Good afternoon everyone, I hope you enjoyed my insightful/crazy ramblings in Travel Predictions for 2016 Part 1: Airlines and Hotels. If you liked that post, you will surely love my crazy predictions about credit cards and MS. Full disclosure, I wrote most of this post on my iPhone standing in front of a dryer at my local laundromat, so the train of thought might be kind of strange. I apologize. Without any further ado, let’s get started!

Credit Cards

Chase – with the loss of Amtrak and the addition of Singapore Airlines in 2015, I think we will see some more changes to Chase’s transfer partners in 2016. I think we will see some more international airlines added (like the Citi Thank You Points program). A few guesses? Air Canada, Qantas, Air China, and Lufthansa (insert your favorite international airline). Chase Ultimate Rewards will continue to transfer 1:1 to all programs and there will be no transfer bonuses. I think there will be a newsworthy announcement for the Chase Sapphire Preferred, maybe adding free Gogo WiFi like the US Bank FlexPerks Credit Card or perhaps a new 3x category to compete with Citi Premier/Prestige Credit Cards. What about our beloved Chase Ink Bold/Plus Business Cards? I am worries that the 5x category might change to something less lucrative or the yearly cap might be lowered. I also predict Chase will launch a completely new travel rewards credit card in 2016. Maybe the Airbnb/Uber Credit Card? Lastly, I hope Chase loosens up on the 5/24 rule or completely eliminates the rule altogether.

Citi – this is my current favorite bank. I use my Citi Forward Credit Card for restaurants on a daily basis, the Citi Premier Credit Card for Uber/Lyft/Bart and all airline purchases, and the Citi Double Cash Credit Card for bank account bonuses and modest MS. I hope the Thank You Points program continues to get better with the addition of new airline partners and maybe even another hotel partner. I’d love to see American Airlines added as a transfer partner. I’m sure there will be more transfer bonuses in 2016. I’m worried about the benefits of the Citi Prestige Credit Card though. Will we still be able to book American Airlines and AA codeshare flights at 1.6 CPP? Will Citi make all airlines eligible for the 1.6 CPP redemption? What about 4th Night Free? Maybe they can introduce “2nd Night Half Off,” that would definitely be a welcome change. Free rounds of golf? Make that free rounds of miniature golf and I might actually use them. I love the $250 airline reimbursement. I hope that stays at $250 and doesn’t drop down to $200. The Citi Dividend Credit Card might be officially discontinued/retired like the Citi Forward Credit Card. And what about the Citi AT&T Credit Card? It seems too generous right now, I think the benefit might be cut down a few notches.

American Express – with the recent loss of Costco and the upcoming loss of SPG (most likely), I’m sure we will see some great promotions and AMEX Offers in 2016. To encourage people to have multiple AMEX credit cards, I think we might see additional bonuses when using AMEX Offers (like get a $10 bonus for each additional credit card you redeem the offer on). I’m sure there will be more negative changes to Membership Reward transfer partners and bigger transfer bonuses to the remaining partners. Maybe even a 50-100% transfer bonus to British Airways or Singapore Airlines. Like other bloggers have already mentioned, I think AMEX will loosen the rules of 1 credit card per lifetime. Maybe change it to once every 2 years.

Bank of America – other than Alaska Airlines and Virgin Atlantic, they do not have any other decent travel credit cards. Maybe the BankAmeriCard Travel Rewards Credit Card will be revamped to compete with Citi Premier. I’m not expecting any major headlines from BofA in 2016. Will it still be almost impossible to convert to a BofA Better Balance Rewards Credit Card?

US Bank – with the loss of the Last Night Free benefit for the US Bank Club Carlson Credit Cards, the only decent cards left are the US Bank FlexPerks AMEX Credit Card (great for online Serve reloads) and the US Bank Cash+ Credit Card. I hope US Bank improves the Cash+ offering to maybe 5% on all categories with a quarterly or annual cash back limit. Will there be any major changes to the FlexPerks program in 2016? I’d love to see 10,000 FlexPoints be redeemed for travel up to $200 or maybe a system whereby all FlexPoints are worth 1.6-1.8 CPP toward paid travel. That would be a huge improvement to the program.

