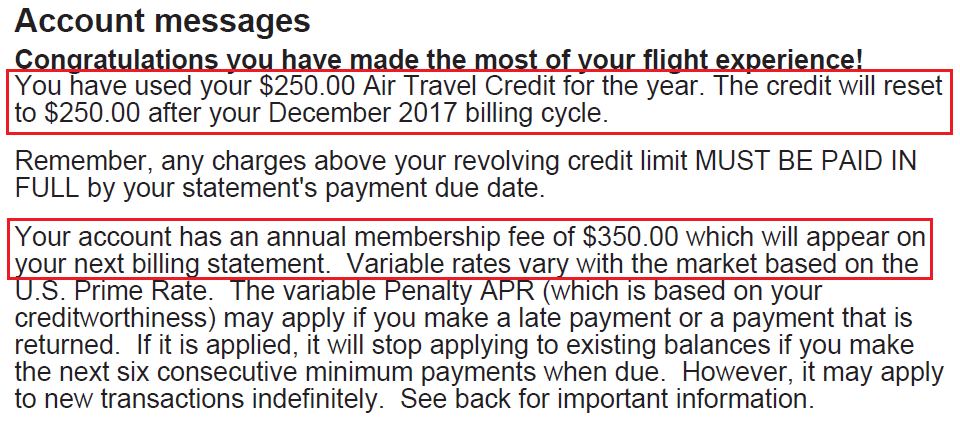

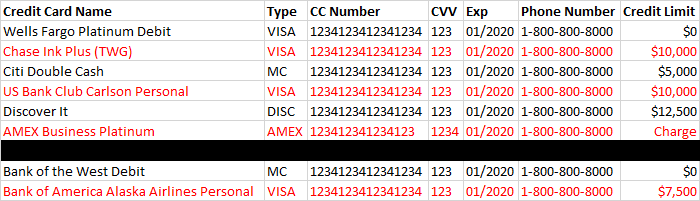

Good afternoon everyone. A few days ago, my Citi Prestige Credit Card statement closed and I confirmed that I did redeem all $250 of my airline travel credit for 2017 (I previously confirmed that Flights Booked with Citi Thank You Points + Cash do not Trigger Citi Prestige $250 Airline Travel Credit). My statement also said that I would be billed the $350 Citi Prestige annual fee on my next statement. I only pay $350 for the annual fee because I have a linked Citigold Checking account. Without that checking account, I would have to pay the $450 annual fee. Considering that I never took advantage of the 3 free rounds of golf, 4th night free on hotel stays, or needed an extra Priority Pass membership, I saw no reason to keep the credit card another year. The only feature that I really liked about having my Citi Prestige Credit Card was the ability to redeem Citi Thank You Points for 1.6 CPP on American Airlines and AA codeshare flights, but that feature is going away in a few months too.