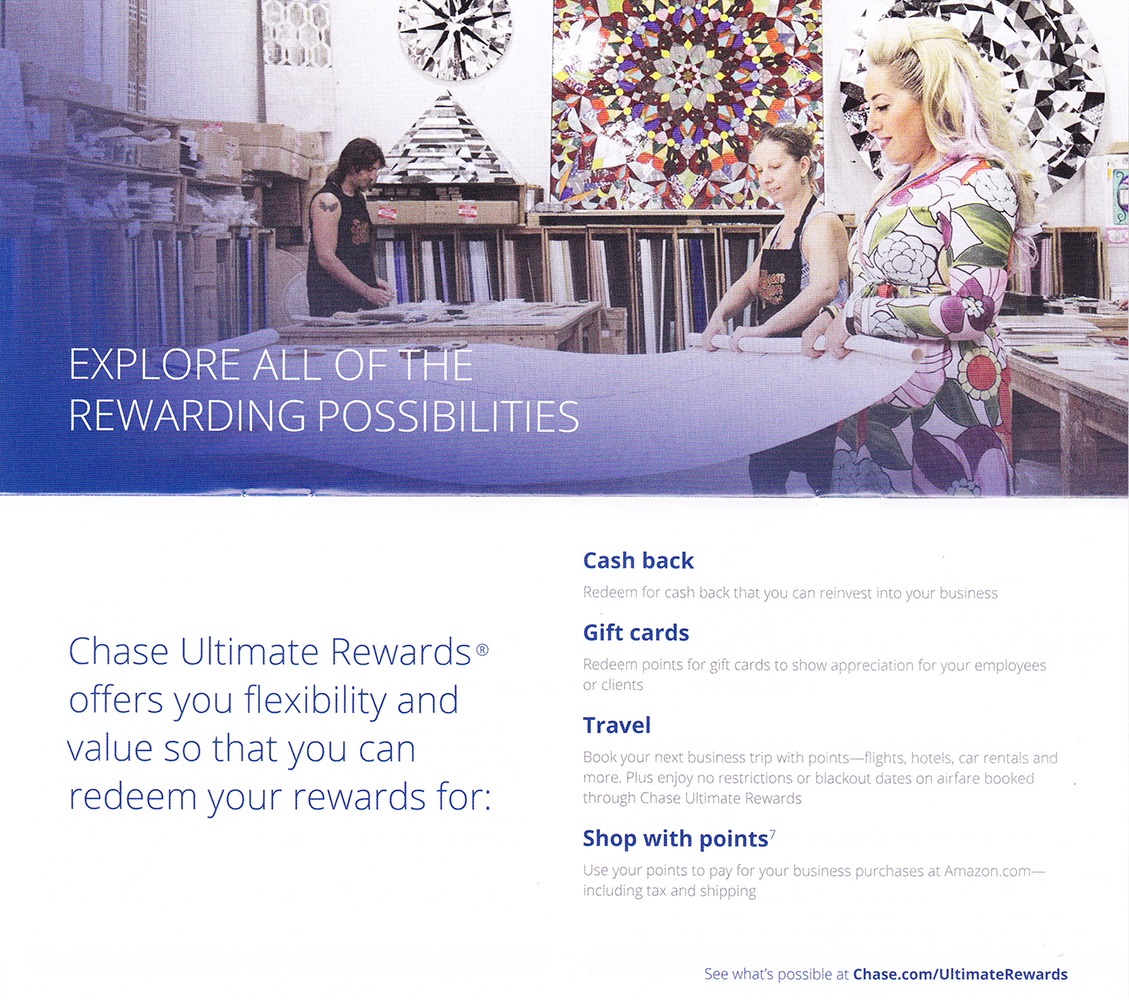

Here is the benefits booklet that covers earning and redeeming Chase Ultimate Rewards Points.

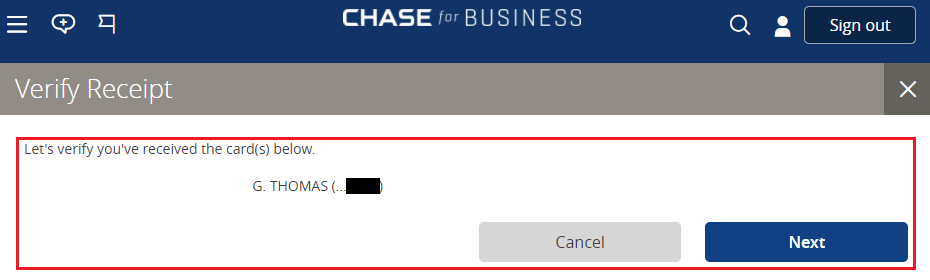

To activate your Chase Ink Unlimited, go to the activation page. If you are an existing Chase member, sign into your account.

Verify the last 4 digits of your new card and click the Next button.

