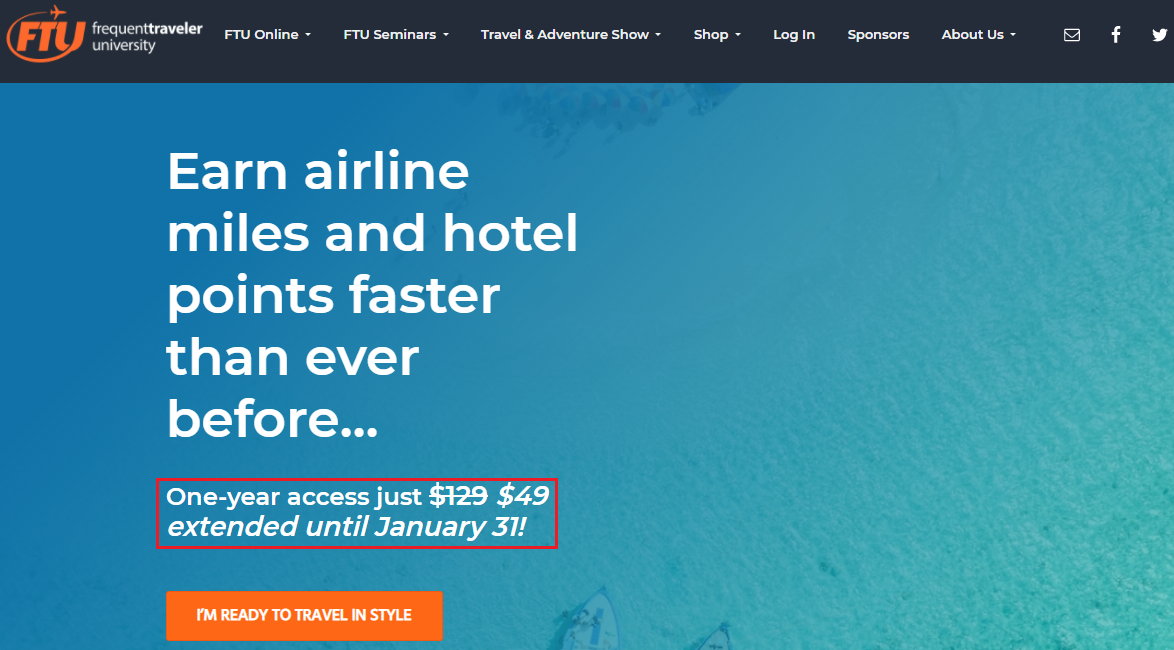

Good morning everyone, I hope your weekend is going well. I’ve written about the FTU Online Annual Membership a few times, but I wanted to remind you that today is the last day to buy your membership before prices rise tomorrow. Beginning February 1, the price will rise to $129. If you want to save $80 on an annual membership, today is your last day to act. With your annual membership, you will receive free access to the next FTU Virtual Seminar on February 20 (or buy a single ticket for $25). Here is the tentative schedule and lineup of speakers (seminars start Saturday at 11am ET / 8am PT). I really enjoyed attending the first FTU Virtual Seminar back on December 12 and I’m sure the next seminar will be just as entertaining and educational.