Discover – I have a love-hate relationship with Discover. I want to love them, but sometimes I just hate them. I’m expecting a few more hiccups along the way toward the Double Cash Back promotion after the first year. I would be really surprised to see the cash back post on-time, in full, without any more drama. I think Discover might increase their rotating cash back categories to 6% or increase the quarterly cap to $2000. That would be a welcome change to the program. For some reason, I am picturing a “Discover Travel” credit card or redemption option to come around in 2016.

Barclays – I predict I will finally get approved for a Barclays credit card. I am 0 for 5 , I believe. By the time I get approved, there will be no more good Barclays credit cards to get (I missed out on US Airways, Lufthansa, and the good days of Barclays Arrival+). Wish me luck :)

Manufactured Spending

2015 was an interesting year, it was a year of 2 halves. In the first half of 2015, we had Redbird credit card reloads (until May 6) and then Redbird debit card reloads (until October 13). Since mid-October, the MS landscape has become more barren. I will comment on my current 4 ways of MS and then share my thoughts on a few other MS topics.

Serve Cards – after the demise of Redbird, I closed all 4 of my Redbird cards (me, mom, dad, and brother) and quickly opened 4 new Serve cards (me, mom, dad, and brother). I then ordered 3 authorized user cards (mom, dad, and brother) linked to my US Bank FlexPerks AMEX Credit Card. I currently have a US Bank FlexPerks AMEX Credit Card linked to all 4 Serve cards and have scheduled loads for all my accounts. Me (load $200/day for first 5 days), then mom (load $200/day for next 5 days) and so on for my dad and brother’s Serve cards. Around the 20th of each month, I consolidate the funds from those 4 accounts and pay a few credit card bills. I don’t do any in-store reloads for any Serve cards since San Francisco is not MS-friendly. I am happy with my $4,000/month of FlexPerks charges, which earns 4,000 FlexPoints, which is worth up to $80 in travel (unless my predictions above come true). Serve reloads can go a few different ways. AMEX can stop accepting AMEX credit cards for online reloads or start allowing Visa and MasterCard credit cards for online reloads. In-store reloads might increase the monthly limit to $6,000/month and add a few more retailers for in-store reloads.

Nationwide Buxx Cards – I currently have 4 Nationwide Buxx cards (me, me, me, and me). I can load up to $1,000 per card per month with a Visa or MasterCard credit card. Right now, I am working toward the Bank of America business checking account $1,000 bonus (more bank account bonus predictions below) and charge $2,500 to my Bank of America Business Travel Rewards Credit Card each month to waive the monthly fee on the business checking account until the $1,000 bonus posts. I also use my Citi Double Cash Credit Card to fund the remaining $1,500 of transactions. Realistically, if Nationwide made absolutely no changes to the program in 2016, I would be very happy. If they want to make me even happier, they could increase the monthly load limit to $1,500 per card and remove the other limits.

AMEX Offers – I am looking forward to a new batch of AMEX Offers in 2016. I hope we will see some great offers like the Sam’s Club AMEX Offer and Smart & Final AMEX Offer from earlier this year. I would love to see more grocery store offers and popular online merchants included in the AMEX Offers. I do not use any IFTTT or robots to tweet AMEX Offers. I do it all by hand. I wonder if AMEX will change the way people can enroll in the Twitter offers. I love stacking AMEX Offers with various shopping portals and different deals. I also expect BankAmeriDeals, Citi Offers, and Plenti to step up their game to compete with AMEX Offers. If they do, we should clean up pretty good in 2016.

