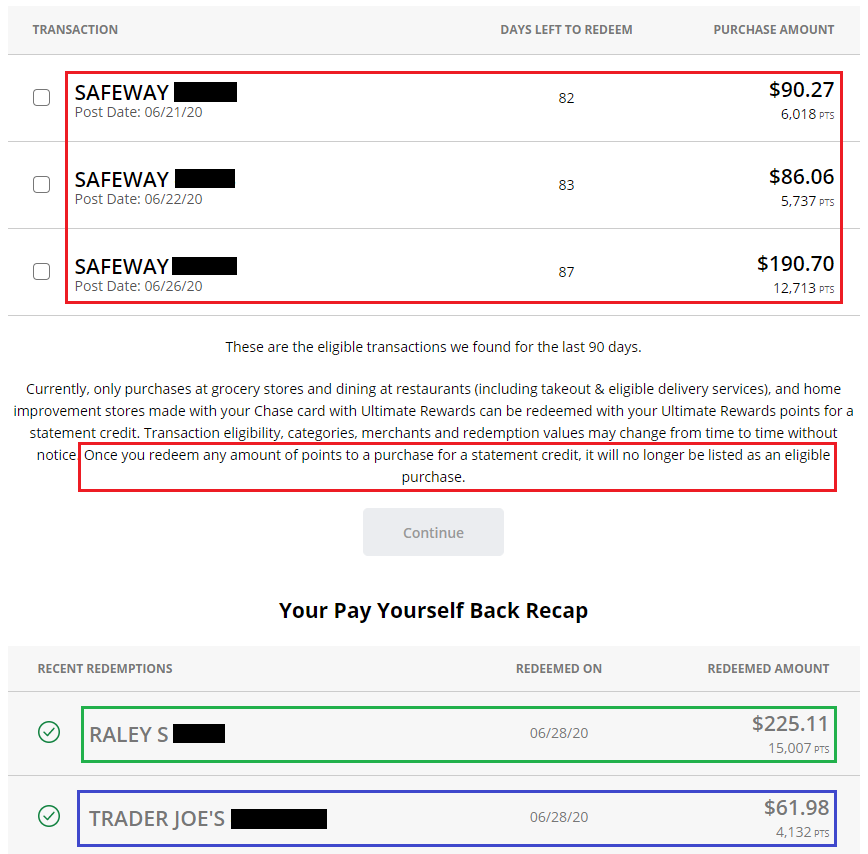

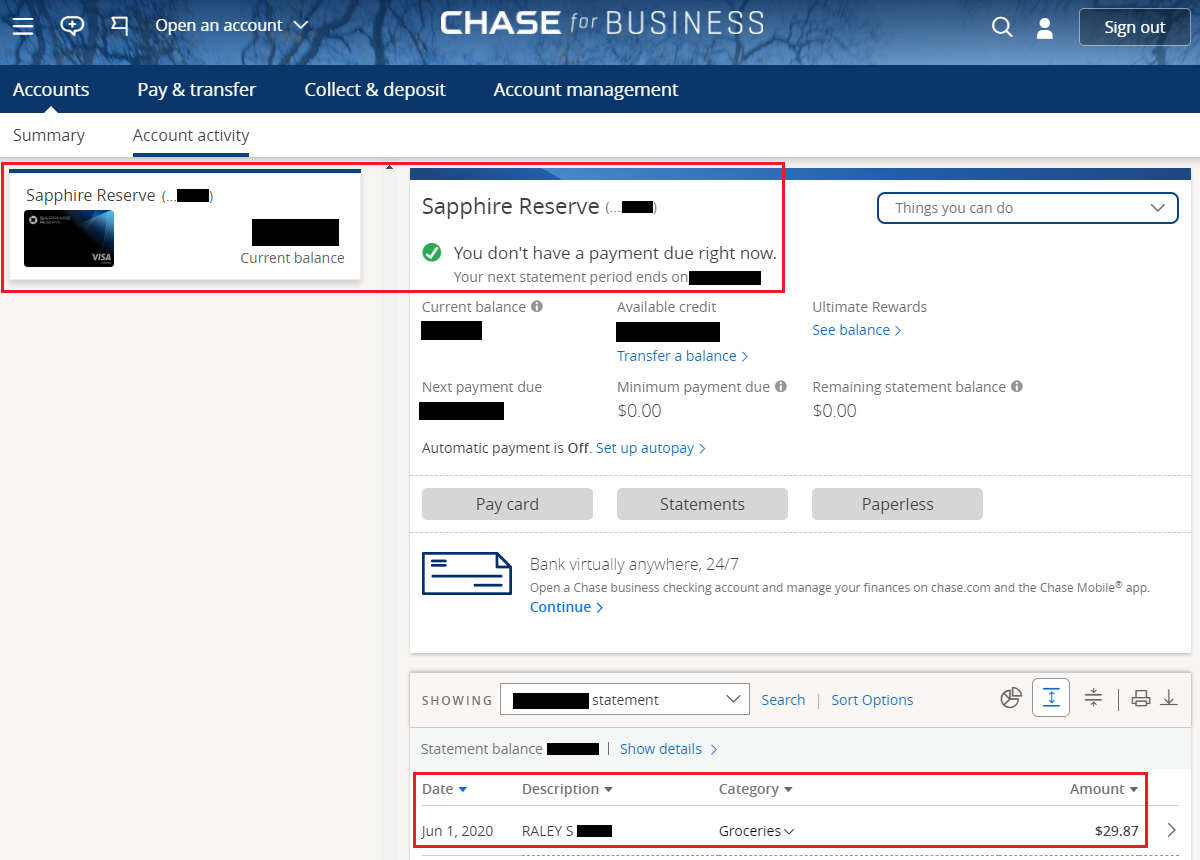

Good morning everyone, I hope your weekend is going well. I recently had a change of heart and decided to redeem 1/3 of my Chase Ultimate Rewards Points with the Pay Yourself Back feature. Chase introduced the Pay Yourself Back feature on May 31 and I wrote How to Redeem Chase Ultimate Rewards Points via Pay Yourself Back (1.5 Cents Per Point for Restaurants, Grocery Stores & Home Improvement). Initially, I was not very excited about the new feature, since I convinced myself that I could use my Chase Ultimate Rewards Points in other ways and get more than 1.5 cents per point.

