Good morning everyone, happy Friday! I hope you all have exciting weekend plans for the first weekend of 2018. My girlfriend and I are flying to Las Vegas this weekend with a couple lounge visits in our future (SFO Centurion Lounge on departure, LAS Centurion Lounge on arrival, again to LAS Centurion Lounge on departure, and then the Escape Lounge (Priority Pass) in OAK on arrival). Enough about my free lounge obsession, let’s talk about the Barclays JetBlue Plus Credit Card.

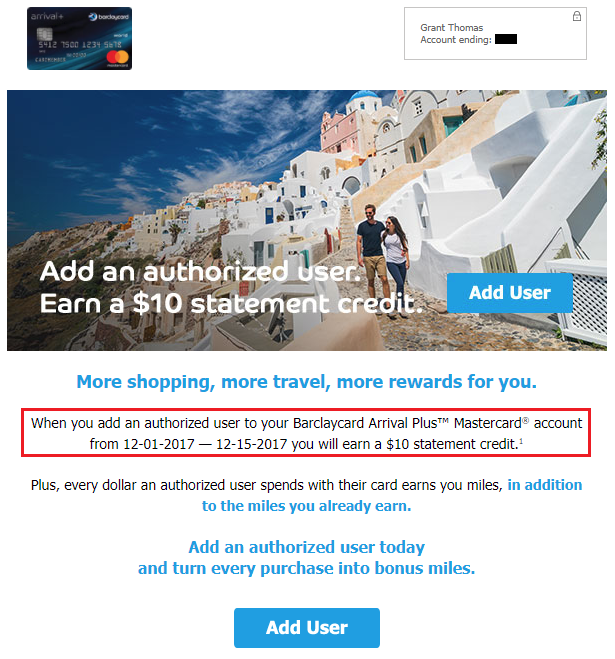

I got this credit card during my December 2016 App-O-Rama and wrote this post about the features of the credit card. I quickly received the 30,000 JetBlue points from the sign up bonus but I didn’t fly JetBlue at all in 2016. But thanks to the generous 3x JetBlue points on Amazon purchases, I continued to earn hundreds of JetBlue points each month. I almost completely forgot about this credit card until this email came to me in early December regarding the annual fee and the 5,000 bonus JetBlue points for being a cardmember.