Bank Account Bonuses – I finally listened to my good friend Will @ Doctor of Credit and got into the bank account bonus game. Not only is it (usually) an easy way to make a few hundred dollars per bank account sign up bonus, but you can also pay with credit cards and earn miles/points/cash back funding the new bank accounts. Plus, most bank accounts are only a soft pull on your credit report, but they will send you a tax form at the end of the year. Here are the bank account bonuses I have *already* received in 2015:

- Citi Gold Interest Checking – 40,000 Citi Thank You Points

- US Bank Gold Checking – $125 bonus

- US Bank START Savings – $50 bonus

- Chase Total Checking – $300 bonus

- Discover Checking – $50 bonus (I signed up before the $300 bonus was announced)

- Discover Savings – $100 bonus

- Technology Credit Union Checking – $150 bonus

- PNC Performance Select Checking – $400 bonus

Total so far is $1,175 bonus + 40,000 Citi Thank You Points ($640 value if redeemed for AA flights at 1.6 CPP). There are 3 more accounts that are open that I am waiting for the bonus to post:

- Provident Credit Union Super Rewards Checking – $150 bonus

- Bank of America Business Advantage Checking – $1,000 bonus

- First Tennessee Checking – $250 bonus (currently available nationwide)

Hopefully in 2016, I receive the remaining $1,400 in bank account bonuses. Most of these offers are nationwide, so anyone can participate in these offers (even if there is no bank branch in your state). In 2016, I predict more bank account bonuses requiring *real* direct deposits to trigger the bonus, along with higher credit card funding limits. My strategy for 2016 is to juggle no more 3 bank account bonuses at the same time (my ADP payroll can only split my paycheck into 3 accounts) and only go for accounts that have a $200 bonus or more.

Gift Card Reselling – I am a small time gift card reseller and prefer using Raise for all my egift card sales. I think we will see some consolidation in the gift card reselling industry, there are just too many gift card resellers out there. My favorites are Raise, Gift Card Zen, and CardPool. I wouldn’t be surprised if eBay/PayPal Digital Gift gets into the gift card reselling space.

Retail Reselling and Fulfillment by Amazon (FBA) – I have never used FBA but apparently everyone loves it. I hope FBA stays about the same or gets a little better, by lowering their fees or by protecting sellers from crazy buyers and their crazy returns.

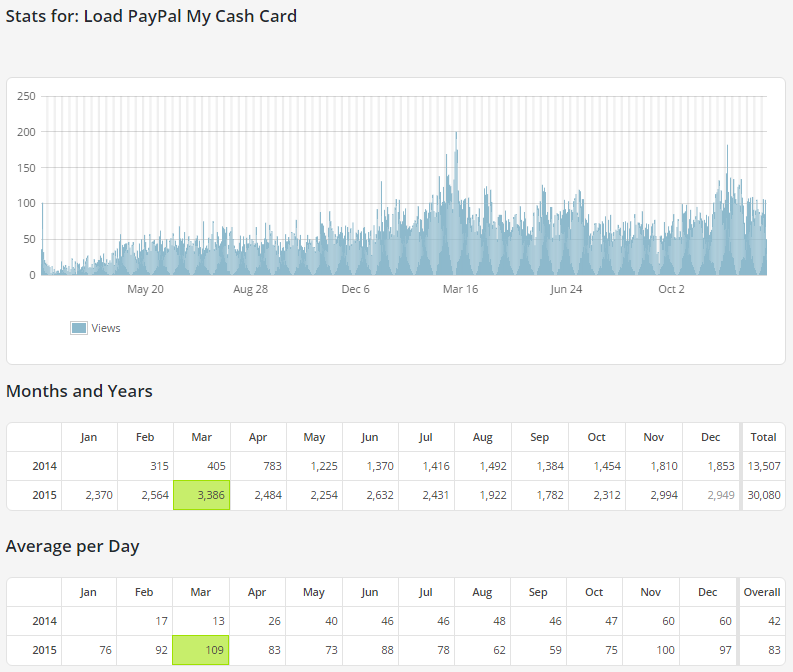

PayPal My Cash Cards – you probably wouldn’t believe this, but my post on loading PayPal My Cash Cards to your PayPal account continues to be one of the most read post on a daily basis. I wrote the post back in February 2014 and I still continue to get many views every single day. I have long since had my PayPal account frozen due to “suspicious” PayPal My Cash Card (PPMCC), PayPal Extras MasterCard (PPEMC), and PayPal Business Debit Card (PPBDC) activity. I expect PayPal to continue to shut down accounts with little to no notice and holding onto the funds for 6 months. I am eager;y waiting a huge class action lawsuit against PayPal, who’s with me?

