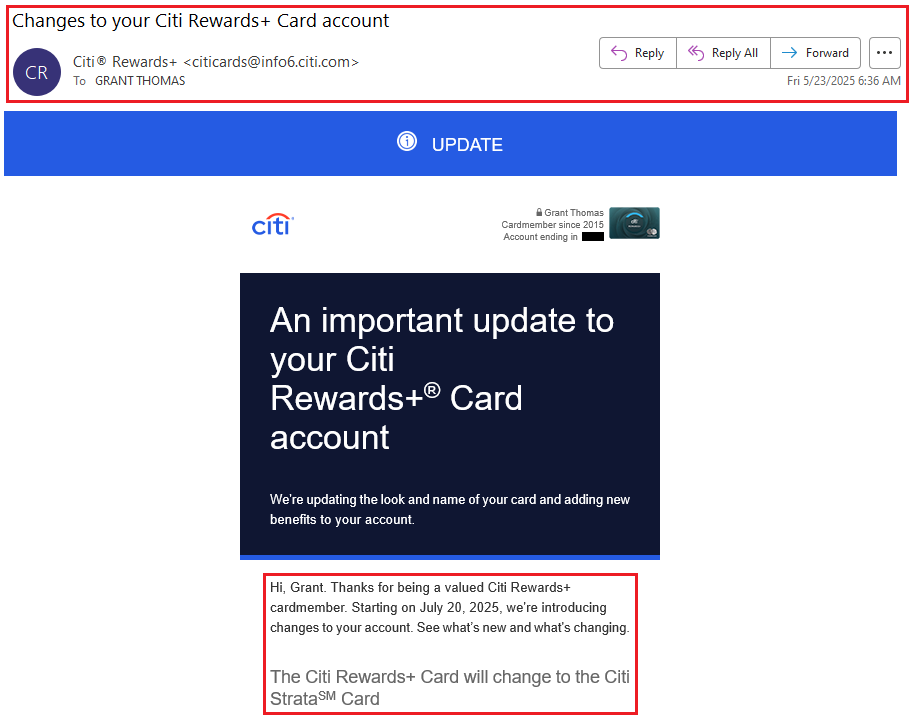

Good afternoon everyone, I hope your week is going well. Last month, both Laura and I applied for the Citi Strata Elite Credit Card because we had a property tax payment due by December 31 (and we were hoping to triple-dip the $300 Annual Hotel Benefit and $200 Splurge Credit). Long story short (and a situation deserving of its own blog post), Citi declined my application but approved Laura’s application.

If you already have the Citi Strata Elite, the $200 Splurge Credit should be very easy to use. I wanted to share our experience and show how quickly you can expect the credit to post. Laura selected Best Buy as her “Selected Brand” and spent $200 on Best Buy’s website (they offer a wide variety of gift cards available). The purchase posted on December 29 and the $200 statement credit posted 2 days later on December 31.

Since the Splurge Credit resets each calendar year, she was able to use it again in 2026. Laura kept Best Buy as her “Selected Brand” and made another $200 purchase on January 3. Once again, the credit posted quickly, just 2 days later on January 5. We were both pleasantly surprised that the credits posted automatically and without any need to contact Citi.