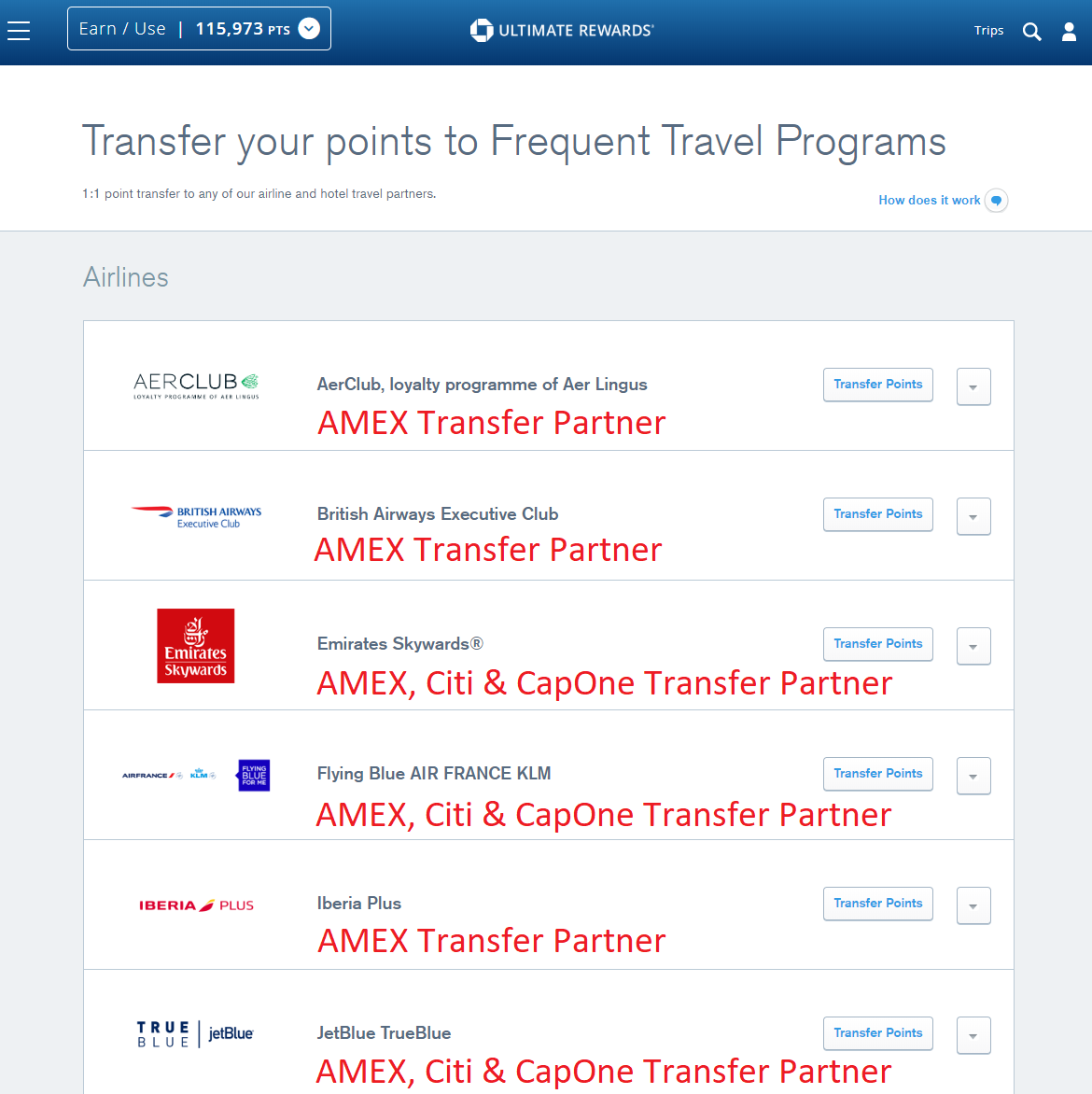

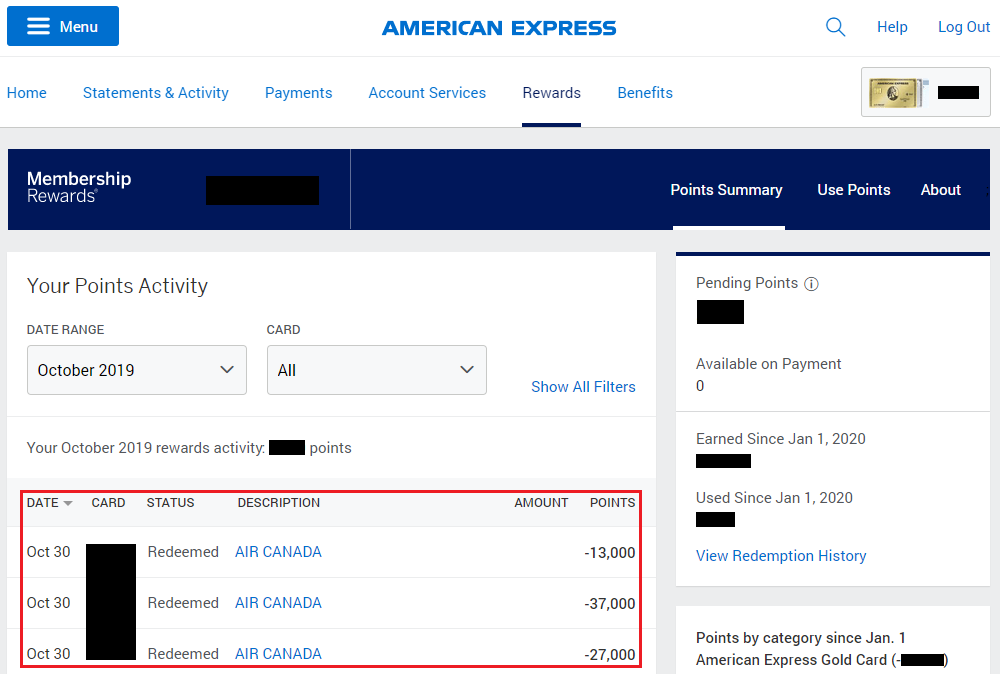

After realizing that I had no concrete travel plans remaining in 2020 (I recently cancelled trips to Boston & New York along with a big trip to Africa), I figured that my stash of Chase Ultimate Rewards Points would probably not be used much this year. Before redeeming 1/3 of my Chase Ultimate Rewards Points, I looked at Chase’s travel partners to see if there were any major reasons to keep my Chase Ultimate Rewards Points. Chase has 13 airline and hotel partners, but only has 4 exclusive partners (Southwest Airlines, United Airlines, IHG, and Hyatt), the remaining 9 travel partners are accessible with American Express Membership Rewards Points, Citi ThankYou Points, and Capital One Miles.

My wife and I have ~58,000 Southwest Airlines points and ~$150 in travel credit, so I would not need to transfer Chase Ultimate Rewards Points to Southwest Airlines. I am not a huge fan of United Airlines and can usually book Star Alliance flights with other travel programs, plus I have ~$178 travel credit from a cancelled United flight. IHG points are worth ~0.5 cents per point and I have ~222,000 IHG points in my account. Last but not least, Hyatt is the only travel partner that stands out from the list. I decided to save at least 60,000 Chase Ultimate Rewards Points just in case we stay at a Hyatt later this year).

I figured that normal spending on our Chase Ink Cash Credit Card, Chase Sapphire Reserve Credit Card, and Chase Freedom Credit Card this year would replenish our Chase Ultimate Rewards Points balance by the end of 2020.

Continue reading →