A few years ago, I wrote My Travel Predictions (Both Good and Bad) for 2014 on December 30, 2013. I thought I wrote a similar post at the end of 2014 for 2015 predictions, but I guess I did not. Anyway, I thought it would be fun to review that original post and see how close I came to predicting the truth. For the most part, I think my predictions were about a year too early.

My original predictions are in black and my thoughts/reactions are in red.

Airlines:

- British Airways – I think the 4,500 and 7,500 (maybe even 10,000) Avios award prices will go away or the entire award chart will be revamped. The current prices are just too good. I was partially right about the 4,500 BA Avios award band. I wouldn’t be surprised if the 4,500 BA Avios band completely disappears in 2016.

- Alaska Airlines and Delta Airlines – since there has been a lot of fighting over routes to/from SEA and SLC, I think Alaska will no longer allow you to earn or redeem miles with Delta. This is an ongoing issue, but I think the fighting will continue in 2016.

- American Airlines and US Airways – after the merger, we will see some new “enhancements” (aka devaluations) to the new award chart. Maybe off-peak awards will be changed or removed. You could see this coming from a mile away. I’m sad that off-peak awards are changing.

- Southwest Airlines and AirTran – hopefully the merger goes through smoothly and quickly. I look forward to using Southwest Rapid Reward Points for flights to Hawaii, Mexico City, and other tropical destinations south of the border. I also think the 50,000 Southwest Rapid Reward sign up bonus will no longer count for companion pass status, it is just too easy to get Companion Pass. I hope Southwest continues to add new routes. I’m especially excited about the newly announced LAX-LIR (Liberia, Costa Rica) route starting in mid 2016.

- Hawaiian Airlines – merge with another airline, maybe JetBlue or Alaska Airlines. This seems unlikely, but it could still happen.

- Lufthansa – revamp their award chart after everyone signs up for their credit card. I wasn’t approved for the Barlcays Lufthansa credit card (or any Barclays credit card, ever), so I don’t care what happens to the Lufthansa award chart.

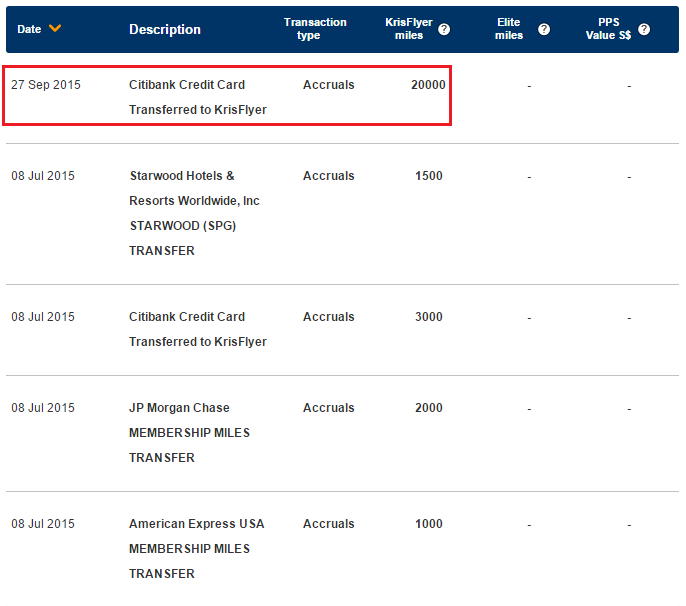

- Virgin Atlantic – miles will be transferable 1:1 with Virgin America and Virgin Australia. This seems unlikely, but Virgin Australia and Singapore Airlines allow transferring miles between their award programs (just not at a 1:1 ratio).