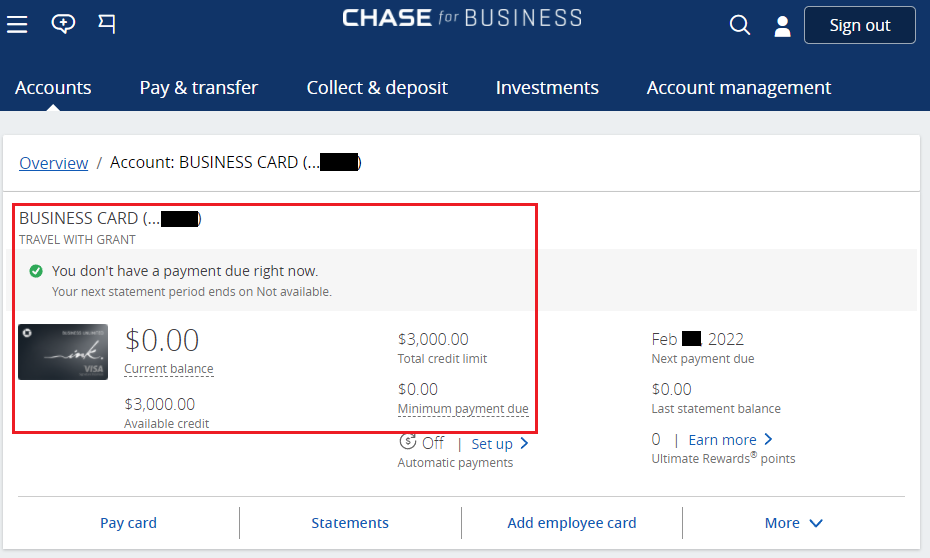

Congratulations, your new card is activated. You can view your account online by clicking the Go To Accounts button.

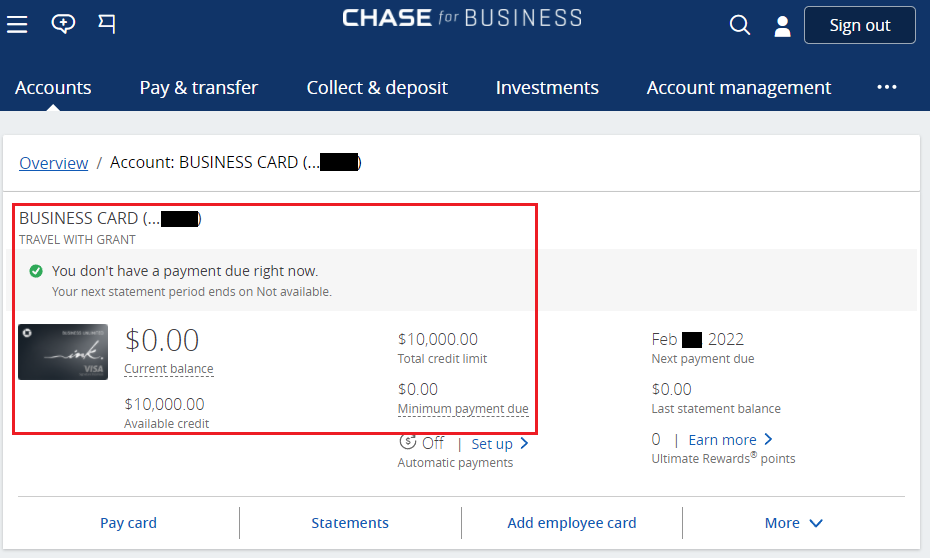

Navigate to your new account online to see the credit limit, due date, and more.

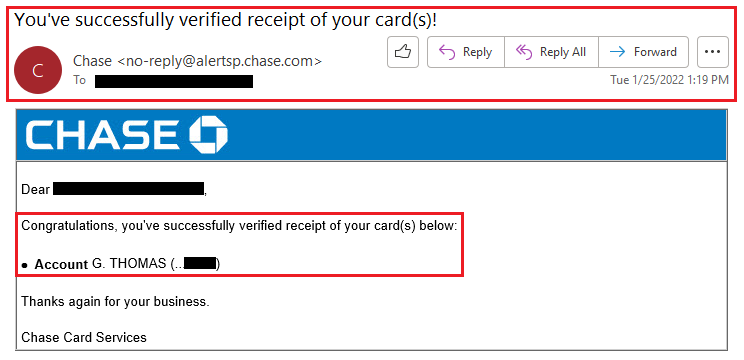

You will also receive a confirmation email that you successfully activated your card.

Like I mentioned earlier, I was approved with a $3,000 credit limit but the minimum spending requirement is $7,500. I called the phone number on the back of the card and spoke to a business rep. I explained the situation and asked if I could move a portion of my credit limits from my other Chase business cards. Yes, that was possible. I was able to move $3,000 from my old Chase Marriott Bonvoy Premier Plus Business Credit Card (no longer available) and $4,000 from my Chase Ink Business Cash Credit Card. That gave me a new credit limit of $10,000 on my Chase Ink Unlimited.

If you have any questions about the Chase Ink Business Unlimited Credit Card, please leave a comment below. Have a great day everyone!

P.S. If you liked this post, I recommend reading my other credit card unboxing posts (sorted by date):

It` been a while for me getting a new Chase card. Already have six. Does Chase still use 5/24 rule? This new card you got is a great choice!

Hi Kat, yes, Chase still uses the 5/24 rule. You must have less than 5 new credit inquiries in the last 24 months to be approved for this card.

Can I move credit from my personal chase sapphire to the ink card if I need? I need at least $25,000 in credit on my business card for it to be useful for me.

Hi Lauren, I don’t think Chase will let you move credit from a personal card to a business card, but you could ask for a credit limit increase.