Updated at 10:30am PT on 6/8/23: Here is a Chase Paze FAQ page and a US Bank Digital Services Agreement page (scroll down to “Using Paze”).

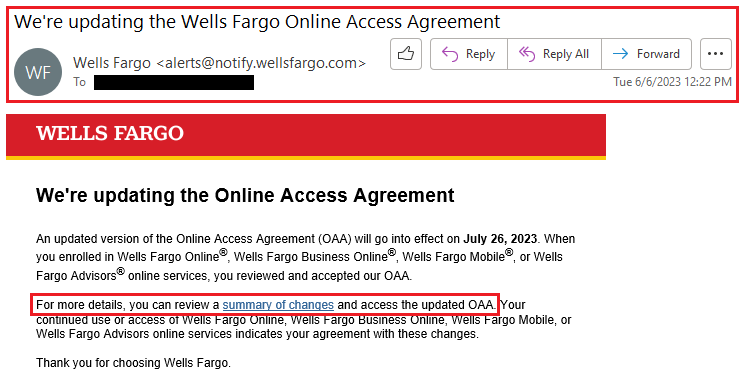

Good afternoon everyone. I went down a deep rabbit hole that started with an email from Wells Fargo and ended with me finding details of Paze – a new digital wallet service from Zelle’s parent company (Early Warning Services). Follow me down the rabbit hole as I explain more about Paze. The journey began when I received this email from Wells Fargo about updates to the Online Access Agreement. I clicked the link to view the Summary of Changes to see if there was anything noteworthy.