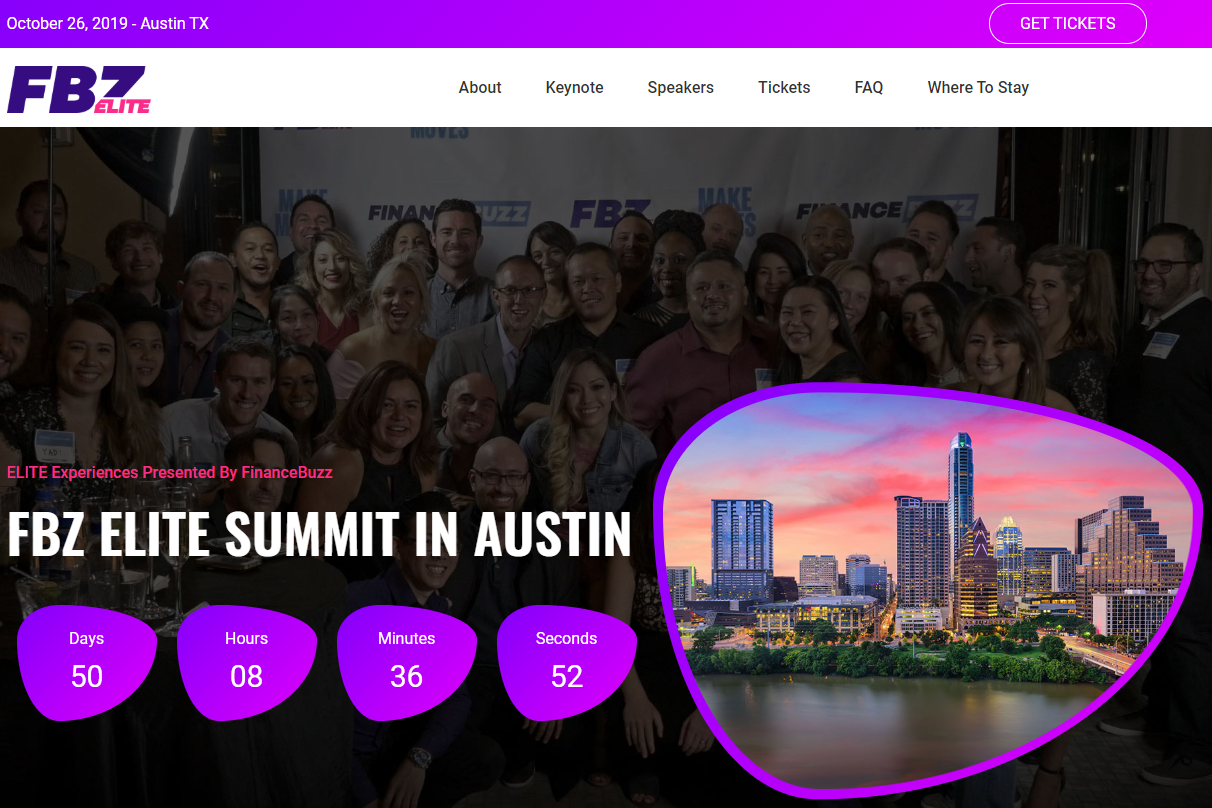

Have you been trying to figure out ways to travel more and spend less? Do you wonder how people stock up enough points to stay in luxury hotels and fly first class? Or maybe, you’re just trying to figure out how to divvy up your points for the maximum amount of free stuff. If any of this interests you, then join me at this year’s FBZ Elite Summit in Austin, TX!

FinanceBuzz is proudly hosting the FBZ Elite Summit for FBZ Elite members, which will be a day-long conference that aims to help attendees learn how to manage points and miles, travel frugally, save money, and connect with other travel enthusiasts. Most importantly, the main FinanceBuzz goal is to help people become financially independent and aware of the clever financial footwork involved in the points and miles game, ultimately resulting in free and discount travel for you and your friends.