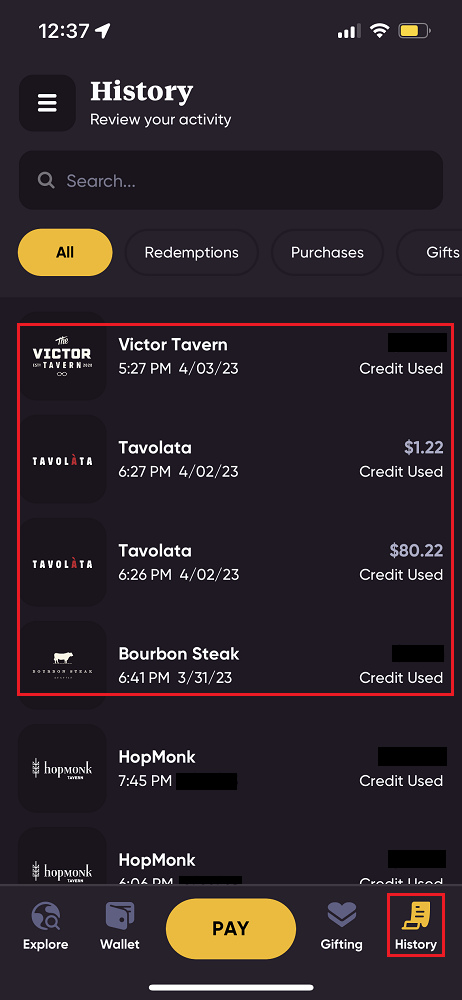

Good morning everyone. A few days ago, I spent a long weekend with my brother and dad in Seattle. We went to a few Seattle Kraken hockey games, a few Seattle Mariners baseball games, went on a locks cruise to Lake Union, took off in a sea plane from Lake Union, and wandered around Woodland Park Zoo. With all of those activities, we worked up big appetites. Luckily, I had some InKind credit to use and there were many excellent restaurants in Seattle that worked with InKind. If you are unfamiliar with InKind, please read My Experience with the InKind App to Pay Restaurant Bill, $25 Referral Credit, & $50 AMEX Offer.

In today’s post, I will highlight the restaurants I went to, the issue I encountered with splitting an InKind bill with my brother, and the $24 March Madness bonus I unlocked. Since I tend to eat early and I like good deals, we did happy hour at Bourbon Steak, Tavolata, and The Victor Tavern. There are many restaurants throughout Seattle that partner with InKind. To see the whole list, go to the Explore tab, type in the city name, and then click the up arrow at the bottom of the screen.