Good afternoon everyone, I hope your week is going well. I was working on my Buy Miles & Points Page and found 5 offers that end soon. Always check the math to make sure that buying miles & points makes sense for you. Do not buy miles & points speculatively unless you have a use in mind. With that said, here are 5 offers that end soon.

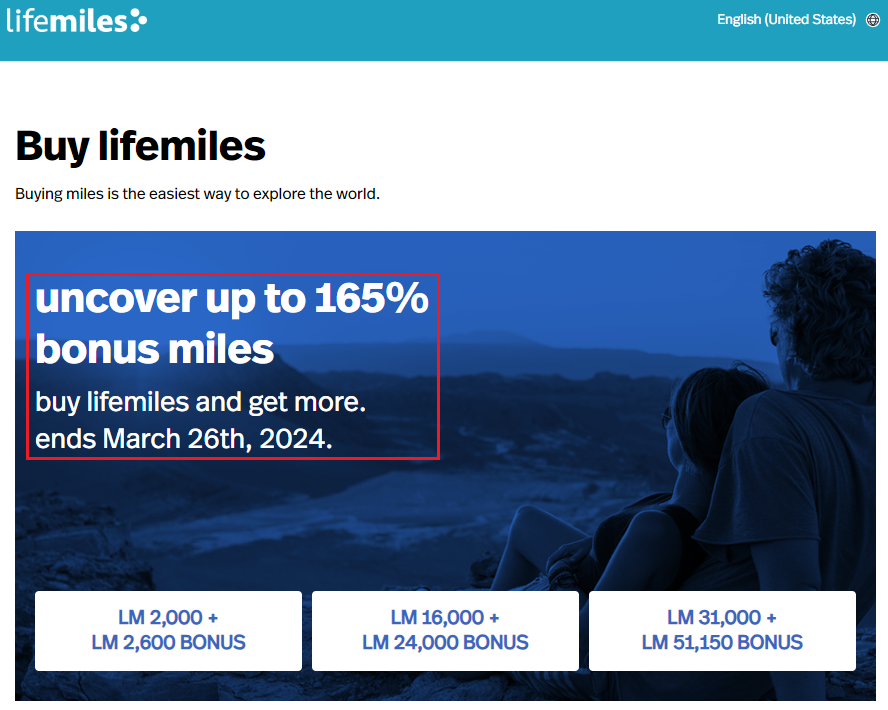

Up first, Avianca Airlines is offering up to a 165% bonus, depending on the number of Avianca Airlines LifeMiles you purchase. This offer expires today – March 26.