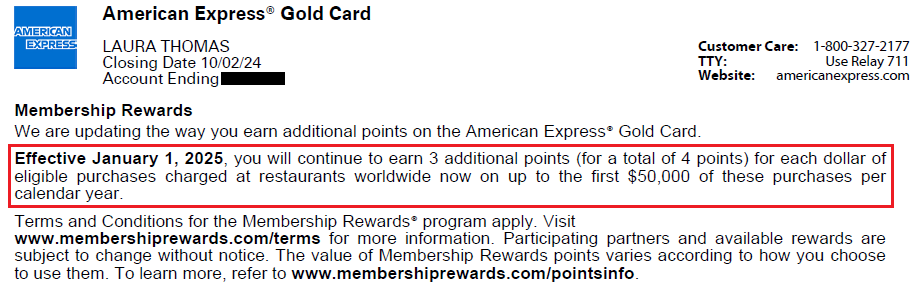

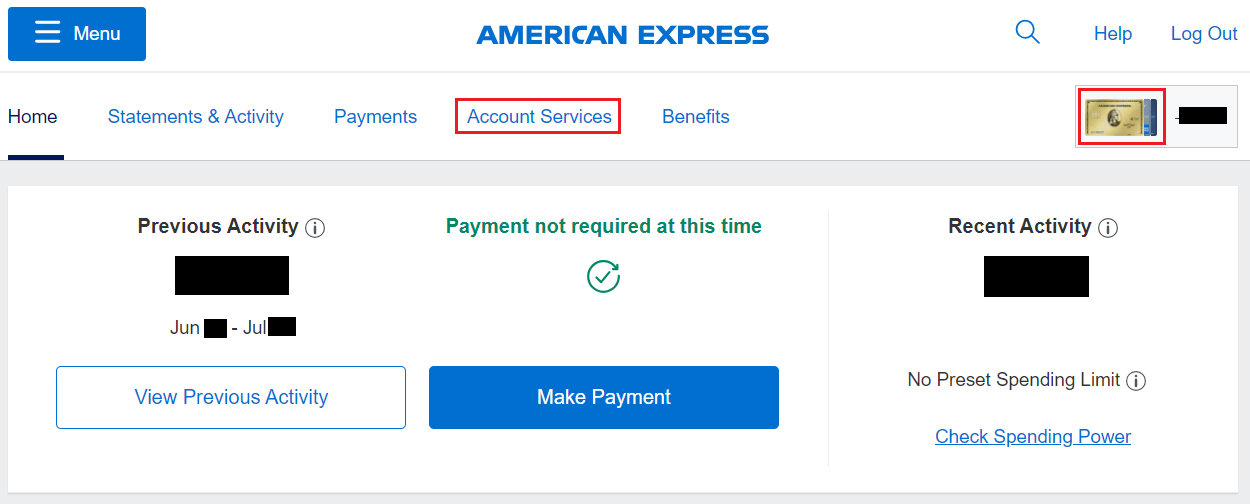

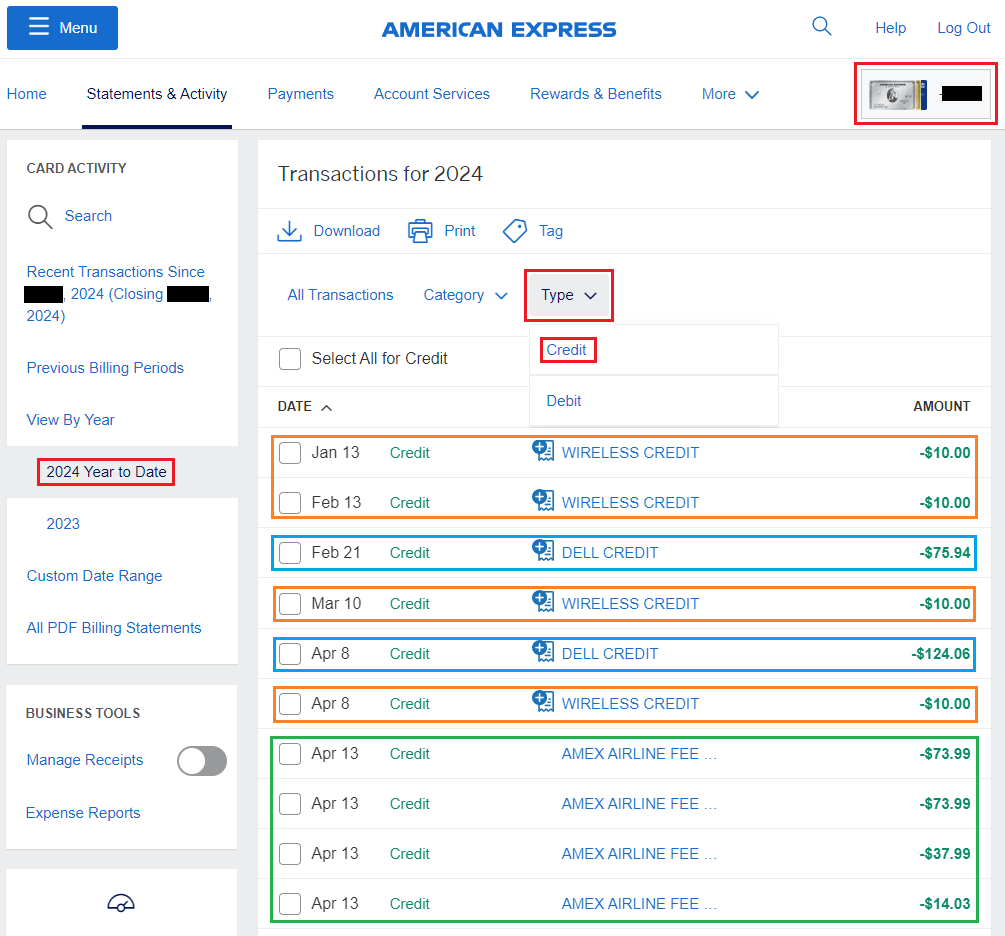

Good morning everyone, happy Friday! Laura was reviewing her recent American Express Gold Card statement and noticed an upcoming change that said:

Effective January 1, 2025, you will continue to earn 3 additional points (for a total of 4 points) for each dollar of eligible purchases charged at restaurants worldwide now on up to the first $50,000 of these purchases per calendar year.

Previously, I do not believe there was a cap on restaurant purchases that would earn 4x AMEX Membership Rewards. I did some more digging to learn more.