That is all the predictions that are fit to print. If you have any thoughts or questions, please leave a comment below. Have a fun and safe New Years everyone! Here’s to a wonderful 2016!

Pingback: Travel Predictions for 2016 Part 1: Airlines and Hotels | Travel with Grant

FYI Amazon FBA announced they are changing the FBA fees (mostly higher) in Feb 2016. See the post on Oren’s Money Saver for details.

Bummer, that’s too bad. The resellers will need to adapt to the higher fees.

In on the paypal lawsuit. My account , wife and 3 brothers that I got permanently shut down due to mycash cards will gladly join

Dang, that’s rough. Hopefully there will be big pay days for us :)

Paypal has it coming. All people victimized by paypal should go to their State Attorney General and file a complaint. I already did it here in KS.

What happens where you filed a complaint with your State Attorney General?

Nothing yet, but a complaint to the BBB caused them to at least reply and feed me some more BS. I believe that if enough people complain there will be some action.

I am still pursuing the matter.

Grant, very informative post. Question – how are you able to load the 3 additional Serve cards with the US Bank Flexperks Amex authorized user cards? Don’t they all have the same account number? I thought that you were not able to link a credit card with the same number to multiple Serve accounts.

They all have the exact same card number but each has a different name on them. They approved all of them to run. That’s why I don’t schedule the reloads to go through on the same day.

Great insights, Grant. I don’t think Chase will be loosening the 5/24 rule, however. If anything, I suspect we will see even more banks adopt this approach. In recent memory, Barclays, AMEX, and Chase have all tightened up. US Bank has long been an anti-churning bank. Citi has stepped up their rewards game recently, but it’s only matter a time before they follow suit. Much like Delta leading the way in destroying their program… when it happens, United and American are quick to follow.

You make some good points. We shall see what happens in 2016.

Re 5/24: After totalling up my new cards in the past 2 years (14, including 4 Chase cards), and having converted my CSP to a Freedom back in the spring, I figured I was never going to be able to apply for a CSP again. Recently, however, I stopped into a branch to pay off one of my Inks, and the teller told me that if I had a few minutes to fill out some paperwork, I was pre-approved for a new card. Turned out to be a CSP with a $15K+ credit line. Ten minutes later I was out the door, and now I’m waiting for my first statement to close so that I can get the 50K UR signup bonus.

Obviously 5/24 isn’t universal – it may be worth going into a branch and seeing if you have any offers…

Interesting data point. I will stop by my local Chase bank branch and see what offers are available. Happy New Year!

I am only seeing a $100 bonus on the B of A Buisness Advantsge checking account. You found a $1000 offer?

Up until mid/late November, the offer was $1000 for the business checking. Hopefully they bring that offer back soon.

How are you getting points for your online Serve load? Is that Amex different from the rest?

Only AMEX credit cards not issued by American Express earn points for online Serve reloads. So the BBVA NBA AMEX CC, US Bank FlexPerks AMEX CC, and Fidelity AMEX CC would earn decent points/cash back.

Aha, thanks Grant. Which of those would you recommend getting?

Well, I think the Fidelity AMEX is currently not available right now but should be back in a few weeks. I use my FlexPerks AMEX since that is the only card I have out of the 3 I mentioned. Do a little research and see which card makes the most sense for you.

Happy New Year Grant! How are you off loading the Nationwide Visa Buxx cards? Are you able to use them as a debit card to load onto any of your serve cards or??

I do Citi over the phone debit card payments to unload my Buxx cards.

Thanks Grant!

I predict with the rise of interest rates and further slowing of economy into 2016 banks will want to slow down credit card exposure, especially to people with high credit lines regardless of exposure. I see a tightening coming and think banks will offer less because they want less risk during potentially risky times. Citi is already publicly predicting a recession… no reason for them over extending themselves with revolving personal debt. Long/Short: Less big sign up bonus and tougher approvals.

Thank you for sharing your prediction. Hopefully the slowing economy is not too rough. It will be interesting to see what happens over the coming year.